As popular as gold is as an investment, it’s not necessarily easy to pinpoint what type of investment gold is. Is it a safe-haven asset? A hedge against inflation? A currency? A store of value? Maybe it’s all of the above…

The thing is, the type of investment gold is depends on the market environment we’re in. There are times when gold acts as a currency, and other times it’s more like a commodity. Investors’ love of gold has been a complicated relationship—and it’s often in the state of flux.

Gold prices tend to move in the opposite direction from the U.S. dollar. In that regard, it’s much like any other commodity. However, the U.S. dollar doesn’t always have a stable relationship with U.S. stocks. That means gold may or may not move in the same direction as the stock market, which makes it much more difficult to label gold a safe-haven asset.

On the other hand, central banks buy and hold gold, and millions of people use gold as a store of value. In that sense, gold works in much the same way as a reserve currency. Of course, unlike the dollar or yen, you can’t spend gold unless you sell it first.

As you can see, despite its popularity, gold as an investment can have several variables affecting it. Nevertheless, the precious metal has been sought after for thousands of years. That likely won’t change anytime soon.

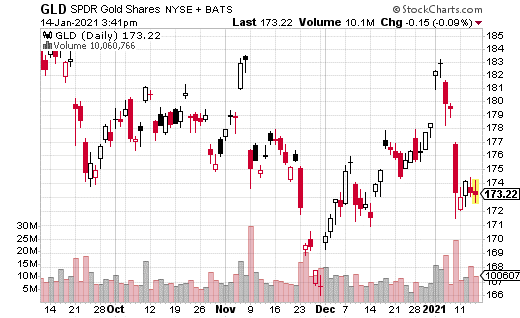

One common way to invest in gold is by using SPDR Gold Shares (GLD). This heavily traded ETF tracks the price of gold bullion. GLD is extremely liquid, with $70 billion in assets and trades over 300,000 options per day on average. One thing it doesn’t have, though, is a dividend.

Perhaps that’s why someone is using covered calls to place a neutral to slightly bullish bet on GLD for the next year. With a covered call, the stock is bought in lots of 100, and one call is sold per lot. The call is usually sold out of the money, but it doesn’t have to be.

In this case, 300,000 shares of GLD were purchased for $173.13, while 3,000 of the January 2022 180 calls were sold. The call premium received was $11.35 per option, which works out to $3.4 million in total premiums collected. By selling the calls, this position generates a yield of 6.5% for the next year.

In exchange for this yield, the upside of GLD is capped at $180. That’s only $7 higher than where the stock was bought, so it doesn’t allow for much appreciation. Still, the lack of upside is made up for with the 6.5% yield. That’s well above the rate on most fixed income products these days. Of course, GLD doesn’t pay a dividend at all, so any yield is a huge upgrade from that perspective.

Covered calls are a smart way to create or enhance a dividend on ETFs like GLD, without taking on too much risk. The position described above is an excellent way to own gold exposure in your portfolio while also getting paid a reasonable amount to do so.