Operations in the energy sector can be divided into three distinct subsectors: upstream, midstream, and downstream. Profits from two of them—upstream and downstream—vary significantly, with price changes for crude oil, natural gas, and refined fuels. The third sector, midstream, has stable revenue streams and makes a good choice for income-focused investors. Major energy companies like […]

Master Limited Partnerships (MLPs)

7% Yield and Consistent Dividend Growth

An attractive yield plus solid dividend growth is a surefire strategy for building investment income and wealth. Energy midstream stocks offer a hard-to-beat combination of yield and dividend increases for investors who want to follow this strategy. Energy infrastructure/midstream companies are split pretty evenly between those organized as Master Limited Partnerships (MLPs) and C-corporations. Managed […]

Why the Shrinking Number of MLPs is Great for Income Investors

Last week the news included announced acquisitions of two master limited partnerships (MLPs). That brings the total to three MLPs that will disappear by the end of the year. The number of MLPs has been shrinking for almost a decade, leaving only the strongest operating. That’s good news for us income investors. Here’s why… As […]

Why High-Yield MLPs Like This One Have a Bright Future

Over the last decade, the master limited partnership (MLP) sector has undergone a deep, multi-year downturn and then a massive recovery. After all that volatility, you might wonder if the sector’s high yields are worth it. Let me show you where I see MLPs going from here… The Downturn From mid-2014 until January 2016, crude […]

The Yin and Yang of Energy Midstream Stocks

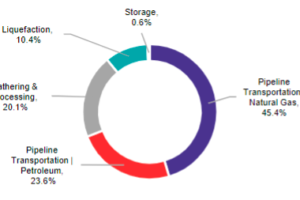

In these uncertain times for investors, energy midstream stocks offer an island of stability. This sector provides an attractive combination of current yield and dividend growth. However, midstream companies divide into two distinct categories, and the differences are important. Energy midstream covers the movement and storage of energy commodities from the upstream drillers to the […]

The Cure for a Directionless Market

High current yields and growing dividends are the cure for the directionless market. And if we are in for a “lost decade” from the stock market, yield plus growing dividends is one strategy that will still produce positive total returns. The strategy works in any market—bull, bear, or stagnant. Let me show you. Over the […]

How to Get High-Yield, Tax-Advantaged Income

A typical trade-off for most high-yield investments is that they pay non-tax-qualified dividends, which would be taxed at your marginal income tax rate. Not a lot of investors know that there is a way (outside of qualified retirement accounts) to earn tax-advantaged, high-yield dividends. The benefits can be substantial. So let me show you how […]

The Best Play on the Shrinking MLP Universe

The DCP Midstream (DCP) buyout offer earlier this month marked another master limited partnership (MLP) coming off the board. Over the last eight years, the number of publicly traded midstream MLPs declined by 74%. Here’s what that means for investors, especially those who like the tax-advantaged, high-yield income from MLPs… On August 18, Phillips 66 […]

Colonial Pipeline Shutdown Puts All Pipelines Back in Vogue

The ransomware attack and subsequent shutdown of the Colonial Pipeline drew a lot of awareness to how much our economy depends on fuels delivered by pipelines. Gas stations from the southeastern U.S. all the way up to New Jersey are out or will soon be out of fuel to sell. Airlines may not be able […]

Your Dividend Life Raft For Unsettled Markets

The first two months of 2021 were marked by heightened stock market volatility. I am sure you watched the GameStop stock price game, where billions were made and then lost. Shares of high-flying Tesla (TSLA) have lost 20% in a few short weeks. For investors who bought at $900, looking at a $700 share price […]