The U.S. economy will likely experience a recession this year. We may already be in one. I believe the 2023 slowdown will be significantly different compared to recent economic contractions.

Memorable recessions are usually associated with a larger financial crisis, such as the bursting of the dotcom bubble or out-of-control subprime mortgage lending, such as what we saw with the Great Financial Crisis.

I am calling the current/pending negative growth an earnings recession.

But here’s the thing – this won’t really spread to the wider economy. Or to our portfolios, as long as you do this one thing…

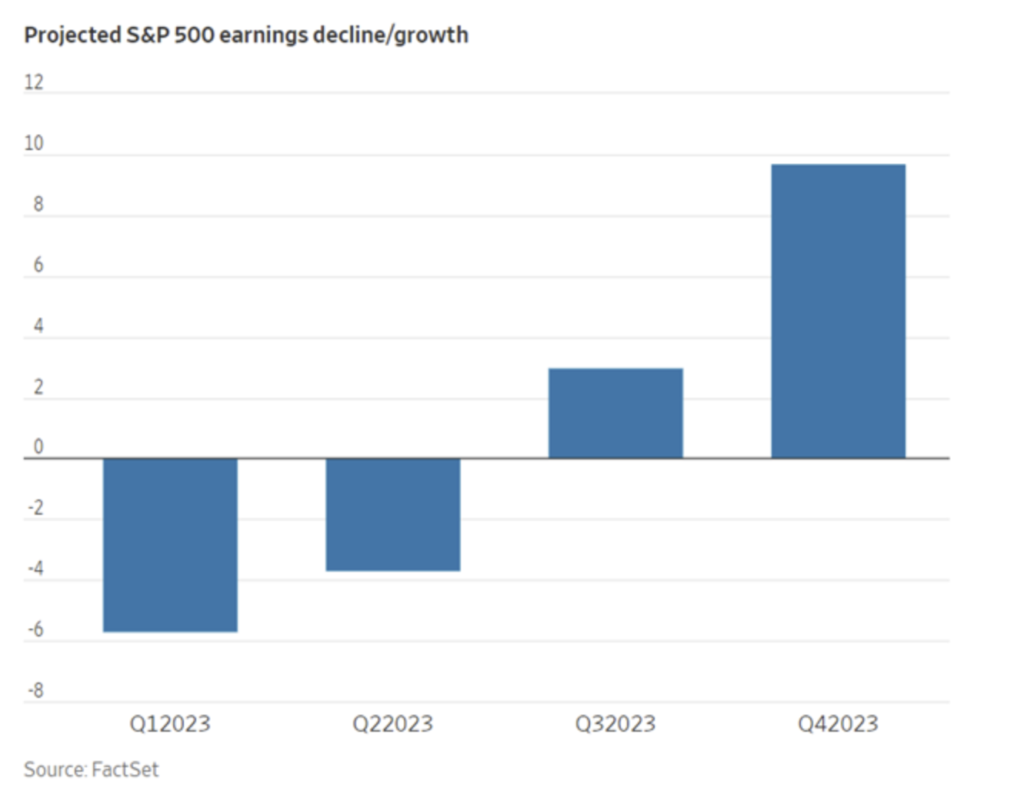

Let’s start with this graphic from a recent Wall Street Journal article:

You can see that corporate earnings are forecast to decline over the first half of 2023. This doesn’t mean that U.S. corporations will lose money. It means that company profits will decrease. Most U.S. corporations will still be profitable, but the profits will likely decline compared to the same periods last year.

The most significant cause of declining profits comes from higher interest rates. As a company has to pay more on its debt, less money falls to the bottom line.

I don’t think the profit slowdown will spread to the broader economy, which would result in higher unemployment numbers. Companies that hired too many employees over the last couple of years might right-size their numbers, but there will not be widespread layoffs. This situation means anyone who wants to work will still have a decent-paying job, and those workers will continue spending like Americans.

The earnings recession will leave regular folks feeling okay about their finances. Investors face a different challenge. They will need to put a value on the shares of companies where profits are going down. Markets don’t like that. For example, last week, New Fortress Energy (NFE) missed on revenue, and the share price dropped by 15% in one day. NFE will be an outstanding long-term stock, but it was a tough day. I picked up a few shares.

The best chance for attractive returns in 2023 will be high-yield stocks in sectors that are either immune or benefit from the current situation with interest rates and inflation.

Energy infrastructure will be one sector with growing cash flows and dividends. To my subscribers, I recommend exposure through the InfraCap MLP ETF (AMZA). The fund boosted its monthly dividends in January and currently yields 8.7%.

Business development companies (BDCs) are killing it with higher interest rates. BDCs lend to small and medium-sized corporations. These loans are almost exclusively floating rate, so higher interest rates mean higher profits. There seems to be daily news about another BDC boosting its dividend rate. For example, Blackstone Secured Lending (BXSL) recently raised its dividend by 16%, giving a current yield of 11%.

I added a fourth BDC to the recommended portfolio with the March newsletter for my Dividend Hunter service. The sector will be so good for investors in 2023.