Recently, I dug into recent financial results of several downstream crude oil refiners. I am a fan of the energy subsector, but I was surprised at how well these companies can and will perform in the current energy price environment. So surprised that I was happy to add a new refiner stock to my dividend […]

Energy Investing

Profiting From a Messy Energy Transition

Everyone pretty much agrees that we will—eventually, at least—transition from a fossil fuel-powered economy to one powered by less polluting energy sources. However, as this energy transition gains speed, the risk of chaos emanating from it is rising. Here’s why… Today, investment in new oil and gas supply is well below what it was a […]

Staying Bullish On Natural Gas

The United States is expected to become the world’s largest exporter of liquified natural gas (LNG) in 2023. Last year was a record for long-term contracts signed by U.S. LNG exporters, with agreements for 65 million metric tons per year in exports—more than triple the 2021 amount! The U.S. has the capacity to export about […]

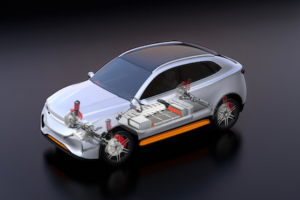

An EV Boom ‘Picks and Shovels’ Play

The global electric vehicle market is projected to grow from just $287 billion in 2021 to a massive $1.31 trillion in 2028, forecasts Sustainalytics, a leading independent ESG and corporate governance research and analytics firm. That nearly one-and-a-third trillion-dollar market is an opportunity few investors will want to miss. However, many investors looking to hitch […]

Why This Oil Major Remains a Buy

The world’s major oil companies have all reported record annual profits. And, despite what Wall Street is telling you, these are still stocks you want to have in your portfolio for both growth and dividends. One oil major in particular reported some great earnings on February 2, making it a buy. Let’s take a look… […]

This Is the Only Place to Buy Stocks Right Now

The Federal Reserve is the swing factor in the current market. The tug-of-war between what the Fed officials have said and what the market thinks the Fed really plans to do is ongoing and makes for a problematic investing and trading environment. Even our favorite special situations landscape is pretty quiet. Insiders are sitting still, […]

These Oilfield Services Stocks are Booming

The energy sector is one that keeps rewarding its investors. For example, let’s look at the so-called “Big Three” oil services companies: Halliburton (HAL), Baker Hughes (BKR) and SLB (SLB)—formerly Schlumberger. In 2022, these firms registered their most profitable 12 months since the heyday of the U.S. shale boom, reporting an aggregate net income of […]

Three Best Energy Dividend Picks After a Big 2022

Last year, the energy sector was the only market sector to post a positive return—and it did a heck of a job! The Energy Select Sector SPDR (XLE) gained 60% last year. One-year gains like that may make you cautious about committing to energy this year, but I believe your portfolio should continue to hold […]

The Pipeline Industry Enters the 21st Century

Traditionally thought of as a means to transport oil and natural gas from point A to point B, pipelines are a critical part of the world’s energy infrastructure. However, that is gradually changing as the world moves away from fossil fuels. We saw one example of this in Europe, in early December. Spain and France […]

European Oil Stocks are Dirt Cheap Right Now

Several times in recent months, I recommended that you consider purchasing the major European oil stocks: BP (BP), Shell (SHEL), TotalEnergies (TTE), and Equinor (EQNR)… so I was gratified to see that many of the large U.S. fund managers are jumping into these stocks. For example, the second-largest holding of the Blackrock Equity Dividend Fund […]