The financial markets are in high volatility mode as the fears of the coronavirus and the ensuing actions by the government are driving huge price swings. We’ve gone from some of our biggest down days in history (in terms of points, not percentages) to one our biggest up days ever, to back down again. To say the market is active right now is a massive understatement.

The coronavirus, known as COVID-19, is causing a major disruption to the global economy. The virus is so contagious and has such a long incubation period that it has essentially turned into a pandemic. While most people who get the virus are expected to recover, the economic damage is expected to be considerable.

In China, entire cities have basically been shut down, including many factories that manufacture goods for the rest of the world. Several conferences and events have already been canceled across the globe. Travel for business and entertainment has plummeted.

Unfortunately, that may not be the extent of the economic damage. As the virus spreads, it is very likely that school systems will be closed. Parents will likely have to stay home with kids (if their workplaces are even open themselves). Many people in the gig economy don’t have vacation pay. In other words, there could be a substantial impact on consumer spending ahead.

Related: Trade of the Week: Volatility

So how do you trade the coronavirus, especially with the market so volatile?

At least one trader feels that gold miners are the way to go. Gold can be a good hedge for market volatility when interest rates are expected to go lower. Gold miners have the advantage of being highly correlated to gold and can also be analyzed like traditional stocks. That is, investors can look at the fundamentals and make a valuation determination.

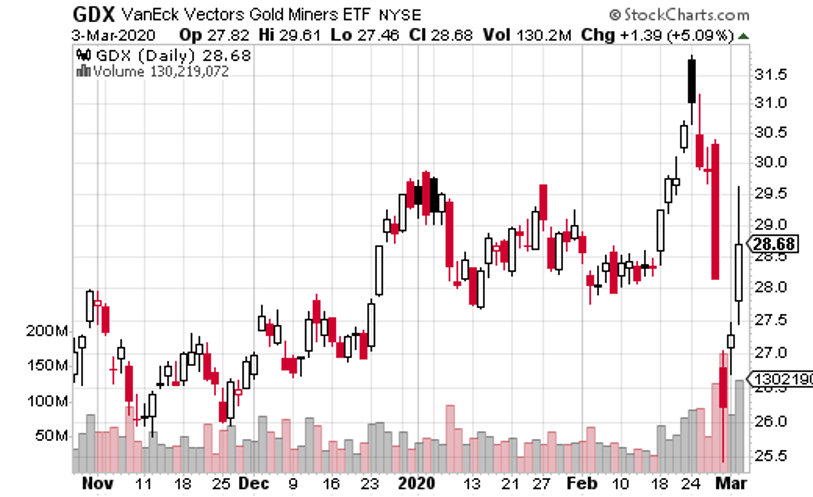

A very popular ETF for gold miners is VanEck Vectors Gold Miners ETF (GDX). GDX averages over 50 million shares traded per day, with more than 135,000 options trading on average. The trader I mentioned above used GDX to make a moderately bullish covered call trade just recently.

More specifically, the trader purchased 600,000 shares of GDX for $29.13, while selling 6,000 of the June 32 calls for $1.09. The shares can make money in stock appreciation up to $32, while the calls provide an upfront payment of $654,000.

The call component works out to a yield of 3.7% in a three and a half month period. Annualized, it would be about a 12% yield. (GDX also pays a small dividend, but it doesn’t amount to much.) The trade doesn’t lose money until GDX drops below $28.04.

It looks like this covered call buyer was taking advantage of the short-term dip in gold prices, which was the result of margin calls on the first week of the big selloff. The trader likely believes gold is going to continues its run higher (but within reason, hence the cap at $32 in GDX).

If you share this opinion, the GDX covered call is a good way to take a relatively low-risk position on gold and gold miners, while also earning a very reasonable yield.