In my high-yield investment service, the Dividend Hunter, the economic and social disruptions of 2020 forced a host of changes in my recommended investments and portfolio management guidance. As we move into 2021, I suspect investors will need to remain vigilant about business conditions as the coronavirus pandemic hopefully comes under control. Here are things I will be watching and analyzing…

I spend little time trying to predict the future in my investment strategies. That is one reason I use dividend-centric investment criteria. In “normal” times, we can build a stable and growing income stream through dividend stocks. At the Dividend Hunter, I recommend higher yield investments to maximize the size of that income stream.

The pandemic and resulting economic crisis has had a range of effects on different business sectors. Some thrived, some struggled, and some are at death’s door. Throughout 2021, I will be watching individual company results for signs of recovery, as well as for delayed effects. Here are some examples from the high yield world:

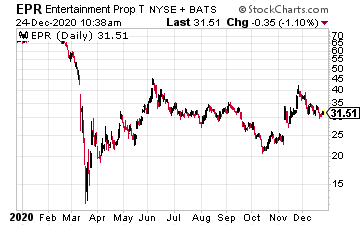

Real estate investment trusts (REITs) that owned experiential business properties got hammered by the coronavirus. EPR Properties (EPR) is the poster child of this group. For years, EPR had been a “buy and hold, forever” type of stock, with a 7% yield, 7% annual dividend growth, and monthly dividends.

Multiplex movie theaters are the primary asset type owned by EPR, which also hosts other experiential oriented real estate, such as Top Golf facilities and ski resorts. With many of its tenants shutdown by the coronavirus outbreak, EPR suspended dividends in May. Another category of REITs in which dividends stopped across the sector is hotels.

I will not try to predict when dividend payments for the REITs in these groupswill return. Instead, I plan to monitor quarterly results to determine how each management team plans to business back up to speed, and how they plan to reward investors with dividends.

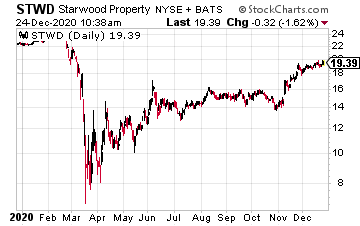

The other side of my 2021 watchlist will be those companies that weathered 2020 reasonably well but may yet be subject to the lingering effects of the pandemic. I currently see two income stock categories in this group.

In general, the commercial mortgage REITs have been able to sustain dividends and cover those payouts with free cash flow. This applies to high-quality companies in the group and not the bottom-feeding finance REITs, such as Starwood Property Trust (STWD), an extremely well run commercial mortgage REIT and a long-time Dividend Hunter favorite. However, even the best-run mortgage company will be challenged if borrowers can’t make their payments.

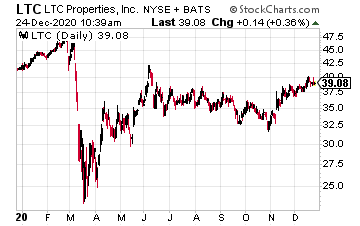

Senior living and nursing home REITs are another sector to watch closely. Recently, the Wall Street Journal put out an article titled “Covid Spurs Families to Shun Nursing Homes, a Shift That Appears Long Lasting.”

At the same time, expenses for senior living facilities may skyrocket due to increased costs to keep residents COVID-free. LTC Properties, Inc. (LTC) is a former favorite in this sector, but I will not recommend it again until I am confident its dividend is secure.