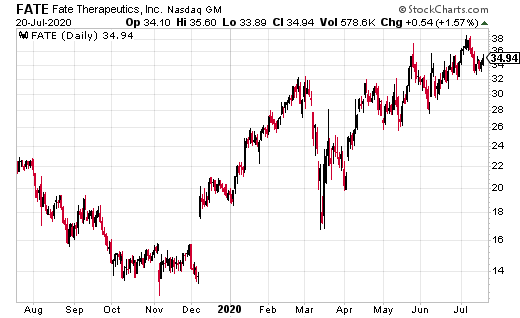

Since bottoming out in March 2020, Fate Therapeutics (FATE) has run from a low of $19.91 to a current price of $35.50 with plenty of catalysts.

For one, FATE just entered into an exclusive license agreement with Baylor College of Medicine covering alloimmune defense receptors, a first-in-class approach that renders off-the-shelf allogeneic cell products resistant to host immune rejection.

Preclinical studies published in the journal Nature Biotechnology demonstrate that allogeneic cells engineered with a novel alloimmune defense receptor (ADR) are protected from both T- and NK-cell mediated rejection, and provide proof-of-concept that ADR-expressing allogeneic cell therapies can durably persist in immunocompetent recipients.

Two, FATE recently secured a $3 billion deal with Janssen Biotech, Inc, one of the Janssen Pharmaceutical Companies of Johnson & Johnson to develop four cancer treatments.

These treatments belong to a class known as immuno-oncology drugs, which help teach the immune system how to identify hidden cancer cells. Not only does this deal now validate Fate Therapeutics technology, notes Investor’s Business Daily, it removes cash flow concerns, and now adds another four potential cancer treatments for the company.

Three, the U.S. Food and Drug Administration (FDA) has cleared the Company’s Investigational New Drug (IND) application for FT819, an off-the-shelf allogeneic chimeric antigen receptor (CAR) T-cell therapy targeting CD19+ malignancies. FT819 is the first-ever CAR T-cell therapy derived from a clonal master induced pluripotent stem cell (iPSC) line, and is engineered with several first-of-kind features designed to improve the safety and efficacy of CAR T-cell therapy.

The Company plans to initiate clinical investigation of FT819 for the treatment of patients with relapsed / refractory B-cell malignancies, including chronic lymphocytic leukemia (CLL), acute lymphoblastic leukemia (ALL), and non-Hodgkin lymphoma (NHL).

Ian Cooper’s Personal Position in FATE: None