If you traded during the dotcom boom of the late ’90s, you probably have fond memories of Cisco Systems (CSCO). The Silicon Valley networking giant was one of the most popular stocks of that era—for several years, the price of the stock did nothing but go up.

[insert Cisco image we have in the media library (I think we have one); make sure there’s ALT text; insert CTA link]

While we now know that most of the stock action from that time was due to “irrational exuberance,” CSCO is still a powerhouse today. Networking equipment and software were key components to the growth of the internet. At the start of the Internet Age, there was massive demand for this sort of product.

The problem for Cisco was that the industry became commoditized. The company has spent the last decade or so trying to figure out how to innovate and get back to high growth.

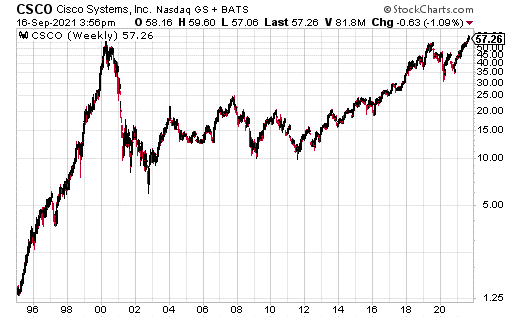

As you can see from the long-term chart of CSCO stock, the price has finally gotten back to the highs of the dotcom boom. The last year or so has been strong for shareholders, with the stock up 29% year-to-date.

Just last week, CSCO management talked about how software growth would push projected revenues up 5%-7% per year for the next four years—solid growth for a mature company. However, the chip shortage has also been weighing on the company’s profits. Analysts generally liked the projections, but the profits were underwhelming.

So, what can you do with a stock like CSCO? It pays a 2.6% dividend but is primarily a slow-moving stock. In that case, a covered call strategy may make sense—in fact, a big buy/write trade occurred last week.

Specifically, a trader purchased a million shares of CSCO for $57.46, while selling 10,000 January 2023 65 calls for $2.90. That’s $2.9 million collected in premium. The roughly sixteen-month trade will provide a 5% return on cash.

Now 5% may not seem like a lot for sixteen months; however, it’s not bad if you compare it to the 2.6% annual dividend yield (approximately 3.5% over the same time period as the trade). Because the covered call holder will receive the dividend and the call premiums, it’s something like an 8.5% return on cash for the life of the trade.

Moreover, because the 65 calls were sold, there’s room for upside appreciation in the stock price. The trade can earn an additional $7.54 in share gains, which amounts to another 13.1% profit at max gain ($65 or above).

All told, the trade could generate over 20% returns from share gains, call premiums, and dividends. For an established company like CSCO, that’s a very reasonable return over that time period.