The Merriam-Webster dictionary defines the idiom “to live off the fat of the land” this way: “to live very well by enjoying the best things that are available without having to work hard to get those things.” Investors can do this literally and sit back and watch their money grow, without doing much work, by […]

Author: Tony Daltorio

This Consumer Staple Giant Has Turned the Corner

Stability can be a virtue in any economic climate. Consumer staple stocks are the very epitome of stability. An analysis by Verdad Research found the sector had the lowest income statement volatility of any listed sector between 1996 and 2023. Most companies that make consumer staples have reliable cash flows and steadily growing dividends—and history […]

Why Exxon Is Making a Lithium Play with This Company

Rapid demand growth thanks to the energy transition away from fossil fuels could lead to a shortage of several metals over the next decade unless there’s more investment in the segment. This is according to the Energy Transitions Commission (ETC), a global group of power and industrial companies, consumers, financial institutions, and scientists. Large supply […]

The 2023 Bond Market Winner: Emerging Markets

There has been an unexpected winner in the bond market in 2023: emerging market bonds. This is especially true for emerging market bonds priced in local currencies. Currently, the gap in government borrowing costs between emerging markets and U.S. Treasuries is at its best level since 2000. The reason is that investors are pricing in […]

Japan Revving Up for the EV Race

Japanese automakers, such as Honda Motor (HMC) and Toyota Motor Corporation (TM), have long been seen as laggards in move toward electric vehicles (EVs). But now, both companies are revving up for the EV race. In fact, Honda has emerged as a star performer in this year’s Japanese stock market rally, as investors cheer its […]

Get a 6% Yield in a Red-Hot Market

Japan has been mired in an economic slump for decades. Despite keeping its benchmark interest rate below 1% since 1995—and at or below 0% or below for more than a decade—GDP growth rates have struggled to consistently stay in positive territory. That’s why investing in Japanese stocks has been mostly an exercise in futility for […]

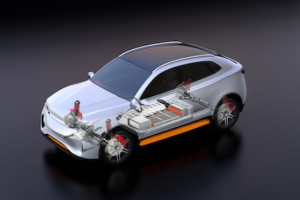

This Car Giant’s Big Bet on Solid-State Batteries Is About to Pay Off

It may have been the Fourth of July, but it was a Japanese titan of the car that set off the fireworks a few weeks ago in the auto industry. The company—and its new CEO, Koji Sato—unveiled ambitions to halve the size, cost, and weight of batteries for its electric vehicles (EVs) following a breakthrough […]

One More Reason to Buy Exxon

On July 13, Exxon Mobil (XOM) agreed to buy Denbury (DEN) for $4.9 billion. Denbury shareholders will receive 0.84 shares of Exxon for every share of Denbury stock they owned. This acquisition will accelerate Exxon’s energy transition business, thanks to Denbury’s established carbon dioxide (CO2) sequestration operation. And far from being too late, this marks […]

The $21.4 Trillion Grid Investing Opportunity

Worldwide, there is gridlock on the grid—the network of power lines, cables, substations, and transformers that takes electricity around countries to power our homes, offices and factories. And there is just not enough of this power, which opens a vast multi-trillion dollar investment opportunity. Let me explain… Around the world, developers of renewable energy infrastructure […]

The Hidden Bull Market in Water Technology

While artificial intelligence (AI) grabs most of the financial news headlines in 2023, there is another area of technology that’s increasingly in the spotlight. This technology is related to the one thing everything else on the planet relies on: water. Earlier this year, the United Nations World Water Development Report 2023 made for grim reading. […]