With the fall of Silicon Valley Bank, the financial news media has remained focused on finding the next “crisis” of the day.

The so-called banking crisis petered out after a couple of weeks, but that didn’t stop the pundits from using it to proclaim that commercial property values and commercial mortgages would be the next problem for the banking industry.

Let’s dig in – and find the opportunity…

Here is how the story goes:

An article in Bloomberg last week noted that a $1.5 trillion “Wall of Debt” is approaching for commercial property owners. As a result, office and retail properties may fall by as much as 40%.

The crisis theory involves owners being unable to refinance because their property values have fallen. Also, lenders—mainly local and regional banks—may be in trouble when property owners default on commercial mortgages.

There are several fallacies to the argument. Bloomberg states that $1.5 trillion of commercial mortgages will mature between now and the end of 2025. But property owners will start lining up new financing many months before their current loans mature. You won’t see banks out repossessing commercial properties because the owner made the last payment and didn’t plan ahead.

The article also focuses on office and retail properties. For both of these types of real estate, there is a tremendous range of quality or status and location. A Class-A office building in Miami will not decline in value, and an owner will have lenders lined up at the door to offer terms on a new loan. And yet a Class-C office building in San Francisco may soon lack tenants as work-from-home policies remain the norm.

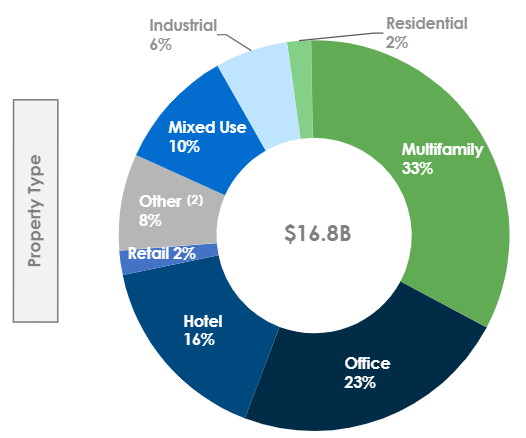

There exists a wide range of commercial property types. Hopefully, lenders in the space have spread their risk across different types of properties. For example, here is the breakdown for the commercial loan portfolio of Starwood Property Trust (STWD):

There is a risk that regulators may tighten lending and asset standards for banks. Smaller local and regional banks would be the most affected. Smaller banks have provided 30% of the credit for office properties and 46% of the financing of retail properties.

Challenges for a specific group of lenders, in this case, smaller banks, provide opportunities for less regulated sources of real estate financing. Over the last month, the commercial mortgage REIT stock prices have fallen along with bank share prices. These REITs have excellent long-term track records, and I would expect them to take advantage and thrive in a credit-challenged real estate market. Here are three to research:

- Starwood Property Trust (STWD) is currently yielding 11%.

- Blackstone Mortgage Trust (BXMT), paying 14.5%.

- Arbor Realty Trust (ABR), with a current yield of 15%.

I recommend two of these three to my Dividend Hunter subscribers. See below on how to join.