Dear Reader,

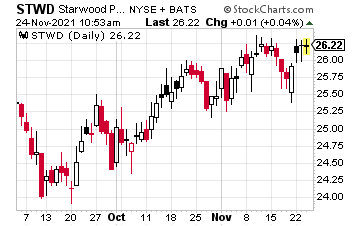

Each quarter, my favorite earnings conference call comes from Starwood Property Trust (STWD) and its CEO, Barry Sternlicht. As the leader of both the publicly traded REIT and the private equity firm he founded, Starwood Capital Group, Sternlicht is excellent about sharing his thoughts on a wide range of financial topics, and recently one topic really caught my attention.

Rather than paraphrasing, here is an excerpt from the 2021 STWD third-quarter earnings call. I have copied the text from the Seeking Alpha transcript and fixed a few of the transcription errors. The discussion covers Starwood’s ownership and valuation of rental properties. I added the emphasis.

And what’s so interesting is that replacement costs, and obviously inflation, have hit the country and inflation in construction prices is giant. You’re seeing 2% increases in cost monthly as both labor and materials. And some of the materials have softened, but I don’t think that’s going to last because of the transportation bill impacted steel, concrete, piping, and all the materials that go into constructing anything, and then add that the fact that the country seems to have lost a million construction workers, and there’s vast labor shortages in construction, and now you’re going to try to fix bridges, roads, and tunnels all over the country.

Good luck finding people to do it. Funny thing is we’re probably going to import all these workers from some offshore country because they don’t exist in the U.S today. So, a small wrinkle on how we’re going to actually execute the $600, $700 billion of physical infrastructure that’s planned to be. It will continue to put pressure on pricing…

If Sternlicht is correct, the recently passed trillion-dollar infrastructure bill will put even more upward pressure on the material prices and labor costs. The Federal Reserve and government leadership expectation of “transitory” inflation just took another hit due to their passing the bill.

Historically, to invest for inflation, you looked for companies and sectors that would benefit from higher interest rates. With this inflation bout, the Fed seems set against increasing interest rates to tamp down inflation. They are going to let prices run higher to the point where it likely will become another crisis.

Investors should look for stocks and companies that will be the ones to earn higher prices as the cost of everything goes up and up and up.

Even though I focus on income investments, Sternlicht’s well-informed opinion has me looking for infrastructure-focused investments. A quick search brought up two interesting ETFs:

- Invesco Dynamic Building & Construction ETF (PKB)

- First Trust Global Engineering and Construction ETF (FLM)

You can also bet that STWD is well-positioned to profit from these trends and continue to pay that very nice 7.5% yielding dividend.

Remember: when investing in stocks, nothing happens in a straight line. Look at long-term trends and be ready to invest when share prices temporarily go against them.