There’s a whole lot to unpack from last week. After five days of waiting for definitive numbers, media outlets have called the presidential election for Joe Biden. Senate control may take until January to decide due to two runoffs in Georgia. In other words, the market has plenty to digest.

Before we talk about trading opportunities, let me step back and say recent market volatility has been good for trading. In my flagship Options Floor Trader Pro service, we recently booked gains of 125% on Brandywine Realty (BDN) puts and 94% on Amkor Technology (AMKR) calls.

Back to the election and its aftermath… a Biden win seems like a good thing for Chinese companies. Keep in mind, the trade war with China was based on tariffs and was mostly unpopular among U.S. companies whose margins shrank due to higher import prices for Chinese goods (or having to switch to imports from other, more expensive locations).

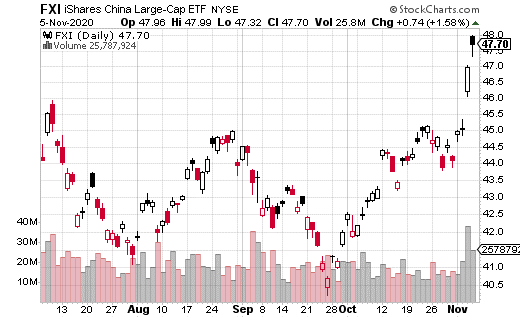

Biden is likely to reduce or eliminate many of these tariffs, which should be a boost for U.S. importers and a boon to Chinese stocks. In fact, even before Biden took to the stage in Wilmington, Delaware, to deliver his victory speech, you could see what iShares China Large-Cap ETF (FXI) had done. The popular China proxy ETF went up 7% over the last week.

The market clearly seems to think a Biden presidency will be good for Chinese stocks, at least the large-cap stocks. Once again, this is highly likely due to the expected reduction or elimination of heavy tariffs on Chinese goods. Lower tariffs will be good for U.S. companies that import Chinese goods and materials. They will also be good for those Chinese companies themselves that do the exporting.

Options action in FXI is also skewed heavily bullish, which is no surprise given how the stock chart looks. At least one trader is moderately bullish on FXI for the next couple of weeks and is using covered calls to express that view.

In particular, 1,150,000 shares of FXI were purchased for $47.83 per share. At the same time, the trader sold 11,500 of the November 20th 49 calls for $0.43. That means the amount of premium collected was just under $500,000. In other words, for just over a two-week trade, the yield will be under 1%. That may not sound like a lot but annualized, it’s actually over 21%.

What’s more, the position can still earn stock appreciation up to a cap of $49. That’s another $1.17 of potential upside should FXI continue to rally. So, if FXI moves sideways for two weeks, the trader will earn about 1%. If FXI drops, that 1% yield provides some cushion. Finally, there’s an upside potential of up to $49.

This position seems like a reasonably safe way to be bullish on China over the next couple of weeks while also generating a small yield. Covered calls can be valuable tools to use to take positions like this and increase yield while still allowing for some stock appreciation.