Gambling on sports has always been controversial in the U.S. What once was the sole provenance of casinos (at least in terms of legal sports betting) has become far more widespread in recent years. Many states are expected to adopt online legal sports betting in time, and some have already done so.

Even before the debate over online sports gambling became mainstream, there was the debate over daily fantasy sports. Fantasy sports has been a popular pastime in the U.S. (and doubtless elsewhere) for decades. But, daily fantasy sports is a more recent phenomenon, gaining popularity over the last decade or so.

In a nutshell, daily fantasy sports allows customers to “buy” certain sports players on a daily basis, with the ability to win money if those players performed well in their games that day. The big players in the industry are Draft Kings (DKNG) and FanDuel. Draft Kings recently went public through a reverse-merger, while FanDuel was acquired by a European sports-betting company.

Daily fantasy sports got so popular, with so much money changing hands, that it became a major concern to state governments. States then had to decide if this type of fantasy was actually closer to gambling than fantasy sports. Ultimately, changes were made to the industry to make it more competitive for the average customer.

Moreover, daily fantasy sports became almost an afterthought once the door opened to the potential for legal online sports betting. In fact, Draft Kings and other fantasy sites have their own sports betting features in states where it’s legal.

The question is, is Draft Kings stock worth buying? Well, George Soros certainly thinks so. It was just disclosed that Soros’ fund owns about $70 million worth of the fantasy sports platform’s stock. The news drove the share price to all-time highs and a market cap of over $18 billion.

Options action also appears to be heavily bullish for Draft Kings. On the day of the Soros announcement, 90% of the action was considered bullish. The five-day average was 82% bullish. Clearly, the stock has gained some attention.

Looking at the trades themselves, there were several smaller blocks of calls purchased. Most of these trades were short-term in nature, with earnings coming up on May 15th. For instance, with the stock between $25 and $26, about 1,500 May 15th 30 calls were purchased in 3 blocks.

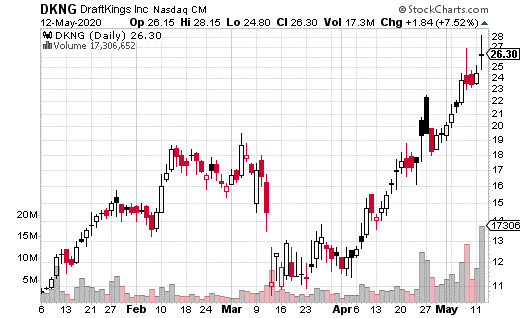

Glancing at the chart, it’s easy to see why investors are excited about Draft Kings’ stock. Of course, it helps that Soros is a big buyer of the shares (along with a few other big names from the sports world).

The one red flag (besides the unsustainable exponential stock move) is the lack of substantial block trades. Smaller blocks aren’t as convincing of a signal as the really big, institutional block trades. Those tend to be in the thousands or tens of thousands.

Still, Draft Kings isn’t a bad choice for a directional flier. The options are still new, and big players may we waiting for more liquidity. It could also be interesting to see what earnings look like after the company’s recent entry into the public markets through reverse-merger.