The world economy was basically on hold for more than a year due to the coronavirus pandemic (and now variants of the virus that causes COVID-19). Some countries, like the U.S., are mostly back to normal operations. Other countries are still dealing with lockdowns and widespread infections due to a lack of vaccinations. Overall, though, economic growth numbers have been headed in the right direction.

While the U.S. and some developed nations have successfully rolled out many vaccinations, emerging market countries have had mixed results. China is ahead of the curve, for instance, while India has had well-publicized issues.

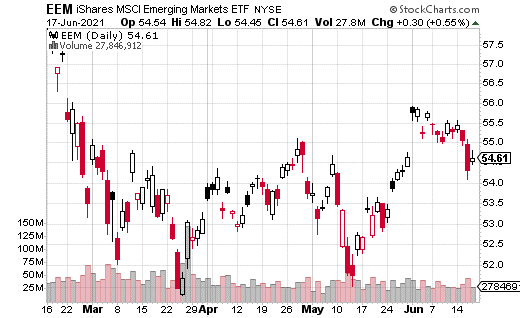

Regardless, some investors are looking at emerging markets as a possible place to park their money while U.S. stocks have been moving mostly sideways. One common way to invest in emerging markets is through the iShares MSCI Emerging Markets ETF (EEM). The popular ETF trades 40 million shares a day on average and 250,000 options contracts.

EEM is made up of more than 1,000 stocks based in emerging market countries; approximately a third of the companies are in China. The following three largest allocations are in Taiwan, Korea, and India. The ETF pays a dividend of around 1.5%.

The thing is, it may take a while for EEM to perform. It’s up about 5% year-to-date, which is considered underperforming the U.S. market. While it may be possible emerging market stocks will get a boost in the coming months, what if there’s a way to earn more money besides the meager dividend?

That’s where covered calls come in handy.

A trader last week placed a massive covered call trade in EEM, likely looking to boost the yield on the position while still allowing for some upside potential. With EEM at $54.58, the trader sold 12,500 September 17 60 calls versus the shares (1,250,000 shares would have been purchased simultaneously).

The calls were sold for $0.23, which may not seem like a lot at first glance. However, the half-percent boost to yield for three months can be a big deal for a trade that size. That works out to about 2% additional yield per year or more than double what the dividend is.

What’s more, there is still room for the share price to climb up to $60 before the gains are capped out. That’s an additional 9.7% in possible profits to the upside. Given EEM’s history, it’s not likely to blow through that strike. In other words, the trader is getting paid an additional 2% a year to own EEM, likely without sacrificing any upside potential.