With tomorrow being Thanksgiving I thought it might do us some good to think about all of the things we have to be thankful, even in the midst of a pandemic, recession, and polarized political environment.

I’m thankful for you. You and other readers are what drive me to research investment ideas and share what I find.

I’m thankful for my wife and my family and the wonderful community that I’m a part of. And I’m thankful to this great nation that gave me a chance to serve in the U.S. Air Force when I was younger and gives me a place to earn a living and lead a successful life.

And I’m thankful to all of the men and women working tirelessly to help get us through this pandemic and return to a more normal lifestyle, whatever shape that might take once we’re through this.

The coronavirus pandemic triggered a stock market crash into bear market territory. While the major market indices have recovered the losses and even set new high water marks, there are market sectors and individual stocks that continue to be priced well below the levels in effect at the start of 2020.

Over the last few weeks, we have seen a shift of investor interest towards value stocks—but don’t worry, it’s not too late to grab some great deals.

Every market cycle is different. Recently, I saw a stat stating that during the Great Financial Crisis, real estate investment trust (REIT) values dropped by 70% and then took eight years to return to the pre-crash highs. At the beginning of the coronavirus pandemic, the U.S. major indexes lost 33% of their value in less than two months, hitting the bottom in late March. The recovery was quick, with the S&P 500 back to record levels by mid-August.

The S&P 500 covers a range of market sectors, and 2020 returns vary tremendously by industry. So far this year, the Information Technology sector leads the pack, up 32.3%. Energy lags at the opposite end of the performance matrix, down 41.1%.

The average investor may stay away from a sector like energy because it lost so much. Smarter investors, such as my Dividend Hunter subscribers, understand that buying income stocks when they are down provides an excellent opportunity for capital gains plus very attractive dividend yields.

To give you places to look, here are the three worst-performing sectors year-to-date.

- Energy, off 41%

- Financials, down 11.1%

- Real Estate, down 4.3%.

The shift to value has begun with these three sectors gaining 17.4%, 9.5%, and 2.75%, respectively, over the last 30 days. You can see that the deeper sectors have fallen, the greater the potential recovery gains. In each of these sectors, look for the most undervalued stocks that have strong fundamentals.

I am excited about the high-yield income sectors I follow and recommend to my subscribers. There are great opportunities to earn high current yields, with potential for capital gains of up to 100% over the next couple of years.

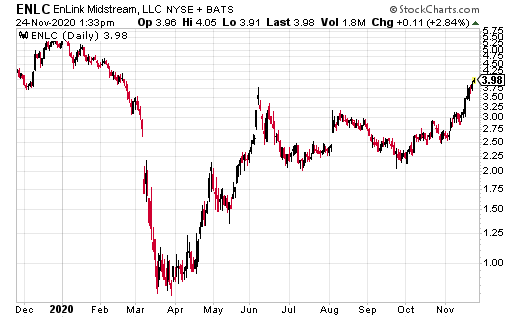

Here is one to discuss around the Thanksgiving dinner table: EnLink Midstream LLC (ENLC) remains down 20% for 2020.

My subscribers who followed my guidance back in April and May already have 200% plus gains in the stock—and there is a good chance it will double again.

The current yield for EnLink is 10%.