For the last decade or so around this time of year, investors and technology enthusiasts have anxiously awaited the launch of brand-new Apple (AAPL) products. Ever since the iPhone became the most popular product in the world, each new iteration of it (and other Apple products) has drawn significant interest.

From an investor standpoint, Apple is a growth company. As such, shareholders (and potential shareholders) want to see how much the new products will add to the top line. They also are generally happy to see long lines outside of Apple stores as they raise the hype level.

What’s funny is that a sort of pattern seems to play out during these pre-launch periods. Apple has a conference to announce new products, usually in September. The stock price rises ahead of the announcement. Then, the new product(s) turns out to be more or less the same as the old product, with a slightly better camera and processor.

The stock then falls because the crowd expected more. (What do they think a new phone or tablet is going to do? Mine bitcoin?) Then, it turns out that everyone still wants to buy the new phone/tablet/computer anyways. Preorders sell out. Lines form. The stock goes up.

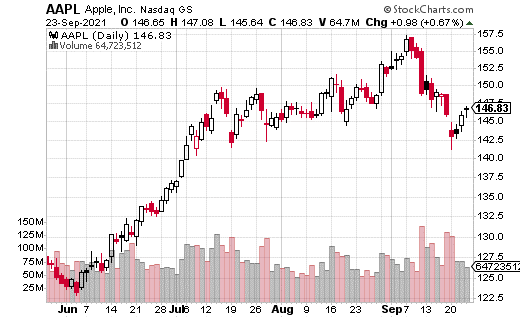

2021 has been no different. As of the writing of this article, ahead of the iPhone 13’s September 24 launch, the stock was already rising on news of heavy preordering. So now that the cycle has basically played out again, can you still make money on Apple and the new iPhone?

One trader is taking a more creative view of the situation by using short-term covered calls. The strategist bought a million shares of AAPL at $146.70. At the same time, the trader sold 10,000 of the October 15 150 calls for $1.57. It’s a three-week buy/write trade.

By selling the 150 calls, the covered call buyer does not seem to expect the stock to climb higher than $150 by mid-October. It could be that the expectation is for the share price to recover due to the brisk sales of the new iPhone but not break into new highs.

Meanwhile, the $1.57 from the call premium provides a source of cash flow. The return on cash, in this case, is 1.1%. That may not seem like a lot, but it’s only a three-week period. From an annualized standpoint, that’s a 19% yearly return. But even a 1.1% return on its own is way more than most people can get from a short-term fixed income product these days.

What’s more, AAPL is about as safe a stock as it gets. There’s not a lot of downside risk. And, the trade can also benefit from a move up to $150 to the tune of an extra $3.30. All told, the trader can earn a 3.3% return in just three weeks, without taking on a substantial amount of risk.