Dear Investor,

The recent stock market declines have many investors fearing a market crash, such as the 2008 – 2009 bear market.

Back then, the major stock market indexes dropped by more than 50%. As I see what is happening in the markets, this recent pullback feels more like 2018. If I am correct, the recent market correction offers a great opportunity, especially for income-focused investors.

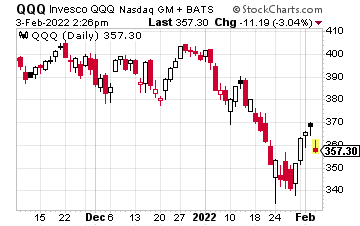

If you look at, say, a five-year stock chart of the Invesco QQQ ETF (QQQ), you can hardly see the 2018 stock market correction. QQQ is the primary ETF tracking the Nasdaq 100 stock index.

From the high for the year in late September 2018 until the correction bottomed at Christmas that year, the QQQ value dropped by 23.5%. That drop was a serious correction, bordering on bear market territory. For comparison, the recent QQQ value of $354 and change represents a 13.3% drop from the pre-Thanksgiving record high.

From the late 2018 bottom, it took the QQQ just over four months to set a new, record high. More importantly, QQQ has gained 144% in just over three years since the 2018 correction bottomed out.

My stock market strategies focus on dividends and generating cash income. I used the QQQ example to show that, while it can feel scary to do so when in the middle of a steep market decline, investing for the long term allows investors to readily take advantage of shorter-term market dislocations.

Following my Dividend Hunter recommendations, a market correction offers double benefits for investors. When you buy a high-yield stock at a lower price, the effective yield is higher, and you earn more income per dollar invested. And the investing-for-income mindset makes it easier to jump on dividend-paying shares when the share prices fall (click here to see how this can help you).

At the same time, income-focused investors increase the value of their investment portfolios if they buy through the decline and recovery. I have a 50% gain on my Starwood Property Trust (STWD) holdings in my personal account because I kept adding shares through the 2020 bear market and recovery. Plus, I continue to earn an 8% yield on the shares (my yield-on-average-cost is over 11%).Because I used QQQ for my stock market correction example, take a look at the Global X NASDAQ 100 Covered Call ETF (QYLD). This covered call strategy ETF uses QQQ as its underlying assets, pays monthly dividends, and yields more than 12%. It’s a strategy I show people everyday in my Weekly Income Accelerator service – and I’d love for you to join us.