Why do retirees crave guaranteed fixed income? It’s simple. Retiring comfortably is having enough money to enjoy your lifestyle, without constantly having to worry about money.

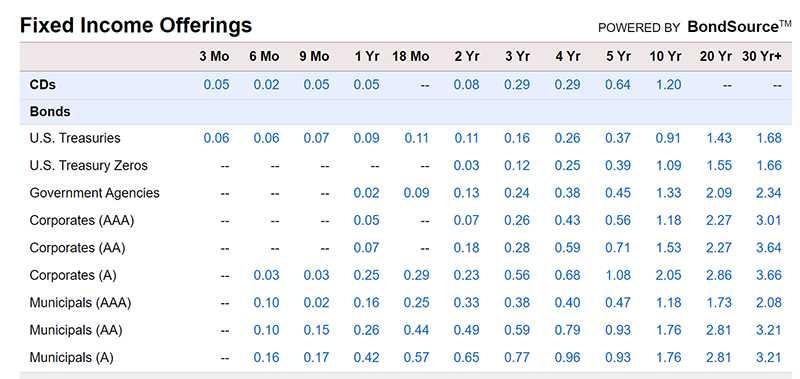

Prior to the 2008 bank bailouts, Certificates of Deposit and top-quality bonds filled that role well. Current interest rates are pathetic.

At current rates, CDs and quality bonds are guaranteed to lose money.

Our friends at WHVP publish an excellent free monthly newsletter, The Swiss View. They report this is a worldwide concern:

“When it comes to government bonds in developed countries, it is almost impossible to find any profitable long-term investments anymore. The 10-year treasury note of the United States for example was the only investment that was still profitable until the beginning of this year.

…. Currently, we are observing the 10-year treasury rate at around 0.9%. Putting this in perspective, with the inflation target of 2%, you will still lose money when buying and holding this investment until maturity.” (Emphasis mine)

In 2016, MarketWatch reported on a Transamerica Center For Retirement Studies survey, concluding,

“Older Americans’ No. 1 fear about their retirement is that they won’t have enough money to afford retirement…. Some 43% said their greatest fear about retirement was outliving their savings and investments, making that the top fear – over loneliness, boredom and even declining health….”

When the survey was completed in 2016 treasury interest rates (select 2016 to view) for a 20-year note was 2.64%. Today it is about half that amount. I’d bet a lot more than 43% would indicate money worries as their top retirement fear today.

2020, a challenging year

Heading in to 2020, my wife Jo and I held our nose, and allocated a good portion of our nest to CDs paying around 2%. We took what little interest being offered in exchange for knowing our money was FDIC insured. We no longer automatically roll them over at current rates. Why would anyone buy an investment guaranteed to lose money? What few we own today are very short term.

We searched for other safe, guaranteed income wherever we could.

Finding good opportunities

What is safe? What is guaranteed? We looked for our monthly edition of Tim Plaehn’s publication, The Dividend Hunter for help. We needed income; while keeping the risk factor to a minimum.

Our criteria changed. While we hoped for some appreciation in stock price, our overriding concern was the ability to continue to pay dividends through thick and thin, and not have the stock price drop like a rock.

Reluctantly, we began buying a few of Tim’s recommendations. We also looked at utility stocks; the yields may be a little lower, but they are unlikely to go out of business – and still pay a lot more than any CD or safe bond. So far, so good. With the stock market setting records, knowing it is in a Fed-created bubble, we kept the allocation to dividend payers under control.

When the market corrected early in the year, Tim wrote a special report for his premium subscribers, “9 Preferred Shares To Take You Through The Recession.” In the past I felt preferred stock dividends were so small, it wasn’t worth it. Tim showed us the market dip caused many of the preferred share prices to drop below their $25 par value; some resulting in double-digit yields.

I wrote about our experiences here, and interviewed Tim about preferred stocks here. The articles generated a lot of positive feedback. Jo and I are not alone in looking for safe, income-producing investments.

An email from subscriber Rick G. hit me like a ton of bricks. He asked, “Both you and Chuck Butler recently discussed diversification and portfolio allocation between metals, stocks, fixed income etc. Where do you put preferred and common stocks in those allocations?”

Rick’s question popped up right after I logged out of my brokerage account; having updated our stop losses.

When it came to the dividend payers, I hesitated. Our dividend payers return a lot more than any CD or quality bond. Are the dividends guaranteed?

With common stock, the answer is no. Many companies cut their dividends in 2020 even though they could have easily paid them. With preferred stock, dividends are guaranteed; some are cumulative and must be paid ahead of common stock dividends.

Some of our common stocks are $50/share and up. All our preferred stocks were bought at less than $25 par value. If one of the common shares dropped 50%, our losses would be scary and who knows when the stock would rebound. Preferred stocks dropping 50% would hurt, but as long as the company stays in business, we felt the dividends were secure. The share prices are interest rate sensitive and would be more inclined to rebound quickly.

If the market tanks, we expect the Fed to rush to the rescue, interest rates would go even lower, which should cause share prices of preferred stocks to rise. Preferred stocks can be called in at par (generally $25/share) just like CDs.

I did not put in stop losses for our preferred stocks. Should we see share prices drop like they did in early 2020, I might be looking to buy more. I kept stop losses for our common stocks.

Preferred stocks are not FDIC insured. The dividends are guaranteed as long as the company remains in business. Do your research, good ones can be found. I feel they are safe enough for us to sleep well at night.

Rick G’s question made me stop and think. I concluded that preferred stocks belong in the “fixed income” allocation of our portfolio. Unlike CDs, they have no maturity date and we plan to hold them, earning nice returns as long as we can. Even though our common stocks are in good, solid companies, I count them as stocks, not fixed income.

A second safe income option

In our recent article, “How do we pay our bills?“, I discussed annuities with a true expert, Stan The Annuity Man. We discussed the fear many retirees have about having to tap into their principal and running out of money before they die.

Stan told us:

“Remember that ALL annuity income (regardless of the type) is a combination of return of principal + interest. Life expectancy is the primary pricing mechanism…with interest rates playing a secondary role.

…. Annuities are in essence, a pure transfer of risk strategy.”

I contacted Stan with more questions. Jo and I do not have an annuity – yet. I told Stan we were lucky enough to not have to worry about dipping into the principal to pay our bills. With interest rates being so low, wouldn’t the majority of the monthly payout be return of principal?

I asked Stan, “If someone was worried about having to dip into the principal each month to pay bills, wouldn’t diversifying part of their portfolio into an annuity make sense?”

Stan is emphatic on buying an annuity for contractual guarantees; what it will do, not what it might do in the market. We discussed a SPIA (Single Premium Immediate Annuity) with a death benefit.

With this type of annuity, you immediately receive guaranteed monthly benefits for life. Assume you bought a $100,000 annuity with the death benefit. When you die, the insurance company calculates the amount you received in benefits. If the amount is less than the premium, your beneficiary is paid the difference.

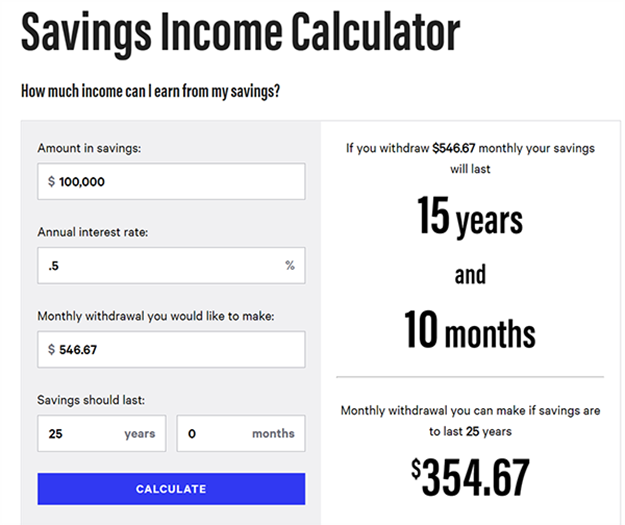

Your risk is the interest you would lose if you bought a CD or bond during that period. If the interest rate is .5%, a CD would pay $500 interest per year. The trade-off is knowing your monthly benefits are guaranteed for life. If you outlive your $100,000 the annuity keeps paying you.

I went to the SPIA calculator on Stan’s website. I ran a quote for a 70-year-old woman, buying a $100,000 annuity. Currently, she would receive $546.67 per month for the rest of her life.

I found this Bankrate calculator. If you have $100,000, earning .5% interest annually, and withdraw $546.67per month, your saving will last 15 years and 10 months.

I understand what Stan meant by “transfer of risk”. I’m 80 years old and would not want to feel the “worry fears” each month as I tap into my brokerage account to make ends meet.

I am NOT advocating going “all in” on any type of investment. An annuity would be a good component of a diversified portfolio.

Retirees MUST do a realistic budget and calculate the income gain or shortfall every month. After downsizing, cutting costs, and doing all they reasonably can, an annuity making up the shortfall, helps transfer the risk and reduce the worry.

I told Jo (and Stan) that when I die, she will lose some social security income. I recommend she take a portion of the life insurance and buy an annuity to cover the lost income.

Hopefully, her interest, stock dividends, and annuity income will allow her to enjoy our grandchildren for the duration. I want to go to my deathbed knowing she is well cared for financially.

These times are financially scary. Would we prefer 6% FDIC insured CDs like the past? Of course, but they no longer exist. Spreading your assets among several classes helps to reduce the risk, and keeps the worry to a minimum.