Electric vehicles have been all the rage lately in the stock and options market. NIO (NIO) has been no exception to this. The company is sometimes called the “Tesla of China” and actually has $1 billion worth of sales already. However, the huge run up in the stock price gave NIO an extremely high valuation, […]

Options

Trading Options On The “Next Tesla”

In a year of unpredictable market action, perhaps the most eye-opening moves are occurring in electric vehicle (EV) stocks. EV companies like TSLA are all the rage right now. Just about any stock that has some relationship to electric vehicles sees a ton of action (in the stock and the options). Just look at what […]

Trade of the Week: TSLA

Another week, another record high for Tesla (TSLA), which continues to be on a tear. Electric vehicle companies have been the most popular picks for investors lately, led by TSLA. The electric vehicle powerhouse has gone from $1,000 per share to over $1,500 in just a few weeks. The euphoria surrounding the industry is partly […]

SLV Price Trending Higher: Here’s How To Earn 8.5% On It

When uncertainty grips the market, investors often turn to precious metals for safety. Well, at least they used to. These days, most of the action in precious metals is in gold. The price of gold has climbed nearly 19% in 2020 to date. Silver has been okay, up 4% so far this year. Platinum, on […]

Trade of the Week: XLF

There was a fair amount of options action ahead of the long holiday weekend. A massive amount of puts traded in the financial sector, more specifically, on the Financial Select Sector SPDR ETF (XLF). Some of the large trades could be setting up a hedge against downside risk through August. One interesting trade in XLF […]

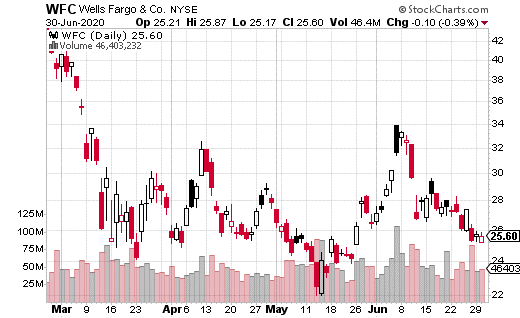

Make 9.7% On America’s Most Notorious Bank

Despite plenty of volatility in the market, it hasn’t been any easier to generate income for your portfolio. Yields are still ultra-low for most fixed income instruments. Moreover, many high-yield dividend stocks have slashed their dividend payments. Regarding dividend stocks, buying and holding them is certainly not an unreasonable way to generate yield. The best […]

Trade of the Week: Carnival

Options activity has been brisk lately, with traders showing concern over the recent news of COVID-19’s resurgence in several warm-weather states. Cruise line stocks had recovered quite a bit in recent weeks, but could be in trouble again in the coming weeks. It now looks like US cruises won’t resume until September, with data showing […]

Trade of the Week: HTZ

Hertz Global (HTZ) declared bankruptcy and received a delisting notice for its stock last week. Nevertheless, the options activity on HTZ has been through the roof. It seems day traders are enjoying the action with both calls and puts trading briskly. One day last week, over 440,000 options traded in HTZ, mostly in small-lot trades. […]

Is AMD Going To Continue To Surge?

Despite a global pandemic and worldwide civil unrest, stocks have mostly gone up. The exuberance of investors is impressive, if perhaps misplaced. It certainly remains to be seen if the gains can hold up when the expected second wave of COVID-19 hits in the fall. Despite the large move in stocks (the Nasdaq just hit […]

Trade of the Week: GE

Stocks rallied sharply last week on better than expected May job numbers. Some of the most beaten down stocks from March saw the biggest gains. Companies like airlines, car manufacturers, and banks saw the most bullish action in the options market. General Electric (GE) is a company that was hit pretty hard in March and […]