One thing that I’ve learned in the many years that I’ve traded options is that most investors hate hedging. It’s not the idea of hedging (i.e., protecting a portfolio’s downside) that’s the issue. It’s the cost. Hedging can be expensive over time.

Investors generally are not fans of things that are meant to lose money in most scenarios. That’s what a hedge is. It should typically lose money except for in extreme cases. It’s a trade that will hemorrhage cash from your account apart from during a big selloff. Those selloffs happen rarely enough that most hedges just turn into losers.

Of course, no one likes regularly losing money on a trade. Yet, a hedge is insurance. Do people complain about paying for car insurance and home insurance? Well, maybe, but we know it’s a necessity regardless. Most customers are willing to pay a fee each month to protect them in case their house burns down. Most likely (and hopefully) the insurance will never be needed.

So why is a hedge any different? After all, the stock market is far more likely to crash than your house is to burn down. It’s mostly a perception thing. Seeing that hedge trade in your account consistently losing money is no fun.

Here’s the thing…

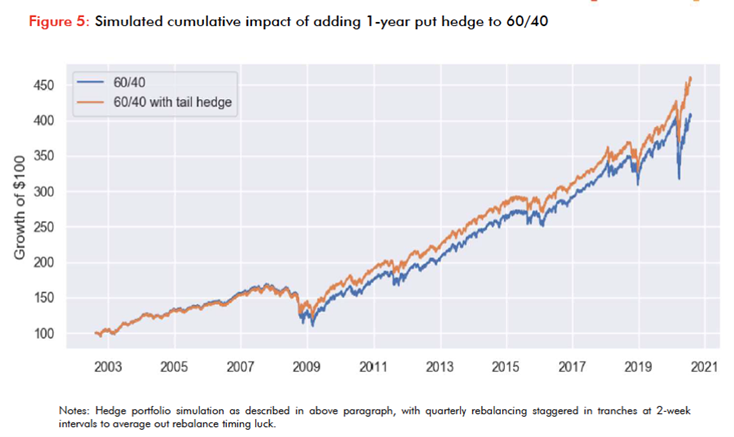

A hedge is more useful and more important than just being simple insurance. The fact is, balanced portfolios that use hedges tend to outperform unhedged portfolios over time! You read that right – hedges actually can improve the performance of your portfolio.

Take a look at the chart from QVR Advisors, a derivatives fund manager that also specializes in tail risk funds. You can see where the 60/40 portfolio (60% stocks/40% bonds) is outperformed by the 60/40 portfolio with a tail hedge, especially after a big selloff.

A tail hedge is one that is designed to have outsized payoffs in the event a major meltdown (black swan event). Tail hedges have become popular since the Great Financial Crisis of 2009-2009. Looking at the QVR chart, you can see why.

The thing is, because tail hedges can be monetized during a selloff (cashed out), there is more money in the hedged account when the market rebounds. Rebounds tend to happen quickly and sharply, so having more assets in your account when it happens is a big deal in terms of performance.

What’s more, having a hedge (tail or otherwise) in your portfolio means you are less likely to pull your funds out if the market starts getting scary. That also means you’re more likely to participate in the market’s upside, particularly if the big selloff never occurs.