In investing, history can be a useful guide to what to expect moving forward. However, its usefulness only goes so far. There’s always something new and surprising in the financial markets that investors have never seen before. Last year it was negative oil prices. This year, it’s the stock squeezes occurring with names like GameStop (GME) and AMC Entertainment (AMC).

I didn’t use the term “short squeeze” because it’s only part of what’s going on with GME, AMC, and others. Technically what we were seeing is called a gamma squeeze because options are causing the squeeze.

Here’s the deal…

The initiators of the gamma squeeze are retail traders on a public forum who have all agreed to buy a stock—or more typically, call options on that stock. In this case, that forum is Reddit, and the sub-group is called /Wallstreetbets (WSB for short).

The WSB traders find stocks that have a very high short interest. That is, many traders (or a few large funds) are short the shares of the stock. These short sellers expect that stock to go down, and have borrowed millions of shares so they can sell them short. Citron and Melvin are two big funds that focus on short selling.

The WSB crowd sees these high short interest stocks and decides they are too low (sometimes for fundamental reasons, but not always), and they all decide they are going to start buying out-of-the-money calls in these stocks. Since there were about two million members in WSB when all this started, that much call buying can make things interesting.

You see, as the WSB traders buy calls, there are the market makers on the other side of that trade. They sell the calls to WSB traders, but they don’t want to have directional exposure (they make money other ways). In order to hedge, they buy stock. The thing is, for every call they sell, they need to buy as much as 100 shares of the underlying stock (although it’s probably going to be 50 or less in most cases).

Keep in mind, options use leverage. That means if someone buys a few calls for, say, $500 total, the market maker may have to hedge with thousands of dollars of long stock. What’s more, because of something called gamma (an analytical measure for options positions), the number of shares that need to be purchased will go up as the stock approaches the price levels where traders own the calls.

Meanwhile, as market makers are scrambling to buy shares, the short sellers may be forced to cover their massive losses. When this situation occurs, it’s a traditional short squeeze as short sellers buy back stock. When you combine market makers buying stock and short sellers covering, you have a gamma squeeze. At that point, the stock price takes off like a rocket ship.

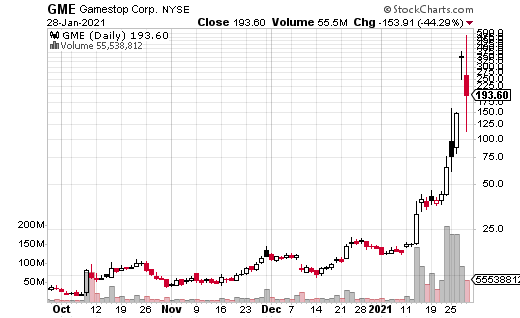

You can see this effect by looking at GME. The stock went from a 52-week range around $2.57 to an overnight high of nearly $500. There are quite literally WSB traders who have become millionaires from GME. At the same time, some short-selling funds are on the verge of implosion.

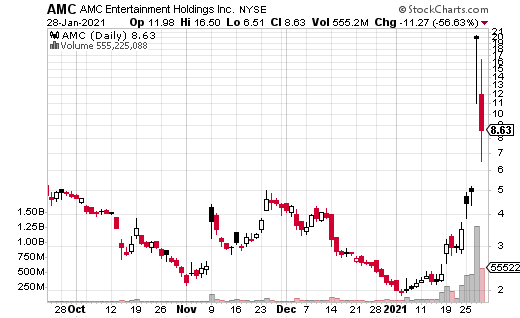

You can see similar action in the AMC chart, although not to the extent of GME.

What’s interesting is that some of the targeted companies were well along the path to bankruptcy before WSB intervened. AMC has already raised capital by issuing shares (and GameStop management would be foolish not to do the same). Will it save the companies from bankruptcy? That remains to be seen.

What about WSB traders? Should their methods be legal? Or, should they be considered manipulation? It’s a complex situation with no easy answers. Frankly, what WSB is doing isn’t really different from what many hedge funds do—WSB is just more public about it.

We’ll see what happens as the situation plays out, but I imagine some changes will occur. When I first started writing this, popular broker Robinhood was forcing GME holders to sell, and other brokers halted trade in some of the most volatile names. Some reversed their decisions and it’s likely still more has changed. Any way you look at it I doubt this will end well for many of the parties involved.

[insert CTA: OFT – Extra Cash – TSLA/NIO]