Shares of GoDaddy (GDDY) are once again making a run at all-time highs after building a nice base of support throughout June. GDDY is best known for its website domain businesses, but it is also expanding into other areas that should significantly enhance its bottom line.

GDDY recently announced the launch of GoDaddy Payments, a new payments solution platform that enables its customers to handle all their commerce transactions. The technology, which was acquired from Poynt last December, provides websites with a fast and secure way for GDDY’s e-commerce customers to get paid.

The setup process is fairly simple and enables customers to begin using GoDaddy Payments for customer transactions within minutes. Payments are processed securely and efficiently, with the money deposited into users’ bank accounts within 24 hours.

GDDY also has payment integrations deals with Amazon, eBay, Google, Instagram, Shopify, and Square, allowing the businesses to create a professional and unique online shopping experience for success in the digital economy. With more consumers shopping online than ever before, these payments deals meet a brand-new generation of new and established digital retailers.

The company has topped or matched Wall Street’s earnings expectations in three of the past four quarters. GDDY topped forecasts by $0.05 in May after reporting a profit of $0.30 per share on revenue of $874 million in its most recent quarter.

GDDY also announced fourth-quarter total bookings of $943.1 million, up 13% year-over-year, with domains revenue topping $402 million. For the current quarter, with results expected in early August, the company expects Q1 revenue of $885 million versus forecasts of $878.5 million. This would represent approximately 12% year-over-year growth.

For the fiscal year 2021, GDDY estimates revenue of $3.7 billion versus expectations of $3.66 billion. Free cash flow was forecast at $945 million, representing a growth of 15% and up from the $825 million of free cash generated in 2020.

There were four price target upgrades following the prior earnings results that ranged from $100 to $113. Currently, 25 analysts are covering the stock, with four strong buy ratings, 19 holds, and two underperforms.

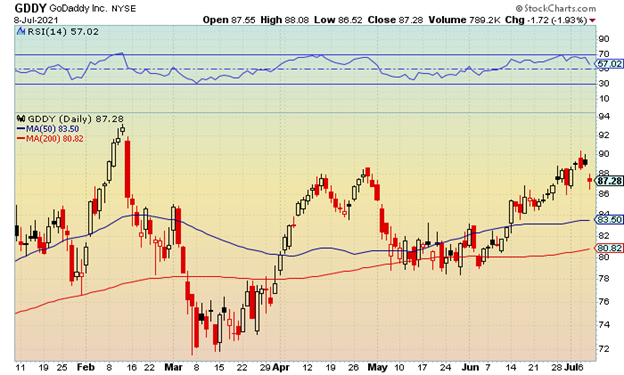

The current chart shows the consolidation period throughout May between $79 and $83, with a breakout above the latter and the 50-day moving average in mid-June. Shares recently tested a high of $90.43 this month; GDDY’s all-time peak of $93.76 was reached in February.

Shares seem to be underappreciated by analysts, given the company’s number of hold ratings as the company remains a solid double-digit organic grower. There will also be an upside to this rate if the economy opens more broadly in the second half of this year.

Conservative traders may want to consider accumulating GDDY at current levels with at least 15%–20% upside based on the previous aforementioned price targets. Near-term covered calls can generate additional income and lower the cost basis in the stock.

Aggressive traders can target the GDDY January 100 call options currently trading near the $3 level. If shares can make a run to $106 by January 21, 2022, these calls would double from current levels as they would be $6 “in-the-money.”