It’s hard to build wealth. The coronavirus outbreak in early 2020 illustrates how quickly a long-term plan can go bust and accumulated wealth can disappear. From my 30 years of being part of the investment world, my biggest recommendation is to have a strategy that is flexible enough to adapt with changing markets. Let’s start with some big picture concepts and work down to the actionable advice.

Building your wealth is like any other meaningful pursuit in life. There are no shortcuts. You need to have a goal and then put in the work to get there. Another factor is that investing can be tremendously humbling. Just when you think you are the greatest investor ever, the floor will fall out, and you’ll need to pick up the pieces and get back to the basics. Let’s start with some top-level concepts.

- Building wealth is a long-term multi-year endeavor, even multi-decades. The marketing for services for hot stocks or secret strategies that will make you quickly rich won’t work.

- Your strategy should have a plan for the bad times– the economic recessions and the market crashes. Everyone makes money in good times. The challenge is keeping it through the bad times.

- Strive to gain knowledge about all types of investment products. While you may have a core investment strategy, such as growth through a rising dividend income stream, you want to have the knowledge and flexibility to take advantage of opportunities in other types of investment.

- Understand how emotions drive investors and how to fight those emotions when you invest. It’s tough to invest when the markets are in panic mode and to sell into the euphoria of new record high prices.

I hope that sounds daunting because the path to building your wealth is challenging. But it is not impossible, and there are hundreds of thousands of investors who started with a few dollars and did the work to get to million-dollar investment account values.

Here’s How Dividend Investors Are Using The Recent Pullback to Boost Their Income In a Short Time

A quick concept here. Typically financial advisors who manage money are not in the wealth-building business. They are in the wealth preservation business for clients who are already wealthy. Investors looking to build their own wealth from the ground up are unlikely to benefit from financial advisors or their services.

There are a host of strategies for investing. Here are just a few: timing the markets using technical or fundamental indicators, building a diversified portfolio with exchange-traded funds (ETFs), buying penny stocks, buying tech stocks, investing in Dividend Aristocrat dividend growth stocks, buying/trading bitcoin, putting everything into Tesla (TSLA) shares.

These strategies range from very conservative, slow growth investments to the equivalent of rolling the dice. With many years of experience in the market, my goal when developing an investment strategy to build wealth was to put together a system that works through the ups and downs of the stock market without trying to guess where stock prices will go next.

I have found that predicting the stock market direction depends too much on guessing. At the start of 2020, experts across the financial world were predicting that U.S. stocks would gain 20% to 30% for the year. Then the COVID-19 outbreak hit the U.S., and the major market indexes dropped from record-high levels to bear market territory, down 25% in a matter of weeks. To paraphrase a financial news talking head, “If you have a long-term outlook and don’t need to draw from your investments for decades, just stick with the stock market. If you are retired or in retirement, I have nothing for you.”

On the flip side, I can accurately predict the amount of cash income a portfolio of dividend-paying stocks will generate. My strategy for long term wealth building is to focus on building a dividend income stream and reinvest the income to compound the growth of that income.

At this point, you may be questioning how well an income-focused strategy will work to build wealth. Fixed income investments yield 1% to 2% while the average yield for the S&P 500 is less than 3%. Those percentages do not look like a yield that would compound to real wealth.

Few investors know, and fewer understand, that there is a world of high yield investments. These include individual stocks of companies organized under pass-through entity laws, preferred shares, high-yield sector ETFs, and closed-end funds. Yields in these investments range from mid-single-digits up into the low teens, sometimes higher. The recommendations list for my Dividend Hunter newsletter has an average yield of about 8% in normal market conditions.

My wealth-building strategy is to reinvest dividends to compound those yields, year-after-year. If you are starting with a small amount, making regular, added investments will help your money grow even faster. Since most online brokers now have zero commissions to buy or sell, you can invest and reinvest in whatever increments fit your budget.

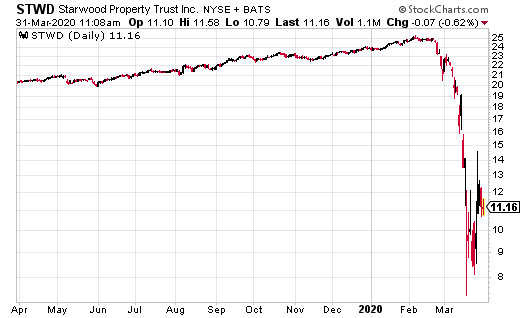

One of the strengths of investing for income is that when the stock markets go down, the current yields go up, which, if you keep reinvesting dividends, increases your compound growth rate. For example, Starwood Property Trust (STWD) typically yields 7%. During the coronavirus-triggered stock market crash, the STWD share price dropped to the point that the yield was up to 15%. Buying shares during the downturn would double your compound growth rate for shares of STWD purchased during the bear market.

A wealth-building strategy that focuses on investing in producing a growing income stream works through the full stock market cycle. An income-focused portfolio brings in cash every quarter and investing that money keeps the growth on track.