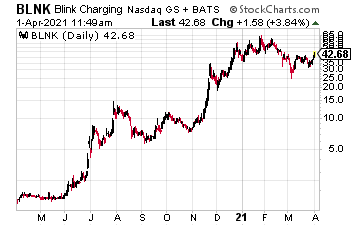

Electric vehicle charging stocks, like Blink Charging Co. (BLNK) were higher this week. All after President Biden made charging stations a top priority in his $2 trillion infrastructure plans.

“AlixPartners estimates $300 billion will be needed to build out a global charging network to accommodate the expected growth of EVs by 2030, including $50 billion in the U.S. alone,” reports CNBC. In addition, the US Senate just introduced the Securing America’s Clean Fuels Infrastructure Act, which would invest more money in clean vehicle infrastructure, including hydrogen refueling stations and electric vehicle charging stations.

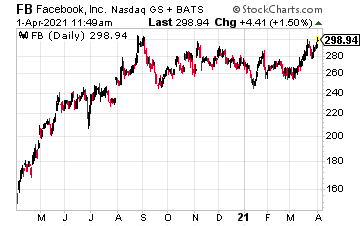

Facebook (FB) is still running after analysts at Deutsche Bank raised their price target on the stock to $385 from $355 with a buy rating. All after positive feedback from advertisers and recent commentary from CEO Mark Zuckerberg.

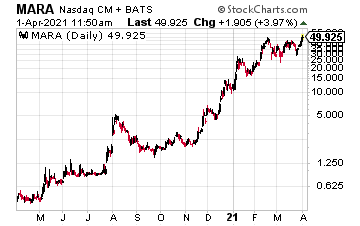

With Bitcoin nearing $60,000, crypto miners, like Marathon Digital (MARA) are along for the ride. Remember, the higher BTC runs, the higher MARA could run. Helping, the company “expects all 103,120 of its miners to be deployed by the first quarter of 2022, at which point, the Company will be directing 10.37 EH/s to the mining pool. In June 2021, the pool will begin accepting other U.S.-based Bitcoin mining companies,” as noted in a company press release.

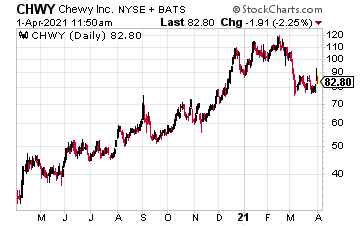

Chewy Inc. (CHWY) Investor tails were wagging on solid earnings.

In its latest quarter, Chewy saw revenue of $2.04 billion, up 51% year over year. That was also ahead of expectations for $1.96 billion. EPS was five cents a share, which also beat estimates for a loss of 10 cents a share. In addition, according to Barron’s, “Guidance was above expectations. For the April quarter, Chewy sees revenue of $2.11 billion to $2.13 billion, up 30% to 31%, and ahead of the previous Street consensus estimate for $2.08 billion.”

As a result, JP Morgan also reiterated its overweight rating with a price target of $98 from $97.

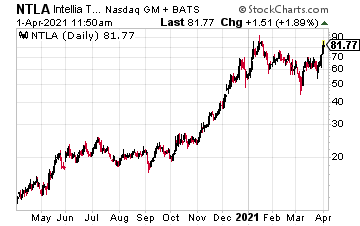

Gene editing stock, Intellia Therapeutics (NTLA) was up about 11% earlier this week. All after its investigational CRISPR treatment NTLA-2001 received EU Orphan Drug Designation for “transthyretin amyloidosis (ATTR), a rare condition that can impact a number of organs and tissues within the body through the accumulation of misfolded transthyretin (TTR) protein deposits,” as noted in the company’s press release.

“This news is a significant milestone for NTLA-2001 and the ATTR patient community,” added Intellia President and Chief Executive Officer John Leonard, M.D. “We are pleased that the EC recognizes the potential significant benefit of NTLA-2001 in the treatment of patients with this debilitating disease where there is no cure. We look forward to advancing the global development of this genome editing product in collaboration with Regeneron.”

At the time of this writing, Ian Cooper did not hold a position in any of these stocks.