When buying options, it’s generally a good idea to keep the capital outlay to a minimum whenever possible, because options typically lose value at a regular rate due to time decay. As such, minimizing the option premium paid (the cost) is essentially the same as lowering risk.

Using vertical spreads is one way to take a directional position with options while keeping costs (capital outlays) low. A vertical spread—when traded for a debit—is when a trader buys an option with a strike near the price of the underlying asset and sells another option further away but in the same expiration.

Both professional and retail traders use vertical spreads for directional trades. Buying a call spread is a bullish trade while buying a put spread is bearish (for the particular underlying asset). The benefit of vertical spreads is what I mentioned above: it lowers costs. The tradeoff is, this type of strategy caps gains. That is, the spread holder can’t make more if the underlying price goes past the short strike.

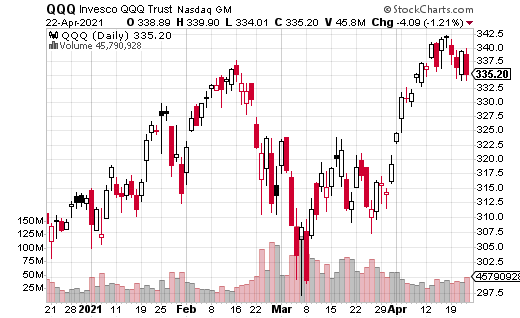

Let’s look at a real example of an index ETF call spread that makes money if stocks go up. In this case, we’re looking at Invesco QQQ Trust (QQQ), the mega-popular Nasdaq-100 ETF. What follows is an actual trade that happened last week.

A large buyer (likely a fund or institutional buyer) purchased call spreads that start making money if QQQ goes up roughly 6% by mid-June. Specifically, with QQQ at $335.83, the trader purchased 12,500 of the June 18 351-364 call spreads. That means the 351 calls were purchased 12,500 times, and the 364 calls were sold 12,500 times.

The cost of this trade was $2.93 per spread. That makes the breakeven point for the position at right around $354. From there, the strategy can profit up to QQQ at $364, where the short call is. The max possible value of the trade at expiration is the difference between the strikes or $13 in this case. However, because the spread cost was $2.93, it means the max profit is equal to $10.07, or 344% gains.

With the spread purchased 12,500 times, the trader spent about $3.7 million on the strategy. While that’s clearly a lot of money, if the trader had just purchased the 351 calls instead, it would have cost $5.6 million. In that scenario, there is no cap on the upside gains should QQQ take off.

Nevertheless, spending $3.7 million instead of $5.6 million is a huge difference (it’s 34% cheaper, to be precise). And, the upside at the max gain is still 344%. Moreover, it’s possible the spread buyer doesn’t believe QQQ can get higher than $364 by mid-June. In that case, why pay for unlimited upside gains if you don’t think they are a realistic possibility?