Last week, I went to fuel up my pickup truck and was shocked to see that gas prices had jumped overnight by $0.40 per gallon. Ouch! I started digging into the cause, looking for an investment angle. What I found reinforced my belief in what I think is one of the best investment opportunities in […]

Energy Investing

Is the Energy Sector Positioned to Outperform for the Rest of 2023?

Today, we’re continuing to monitor the current situation in the energy sector. As we’ve been telegraphing to our clients, we believe there’s an increasingly better chance that we’ll see this energy sector outperforming for the remainder of 2023. Looking at the monthly chart of the Energy Select Sector SPDR ETF (XLE) you can see a […]

Utility Stocks are Great – But These Energy Stocks are Even Better

A recent article highlighted the differences between the different income-focused investment sectors. Investors often see energy midstream and utilities as similar infrastructure-type investments. Both pay high yields and tend to be pretty safe bets. But significant differences exist, so let’s see where best to put your money… Utility stocks, real estate investment trusts (REITs), and […]

Why Focusing on Quarterly Earnings Results Will Lead You Astray

Investors often use quarterly earnings results to decide whether to buy or sell individual stocks; however, investors who focus on past results will likely miss out on the blow-out positive quarters when looking at upstream energy producers. Here’s what to look for instead, and what to look for… Upstream energy companies are oil and gas […]

Why Exxon Is Making a Lithium Play with This Company

Rapid demand growth thanks to the energy transition away from fossil fuels could lead to a shortage of several metals over the next decade unless there’s more investment in the segment. This is according to the Energy Transitions Commission (ETC), a global group of power and industrial companies, consumers, financial institutions, and scientists. Large supply […]

This One Stock Capitalizes on The World’s Most Important Trend

Today, I have an idea that capitalizes on one of the most important trends in the world. While a lot of us love to hear politicians promise a bright green future with no oil and gas, the truth is that’s not happening any time soon. I touch on the reason it cannot happen and discuss […]

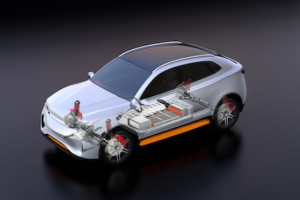

This Car Giant’s Big Bet on Solid-State Batteries Is About to Pay Off

It may have been the Fourth of July, but it was a Japanese titan of the car that set off the fireworks a few weeks ago in the auto industry. The company—and its new CEO, Koji Sato—unveiled ambitions to halve the size, cost, and weight of batteries for its electric vehicles (EVs) following a breakthrough […]

One More Reason to Buy Exxon

On July 13, Exxon Mobil (XOM) agreed to buy Denbury (DEN) for $4.9 billion. Denbury shareholders will receive 0.84 shares of Exxon for every share of Denbury stock they owned. This acquisition will accelerate Exxon’s energy transition business, thanks to Denbury’s established carbon dioxide (CO2) sequestration operation. And far from being too late, this marks […]

The $21.4 Trillion Grid Investing Opportunity

Worldwide, there is gridlock on the grid—the network of power lines, cables, substations, and transformers that takes electricity around countries to power our homes, offices and factories. And there is just not enough of this power, which opens a vast multi-trillion dollar investment opportunity. Let me explain… Around the world, developers of renewable energy infrastructure […]

What the Future of Oil and Gas Stocks Really Looks Like

The International Energy Agency (IEA) predicts crude oil production growth will slow to near-zero by 2028. OPEC, the cartel of mostly Middle Eastern oil-producing countries, disagrees. Some history lessons give us a clue as to which party is probably correct. The answer will have a huge impact on how to invest for income in the […]