Stock market volatility is arguably one of the most misunderstood concepts in investing but can be an extremely important technical tool when it is used to analyze the stock market. To start, volatility is often referred to as the fear gauge, and the range of price change the stock market can experience over a given […]

Volatility

Will Market Volatility Return This Year?

2020 is in the rearview mirror, and I think we can all agree that it’s a good thing. While last year was certainly interesting for investors, I don’t think anyone wants to relive the other parts of 2020. The year is, of course, marked by the start of the Covid-19 pandemic. But let’s not forget […]

Will SNAP Continue To Defy Gravity?

Earnings season has pretty much been a non-event this year, with investors entirely focused on the election and the COVID-19 pandemic. The week leading up to the election has been extremely volatile, and you could indeed be forgiven for not realizing earnings are still rolling out. The thing is, what may have been overlooked with […]

MSTB: A Better Way to Get Broad Stock Exposure and Beat SPY

One of the more intriguing current trends in U.S. investing is the growing number of strategic ETFs that have become available to investors. Index investors have typically used ETFs like SPY to capture the action of the broader market. However strategic ETFs represent or emulate an entire trading strategy, rather than just tracking an index […]

Is Micron Set For a Big Move?

Making directional trades in this market isn’t easy. On the one hand, you have high flying stocks that are trading well above reasonable valuations. Trading those types of stocks can be dangerous since they can reverse on a dime. On the other hand, value stocks are dead. Stocks trading below reasonable valuations just seem to […]

Trade of the Week: Volatility

The market finally saw some active selling last week, with volatility climbing quite a bit higher. The iPath VIX Short-term Futures ETN (VXX) is one of the most popular ways to trade volatility. It covers the first two VIX futures contracts and tends to go up sharply when the market sells off. As you may […]

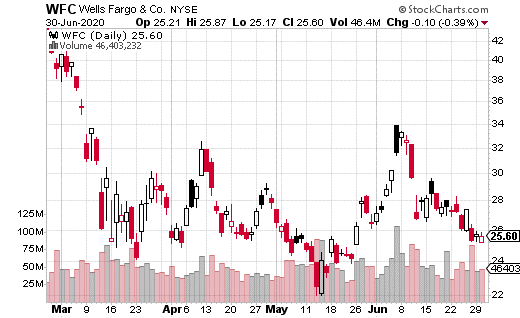

Make 9.7% On America’s Most Notorious Bank

Despite plenty of volatility in the market, it hasn’t been any easier to generate income for your portfolio. Yields are still ultra-low for most fixed income instruments. Moreover, many high-yield dividend stocks have slashed their dividend payments. Regarding dividend stocks, buying and holding them is certainly not an unreasonable way to generate yield. The best […]

Trade of the Week: Facebook

The market is experiencing a resurgence of volatility, adding to the already very active options market. Last week, the bears finally caught up to Facebook (FB). The social media platform’s share price dropped 8% in one day, with options trading over 1 million contracts. The selloff came courtesy of Verizon (VZ), which decided to pull […]

The Fed Is Telling You Where the Market Is Headed. Here’s How You Play It.

Trying to understand the stock market in the middle of a pandemic is a challenge for even the most seasoned of traders. It’s not like the investing world has much to compare to. Sure, the Spanish Flu seems roughly like a similar situation—but that was more than 100 years ago. The markets are far larger […]

A Brand New Way To Trade Volatility

Over the last two decades, the investment landscape has been dramatically altered by two trends. The first is the shift from single stock and mutual fund investing into exchange-traded products (primarily ETFs). The second is the emergence of volatility as an asset class. First off, ETFs opened the door for the average investor to trade […]