It is an exciting time to be an income-focused investor. Business results are improving, yet share prices have not recovered from the February-March crash. The lack of share price recovery allows us to pick up shares of solid income stocks at excellent yields. Who wouldn’t like earning 9%, 11%, or even 15% from an investment where the dividend looks secure, and there is tremendous potential for share price appreciation?

I keep watch on several hundred dividend-paying investments. There are hundreds more that I may or may not have perused. My Dividend Hunter subscribers are a good source of new income investment ideas. Each month I ask the subscribers to my Dividend Hunter Insiders service to submit a stock that they’re interest in for for me to perform an in-depth dive review. These will be stocks or other investments that are not in the Dividend Hunter recommendations list.

Do you have $25,000? If you do, you’re set. You can generate tens of thousands of dollars from dividend stocks for your entire lifetime. Click here for the plan set-up. [ad]

My Insiders send me up to 70 stock ideas each month for a deep dive review. I select one, apply my analysis techniques, and send to all of them – whether they submitted a stock or not – a report on the chosen investment. Each month, the crowdsourced list includes some intriguing investment ideas of which I was not aware like the biotech closed-end fund that long time subscriber Scott suggested.

As the economy continues to steadily climb out of the coronavirus pandemic economic crash hole, I am excited for the high-yield investment choices going into the new year. For the next Dividend Hunter newsletter issue, I will show the mathematic logic for 100%-plus share price returns, plus high dividend yield’s over the next couple of years.

For fun, here are five of the submitted investments that I find interesting. These are not current recommendations, but they may warrant a more in-depth look.

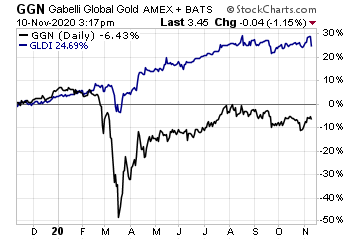

I’m lumping together the first two investments: GAMCO Global Gold, Natural Resources & Income Trust (GGN) and the Credit Suisse Gold Shares Covered Call ETN (GLDI).

The two funds take different strategies to provide high-yield exposure to gold and natural resources.

These days I am somewhat of a gold bug. The massive dumping of stimulus cash into the global economy could lead to currency devaluation, which is very good for the price of gold.

GGN has a current yield of 10.3%, and GLDI yields 12.7%.

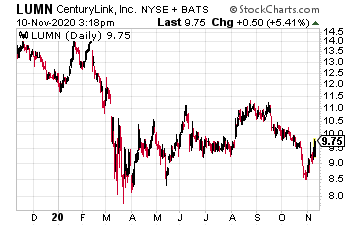

I thought I was was not familiar with Lumen Technologies (LUMN) and its 10% dividend yield; however, with some digging, I discovered that Lumen is actually a rebrand of CenturyLink.

The recent history of CenturyLink has been extremely troubled.

The dividend was cut by 54% in March 2019, well before we had heard about the coronavirus.

I suggest not being taken in by the new fancy name.

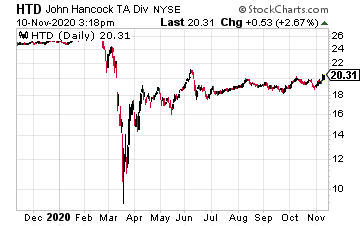

I often refer to the closed-end fund universe as a junkyard. As with any junkyard, you can sometimes find something valuable if you shift through the junk.

The John Hancock Tax-Advantaged Dividend Income Fund (HTD) may be such a nugget.

The fund invests in utility common shares and preferred stock shares.

I suggest further research to determine the level of tax advantage that applies to your particular situation.

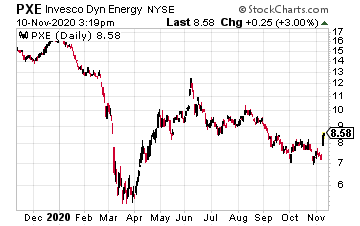

The Invesco Dynamic Energy Exploration & Production ETF (PXE) offers a very contrarian play for future energy production.

The fund owns a portfolio of oil drillers and refiners. Both ends of the carbon-based energy spectrum are significantly out of favor.

PXE currently yields 6.5%.

As I noted, these investments were sent by my very smart Dividend Hunter Insiders subscribers, they’re a special group of Dividend Hunter readers.