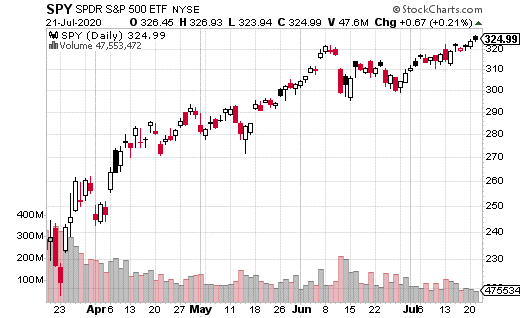

The S&P 500, and its ETF analogue SPY, is roughly breakeven for the year, which is crazy if you think about it. We had a full market crash in March due to the coronavirus pandemic. For the most part, the concerns that arose in March haven’t come close to being resolved; yet the stock market has gained back almost everything it lost in the selloff.

Part of the apparent resilience in stocks is due to extremely low interest rates. In other words, with fixed income investments paying virtually nothing, investors have turned to stocks in hopes of generating higher returns (to make up for the lack of yield in more traditional investments).

Nevertheless, the pandemic won’t be going away anytime soon, nor will its impact on the economy. Investors may have hoped for a quick recovery from the economic shutdown earlier in the year, but that does not seem to be the case. In fact, several hard-hit areas of the US are going through another round of shutdowns.

So what can we expect from the stock market moving forward?

Even in normal times, you can’t really use history as a guide for expected market returns; however, it’s even more nebulous under current circumstances. This pandemic may still be in its early stages. There’s an extremely high-stakes election in the US in November. And, we have no idea what kind of long-term impact the coronavirus pandemic is going to have on the economy.

In times like these, understanding options becomes even more important. Options strategies can help protect your investments and allow you to take advantage of significant market swings.

I came across a trade recently that seems like a perfect fit for the current market environment. This trade occurred in options on SPDR S&P 500 ETF (SPY), the most heavily traded ETF in the world.

With SPY trading at $325.78, a trader (likely a fund or institution) purchased the August 21st 300-315 put spread. That is, the 315 put was bought and the 300 put was sold at the same time (in order to reduce the premium cost of the trade). The trade cost $2.29 and was executed 10,000 times (for $2.3 million premium).

A trade like this is generally one of two things: a portfolio hedge or a directional bet. If it’s a hedge, it will protect a broad-based stock portfolio by making money if the market sells off. If it’s a directional bet, then it can be considered a relatively inexpensive way to short the market.

The put spread will be profitable if SPY drops to $312.71 by August 21st expiration. Max loss is only the $2.29 spent on premium for the trade. However, max gain is $12.71, which can be achieved if SPY is at $300 or below at expiration. That’s 555% in gains if max gain occurs (or $12.7 million in dollar terms).

The put spread strategy brings down the cost of this bearish strategy by half. In other words, just buying the 315 put would cost twice as much. By selling the 300 put, this strategy becomes much more viable as a hedge or directional bet because it’s far more affordable than just buying the puts outright.