Last week, Seeking Alpha put out a list of low-valuation ETFs with strong performance year-to-date for 2021. The short discussion pointed out how investors may benefit from a shift away from high-valuation growth investments, to those with lower valuations that are also out of favor with the “hot stocks” crowd.

The low-valuation list sports some very attractive year-to-date returns. Take a scan through the ETFs, and I will tell you below which I recommend to my subscribers. Hint: the fund shares yield almost 10%.

- FCG): +7.25% in May and +61.54 YTD

- AMZA: +5.03% in May and +52.61% YTD

- IEO: +6.03% in May and +48.78% YTD

- SYLD: +2.28% in May and +45.41% YTD

- FTXN: +6.22% in May and +44.05% YTD

- XSVM: +0.10% in May and +43.26% YTD

- IAT: +0.61% in May and +34.63% YTD

I am sure you noticed the returns from 2021 to date range from 34% to 61%. These gains are primarily due to smart money rotating out of growth and into value—mighty fine returns for investments described as “low valuation.”

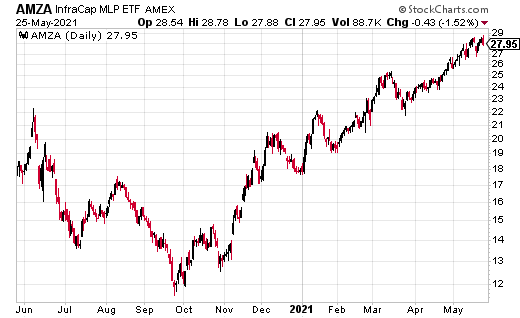

My recommended ETF came in at number two on the list. The InfraCap MLP ETF (AMZA) is, as the name states, a fund focused on the master limited partnership (MLP) sector. Longer-term, AMZA has a horrible-looking track record, reflecting the brutal results from the energy midstream sector over the last half-decade.

AMZA had the dire misfortune of launching in 2015, just as the MLP sector completed a 20-year run of excellent returns from attractive yields and distribution growth. When OPEC crashed the price of crude oil in late 2014, it put the U.S. energy sector into a bear market that took years from which to recover.

The long and painful—and often money-losing—recovery led to plenty of hate towards MLPs and energy midstream corporations. However, if you have been holding that attitude about MLPs, it’s time to shift your thinking. Energy midstream companies are now much more financially stable, with low debt-to-equity ratios and high cash flow coverage of the distributions.

Most companies now fund growth projects with excess free cash flow rather than tapping the debt and equity markets for every new project. These are not the early-2000s MLPs. The 2021 gains listed above are proof of the new energy midstream universe.

AMZA is a core holding in my strategy that turns $25,000 into income for life. It’s a special income building program that uses a small group of specialized dividend stocks and compounding strategies to quickly build up a sizeable income stream starting with as as little as $25,000. See if your account qualifies here.

As an ETF, AMZA gives actively managed exposure to MLPs without the Schedule K-1 tax filing hassles. The fund does pass through the tax advantages of MLP distributions. AMZA pays a stable monthly dividend and currently yields about 9.5%.

My Dividend Hunter service subscribers like monthly dividend checks, and AMZA is one of a half-dozen monthly payers on my recommended high-yield investments list.