Cryptocurrencies have been red hot, as we noted on November 5.

So it came as no surprise when Bitcoin hit a new all-time high of $66,566 a day later.

The surge is all thanks to retail and institutional interest, as well as JP Morgan, which says Bitcoin could be headed to $146,000. “The re-emergence of inflation concerns among investors during September/October 2021 appears to have renewed interest in the usage of bitcoin as an inflation hedge,” JPMorgan’s Nikolaos Panigirtzoglou said, as quoted by Yahoo Finance.

That’s not only great news for Bitcoin—it’s also a big catalyst for bitcoin miners.

Bitcoin Mining Stocks are Racing to Higher Highs

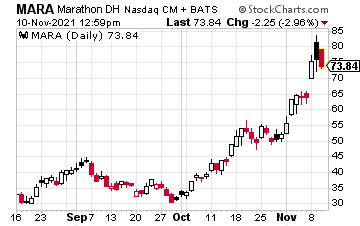

On November 5, we brought your attention to Marathon Digital (MARA), which soared by $11.48 to a high of $77.33 on the heels of the Bitcoin rally. The company also just announced it produced just over 417 bitcoin in October, increasing its total holdings to 7,453 bitcoin.

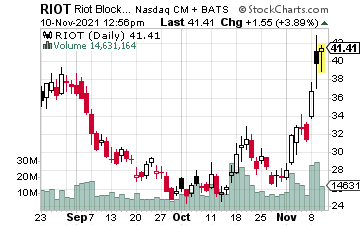

We also highlighted Riot Blockchain (RIOT), as it traded at $31.50. Earlier this week, it soared $5.20 higher to $36.70… and it could push even higher, helped by the company’s recent announcement it produced 464 bitcoin in October, bringing its total BTC holdings to 2,921 bitcoin.

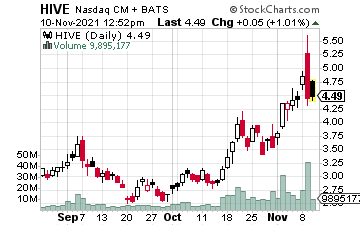

Even HIVE Blockchain (HIVE) pushed higher.

When we first highlighted the HIVE stock, it traded at $4.29. It’s now up to $4.86. While we’re not seeing any October numbers for HIVE just yet, there’s a good deal of growth here. As we noted on November 5: “HIVE is also quickly growing. In its most recent earnings report, HIVE reported gross revenue of $37.2 million from mining—a 466% jump year over year. Net income came in at $18.6 million from $1.8 million year over year. Gross mining margins were up to $31 million from $2.6 million. That’s impressive, solid growth.”

With Bitcoin pushing higher, bitcoin mining stocks—like MARA, RIOT, and HIVE—should follow.