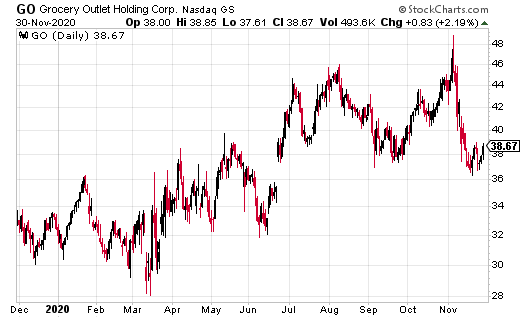

Shares of Grocery Outlet Holding (GO) have dropped over 20% since reaching a 52-week peak of $48.87 in early November. Some of the selling pressure came ahead of the company’s third-quarter earnings announcement and continued afterwards despite an impressive quarter.

Grocery Outlet reported third-quarter earnings of 50 cents a share on revenue just north of $764 million. Wall Street had penciled-in earnings of 23 cents a share on sales of $758 million. It was the fourth-straight beat with the prior three quarters topping estimates by 19, seven and four cents a share.

The company reported comparable store sales increased by 9.1% compared to a 5.8% increase in the same period last year. Given the competition in the grocery retail space, this was a phenomenal achievement.

Grocery Outlet is also expanding despite the ongoing coronavirus concerns and currently expects to open 34 stores this year with no closures planned. This is consistent with their longer-term plan to build its real estate pipeline to support 10% annual unit growth.

Guidance was also given as the company said quarter-to-date comparable store sales growth for the fourth quarter was in the positive mid-single digits and expects results for the full fourth quarter to remain consistent at these levels.

Three analysts issued Buy ratings on the stock in July and August with Price Targets in the range from $47-$50. There were two recommendations in November, one with a Buy rating and $50 price target, and another with a lowered price target from $53 to $50 buy still having a Buy recommendation.

The chart below shows shares have been holding longer-term support at $37-$36.50 and levels from September. Current and key resistance is at $38 and the 200-day moving average. If cleared and held, this would be a bullish development for additional near-term strength and a possible retest towards $40-$40.50 and the 50-day moving average. Additionally, relative strength is just above 40 and a level that usually indicates shares are slightly oversold.

To play a possible bullish setup and run towards $40, option traders can target the GO January 40 calls. These options are currently trading for $1 and would double from current levels if shares are technically at $42 by January 15th and when the options expire.

At $42, the aforementioned calls would be $2 “in-the-money” for a 100% return from current levels. If shares are at $41, the trade would breakeven as the calls would be $1 in-the-money. The call options currently have six weeks before expiration so there is plenty of time for the position to play out.

The risk to this trade would be if shares close below $36.50-$36 as it would signal possible lower lows and a further pullback towards the $32 area. If $36 fails to hold, traders can exit the call options to save the remaining premium.