Once you start looking for option trades on your own, the most important thing you can do to find trades with triple-digit profit potential is staying up on the news. The market and stocks in general move up and down over time, and the key is to identify these cycles. You will learn to decipher […]

Options

Trade of the Week: RBLX

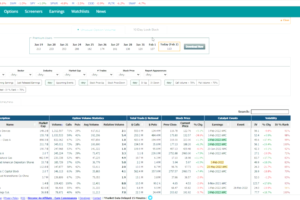

One of the most active options chains last week was in Roblox (RBLX), the popular video game company. RBLX thrived during the pandemic, when it attracted a massive audience (especially among kids). However, with the earnings release last week, it’s apparent that growth has slowed now that pandemic era seems to be coming to a […]

Buy alert in sector taking off (not energy)

Watch Serge Berger’s weekly video above.

Trade of the Week: Copper

When inflation is a going concern for the economy, we tend to see a lot of action in commodities and natural resource stocks. One heavily traded commodity stock last week was Freeport-McMoran (FCX), which is one the largest copper producers in the world. Options trading in FCX was unusually heavy on a day last week, […]

Top 3 Ways to Play Defense In the Stock Market

Watch Serge Berger’s weekly video above.

What’s Next For FB?

Last week, shares of Meta Platforms (FB) plunged after the company reported worse than expected earnings. In fact, the stock dropped over 26% in one day, the biggest single-day decline in its history. The company missed on revenues, revenue forecasts, and number of users. Despite the huge down day, about 61% of the 2 million […]

Trade of the Week: GOOGL

On a very busy week for earnings, Alphabet (GOOGL) shares got a huge boost after beating on both the top and bottom line. With the stock up 8% on the day after earnings, most of the options action was in calls. 71% of the options volume was on the call side, which tends to be […]

Trade of the Week: Gold

There was quite a bit of options action across multiple asset classes last week between the Fed meeting and several key earnings releases. One asset that saw plenty of options activity was gold, particularly SPDR Gold Shares (GLD). GLD tracks physical gold prices and is generally a heavily traded ETF. On a busy day last […]

Is LYFT ready for a rebound?

The ride sharing industry has taken a beating over the last couple years due primarily to the pandemic. But is there a rebound is sight? The pandemic may finally be slowing to a crawl. Lyft (LYFT), one of the two ride sharing giants, has seen its stock price trend down since last summer. However, a […]

Trade of the Week: Gold Miners

The market may have been selling off last week, but it didn’t stop gold miners from catching a bid. In fact, VanEck Gold Miners ETF (GDX) was up over 7% one day last week when one of its major component companies posted better than expected earnings. GDX traded over 300,000 options that day, with 76% […]