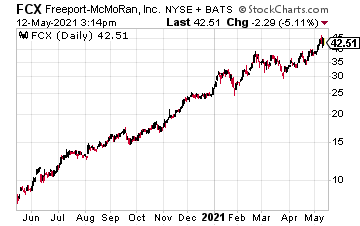

Freeport McMoRan (FCX) could see higher highs on the copper supply-demand fiasco. according to Barron’s, “Supplies, already tight as the global economy recovers, could be further strained by a predicted fivefold rise in green energy demand in the current decade, leading to significant shortages, starting in the mid-2020s, according to a report by Goldman commodity analyst Nicholas Snowdon. He sees copper, now around $4.50 a pound, hitting $6.80 by 2025. Bank of America commodity strategist Michael Widmer thinks the price could hit $6 this year.”

In addition, according to Goldman Sachs, copper could rally to $15,000 by 2025. The firm also believes annual demand for copper could skyrocket 900% to 8.7 million tons by 2030.

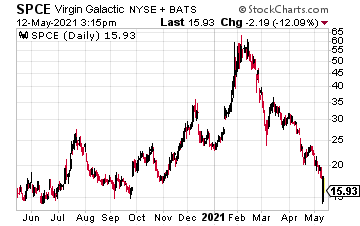

Virgin Galactic (SPCE) is plunging back to Earth.

Not only were earnings far from impressive, Jeff Bezos’ Blue Origin announced plans to launch the first crewed flight of its rocket on July 20. That could remove SPCE’s first-mover advantage, says CNBC. Plus, insiders like Chairman Chamath Pailhapitiya, Richard Branson, and Cathie Wood’s new space-themed ETF have been selling.

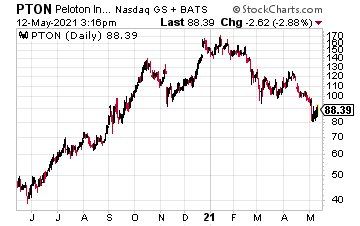

Peloton (PTON) is falling apart on news it’s recalling all treadmills after reports of injuries, and a death. “The company is advising customers who already have either the Tread or Tread+ products to immediately stop using the equipment and contact Peloton for a full refund or other qualified remedy,” says CNBC.

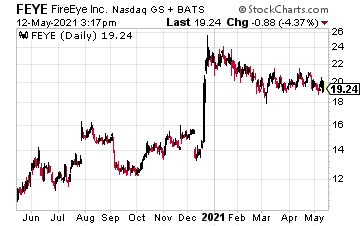

Cybersecurity firm, FireEye (FEYE) caught traction after top U.S. fuel pipeline operator, Colonial Pipeline shut down its entire network after a ransomware attack. That’s a big deal considering Colonial transports 2.5 million barrels per day of gasoline, and other fuels through 5,500 miles (8,850 km) of pipelines linking refiners on the Gulf Coast to the eastern and southern United States, according to Reuters.

Plus, “This is as close as you can get to the jugular of infrastructure in the United States,” said Amy Myers Jaffe, research professor and managing director of the Climate Policy Lab, as also quoted by Reuters. “It’s not a major pipeline. It’s the pipeline.”

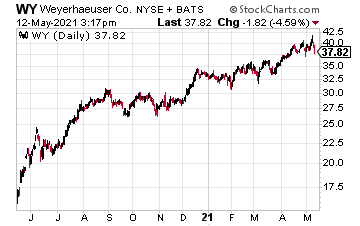

Weyerhaeuser (WY) is still running on higher lumber costs.

In fact, lumber prices are now through the roof, and no one knows when they will change. According to News 5 Cleveland, “According to the National Association of Home Builders, the rise in lumber has added about $36,000 to a newly built home. In May of last year, $50,000 worth of lumber could build about 10 homes, this year, it can build only 2. The price is up more than 300% from last year.”

At the time of this writing, Ian Cooper did not hold a position in any of these stocks.