The recent, short-term, stock market crash has led to a “flight to quality,” which means money running out of stocks and into safe investments such as U.S. Treasury notes. Demand for Treasuries lifts bond prices, which has the mathematical effect of pushing down yields. Over the last two weeks, the yield on the benchmark 10-year Treasury Note has crashed. The current yield is 1.08%. That’s basically a one-percent yield on a security that doesn’t mature for a decade.

The 10-year yield dropped by 43 basis points over the last month. A basis point is finance speak for 1/100th of a percent, so the bond yield is now 0.43% lower than it was 30 days ago. That roughly one-half a percent drop in the yield produced a 4.5% increase in the price of the 10-year Treasury. Buying bond funds a month ago, or even a year ago, was a great investment move as interest rates (as represented by the 10-year yield) declined by 168 basis points over the last 12 months.

Make sure you understand the mathematical fact that when interest rates fall, bond prices go up. The reverse is also true. With the 10-year rate now at one-percent, it is hard to imagine there will be more capital gains from owning longer-term bond funds. The best case now is that rates stay low and investors in a Treasury ETF or index fund will earn 1% a year for the next decade. If rates start to increase, bond fund prices will fall, resulting in what could be significant capital losses.

Point two to understand is that a bond fund/ETF is different from owning individual bonds. A bond will mature and pay off the principal amount. If a bond’s market price falls due to rising rates, an investor can hold on until maturity and receive the full face value. In contrast, a bond fund portfolio owns bonds to match the fund’s target maturity. It never holds bonds until they mature. For example, the iShares 20+ Year Treasury Bond ETF (TLT) will always match the market value and current yield of a 20-year Treasury bond.

If you own Treasury or investment-grade funds or ETFs for the safety, be aware that if interest rates start to increase, these funds will experience serious capital losses. Plus, the open-end nature of this fund type means that if interest rates stay higher, you will never recover the principal value losses.

If you have a company-sponsored 401(k) account, check the percentage of fixed income investments in your account. My experience is that most advisor managed 401k accounts have 30% or more in bond index funds or ETFs.

Here are three popular bond investment products to sell now that you have racked up some nice capital gains.

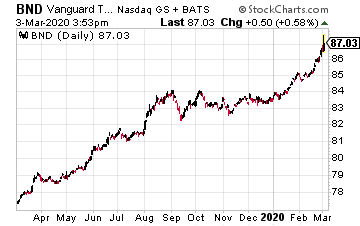

The Vanguard Total Bond Market ETF (BND) has assets of $51.4 billion and is one of the most popular fixed-income investment funds.

Over the last 12 months, BND returned 11.77%. The current yield to maturity is 2.0%. Not many investors would be happy, earning 2% for the next decade.

They will be less happy if interest rates increase, and the share price drops 10%, 15%, or more.

Advisors use BND as a no thought required way to put fixed income exposure in a portfolio. It could easily be a no thought danger to your wealth.

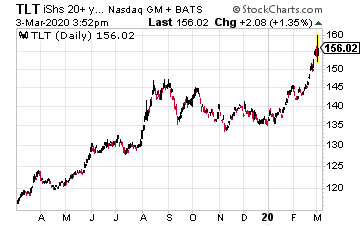

Traders use the iShares 20+ Year Treasury Bond ETF (TLT) as a vehicle to bet on the direction of interest rates.

That bet has worked with the ETF shares gaining 6.9% in February and the fund posting a 33.5% total return for the past 12 months.

The big capital gain occurred as the yield on the 20-year Treasury bond fell from 2.9% to under 1.5%.

Imagine the share price loss if long term yields go back up to 3% to 4%.

TLT is not an ETF to own for a “safe” 1.65% yield to maturity.

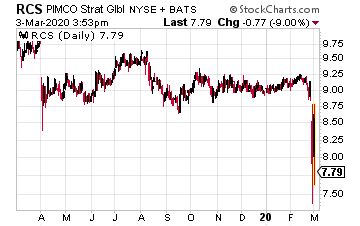

Even scarier are closed-end bond funds like the PIMCO Strategic Income Fund (RCS).

The portfolio description of income-producing securities of U.S. and foreign issuers, including emerging market issuers, the fund seeks to generate, over time, a level of income higher than that generated by high-quality, intermediate-term U.S. debt securities, sounds safe enough.

The monthly distributions with a 9.3% yield are very attractive. The danger is this fund has $1 billion in assets and just $300 million in equity.

The yield is supported by a bond portfolio sitting on top of three times equity leverage.

If bond values fall by 10%, the RCS share price will drop by 30%. Stay away.