Today, I have an idea that capitalizes on one of the most important trends in the world. While a lot of us love to hear politicians promise a bright green future with no oil and gas, the truth is that’s not happening any time soon. I touch on the reason it cannot happen and discuss […]

Investing Strategies

The Market Is Both Red Hot and About to Crash – So Invest in This Forgotten Moneymaker

We are in an interesting phase of the stock market cycle. The monetary and valuation models flash yellow and red, while momentum and sentiment are bright green. And the Federal Reserve has raised rates at a faster pace than ever before, which is going to hurt stock prices eventually. Interest rates are a vital component […]

Two Strategies to Build Wealth Faster Than You Ever Thought Possible

Wes Gray is one of the most innovative and interesting voices in all of finance. A Marine Captain who served in Iraq, he also studied under the legendary Eugen Fama at the University of Chicago, earning both an MBA and a Ph.D. After serving for a period of time as a Professor of Finance at […]

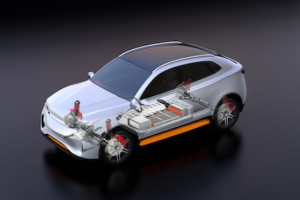

This Car Giant’s Big Bet on Solid-State Batteries Is About to Pay Off

It may have been the Fourth of July, but it was a Japanese titan of the car that set off the fireworks a few weeks ago in the auto industry. The company—and its new CEO, Koji Sato—unveiled ambitions to halve the size, cost, and weight of batteries for its electric vehicles (EVs) following a breakthrough […]

One More Reason to Buy Exxon

On July 13, Exxon Mobil (XOM) agreed to buy Denbury (DEN) for $4.9 billion. Denbury shareholders will receive 0.84 shares of Exxon for every share of Denbury stock they owned. This acquisition will accelerate Exxon’s energy transition business, thanks to Denbury’s established carbon dioxide (CO2) sequestration operation. And far from being too late, this marks […]

Insider Buying is Dead – Except Here

Markets are clearly overvalued at current levels. We are trading at multiples of earnings that have not been seen in over a decade. It did not end well on previous occasions, and it won’t end well this time. Corporate insiders are clearly not impressed by current market conditions either. We are seeing very little insider […]

The $21.4 Trillion Grid Investing Opportunity

Worldwide, there is gridlock on the grid—the network of power lines, cables, substations, and transformers that takes electricity around countries to power our homes, offices and factories. And there is just not enough of this power, which opens a vast multi-trillion dollar investment opportunity. Let me explain… Around the world, developers of renewable energy infrastructure […]

I’ve Never Been More Excited About Commercial Real Estate Investing

Last week, I told you I would soon have a couple of real estate-related bonds for you to consider. I realize that recommending real estate-related securities right now is considered the most horrific suggestion in the history of horrific investment suggestions—after all, everyone “knows” that commercial real estate will collapse soon. The very best people […]

Do This to Stay on the Fed’s Good Side

“Don’t fight the Fed.” Famed fund manager Marty Zweig came up with that one in 1970 and repeated it religiously until he passed away in 2013. The Federal Reserve has been raising rates since March of 2022, and Fed funds rates have gone from 0.25% to more than 5%. Three-month Treasury yields have risen from […]

This “Longshot” Investing Strategy Makes Enormous Amounts of Money

Several years ago, I tested a system of betting college football games against the spread. Turns out that using small amounts of money betting on underdogs to beat the spread is a winning strategy. The winning edge is small, and you must bet on every underdog, so you are making a lot of bets every […]