It’s earnings season, so you know there’s going to be plenty of options activity. Last week, we saw blowout earnings from Facebook (FB), which is up to 3.5 billion users worldwide across its varies products. FB posted way better revenue and earnings than expected. A trader is attempting to profit from the good news using […]

Options

Where I see a 5% pullback in May

I’m on the road this week working remote, however, I still wanted to share this important update of what I’m seeing. May usually begins choppiness in many markets… And there’s one particular area of the market I see a potential 5% pullback. That’s not to sound warning bells…but more to alert you of a potential […]

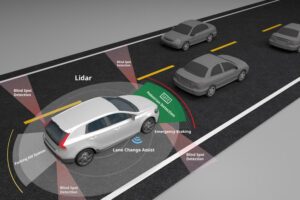

Luminar Technologies Remains Laser Focused Despite Steep Selloff

Luminar Technologies (LAZR) became a publicly traded company in November 2020 through a special purpose acquisition company (SPAC), and rose more than 30% in its debut. Shares eventually surged to a high of $47.80 just 13 trading days after going public, but are now trading in the high teens. Although it might be too early […]

How To Make 344% From Stocks Going Higher

When buying options, it’s generally a good idea to keep the capital outlay to a minimum whenever possible, because options typically lose value at a regular rate due to time decay. As such, minimizing the option premium paid (the cost) is essentially the same as lowering risk. Using vertical spreads is one way to take […]

Trade of the Week: NKLA

After dropping out of the spotlight in recent months, option trading in Nikola (NKLA) is back. The electric truck designer is expecting to install hydrogen filling stations in CA, and the stock jumped nearly 15% on the day the news broke. Considering the company hasn’t produced anything meaningful to date, the crowd took this as […]

How to Live A Happy Life as a Trader

Click the video above to watch this weeks Serge Berger Weekly Options Trade

GME, COIN, PG, or V? What’s the Best Pick for Traders Right Now?

While volatile stocks may be more exciting to trade, most investors are looking for consistency in their portfolios. Whether the goal is steady growth or consistent income, boring may be better in the long term. As fun as it may be to trade stocks like GameStop (GME) or the latest buzzworthy IPO like Coinbase (COIN), […]

Aggressive Traders Could Double Their Money on LEVI With This Trade

Shares of Levi Strauss & Co. (LEVI) recently broke out to a fresh 52-week peak following another solid earnings announcement. The company reported a first-quarter profit of $0.34 per share on revenue of just north of $1.3 billion. Wall Street was looking for a profit of $0.25 per share on sales of $1.25 billion. The […]

Trade of the Week: RBLX

One active name in options this past week was Roblox (RBLX), a video game company that recently had its IPO. RBLX produces an extremely popular game that has shown very strong growth. The company recently partnered with Hasbro for physical toys as well. On a busy day last week, 85% of the options that traded […]

This Index is About to Drop Soon… Here Are Two Ideas on How to Trade It

I’m looking at a scary chart in the video above. It’s a chart that shows the market…especially the S&P 500…could be do for a correction in the next month as we go into earnings season. Watch my quick 4 minute 41 second video to discover: Where the S&P 500 could drop to (more importantly) – […]