FATE’s stock price was higher on Friday because Fate Therapeutics (FATE) highlighted positive interim data from its study of FT516 in combination with Rituximab for B-cell Lymphoma.

“FT516 is the Company’s universal, off-the-shelf natural killer (NK) cell product candidate derived from a clonal master induced pluripotent stem cell (iPSC) line engineered with a novel high-affinity, non-cleavable CD16 (hnCD16) Fc receptor, which is designed to maximize antibody-dependent cellular cytotoxicity (ADCC), a potent anti-tumor mechanism by which NK cells recognize, bind and kill antibody-coated cancer cells,” according to a recent press release from FATE.

Better, “No dose-limiting toxicities, and no FT516-related serious adverse events or FT516-related Grade 3 or greater adverse events, were observed. The FT516 treatment regimen was well tolerated, and no treatment-emergent adverse events (TEAEs) of any grade of cytokine release syndrome, immune effector cell-associated neurotoxicity syndrome, or graft-versus-host disease were reported by investigators,” they added.

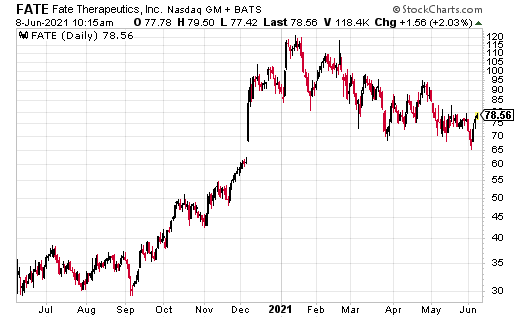

Further progress could lead to higher highs for Fate Therapeutics.

In addition, the company reported a quarterly loss of 48 cents for Q1 2021, which was wider than a year-earlier loss of 44 cents. Fate also posted revenues of $11 million for the quarter, beating year-earlier revenue of $2.5 million. The company also hold $888.4 million in cash.

At the moment, shares of FATE trade at $75.65.

At the time of this writing, Ian Cooper did not hold a position in Fate Therapeutics stock.