Finally, election day is in the books. No more calls, texts, or TV ads, and soon congress and the president can get back to governing the country. Even if your guy was not the winner, do not despair about your investment prospects. History shows that the U.S. stock market has gone up during the term(s) of every U.S. President.

If we learned one thing from 2020, it is that unpredictable events can upset everything. We now have the opportunity to reset and restart our expectations. Here are a few of mine.

Congress will pass another stimulus bill, and the president will sign it. With electoral politics out of the way, our elected officials can get back to doing the right thing (as much as they are able) for American citizens. The couple of trillion bucks from the bill will give the economy a big 2021 first-quarter boost.

This check waits in your mailbox… [ad]

If you follow closely what I have to share today (and it’s free), you could find a check in your mailbox in the next week or so. Actually, you could get one every month if you follow this 30 second tip I share here.

After a record recovery for the 2020 third quarter, the lack of a pre-election stimulus package will end up showing flat economic activity for the final quarter of the year. The new stimulus payments will give a boost to the GDP for the first half of 2021.

I am looking at two investment themes for the new year. As much as I would love to see travel sectors recover, I don’t think the airlines, hotels, and theme parks will get back to pre-pandemic levels in 2021. This means housing-related investments will remain hot. People who were forced to stay at and work from home for much of 2020 have found they can enjoy the home life if they spend money on upgrades. There will also be a trend of work-at-home employees choosing to move and live where the cost of living is low and the weather is nicer.

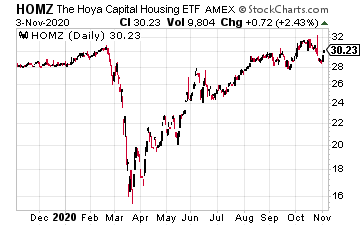

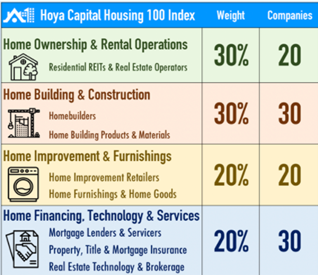

The Hoya Capital Housing ETF (HOMZ) provides investment exposure to the different subsectors related to where we live.

This Hoya Capital graphic shows how many different types of businesses depend on homeownership or rentals.

For my investment services, I prefer individual stocks, and I will be focused on the housing theme throughout 2021 as I look for new stock recommendations.

Investing in housing, whether through your residence, owning rental or investment property directly, or by investing in real estate-related securities, should be a priority. I got a little lucky when I took advantage of a good deal last year to purchase my current residence. I live in one of those places that are attractive to people that want to get away from high-cost, high-tax, coastal cities.

For 2021, I have a hope or goal to search out some recreational property to buy. Something in a nice area where initially I could stay with my travel trailer, and over time possibly add improvements over time. (Check out last Monday’s article for more about my new travel trailer. I purchased with the the dividends I earn as part of my Dividend Hunter strategy.) At this point, it’s more of a hope or a dream, but maybe I can squeeze out some time during the year to explore with an idea to possibly buy.

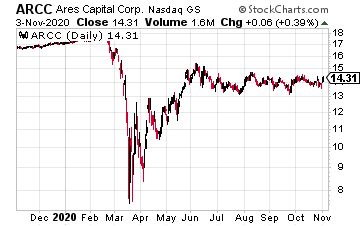

Another investment theme for 2021 will be Business Development Companies (BDCs). The category covers a select type of finance business that by law provides capital to small and medium-sized enterprises. The better BDCs also offer management and business advice to their client companies. The laws governing BDCs require a company using the BDC structure to pay out 90% of net investment income as dividends. As a result, BDC stocks are high-yield investments, with the potential for dividend growth as the economy recovers.

Ares Capital Corp (ARCC), with a $6 billion market cap, is the largest or close to the largest company in the sector.

ARCC has paid a steady to slowly growing dividend since 2009.

The dividend was sustained through the worst of the “coronacrisis,” with Ares earning enough investment income to cover the dividend. Look for a resumption of dividend growth in 2020.

ARCC currently yields 11.5%.

Out of the 50 or so publicly traded BDCs, about one out of ten can be classified as the “cream of the crop” type of investment.

Currently, I recommend three BDCs in my Dividend Hunter high-yield focused investment service.