It’s not often that you hear investors talking about a bank stock as exciting. Well, it may be more accurate to say, it’s not often you hear investors talk about a bank stock at all. Bank stocks don’t tend to be all that interesting in terms of growth (although they can be excellent dividend stocks).

Banks generate a large part of their profits from loans. That is, they get money in at a low rate and loan it out at a higher rate. The spread between those rates is profits for the banks (minus any variable costs from making/servicing the loans). The interest rate spread is a slow and steady way to make money. Generally, it means banks are suitable for long-term holding and paying out dividends; however, it also means banking stocks tend to be boring.

There typically is not a lot of growth potential compared to something like a tech stock. What’s more, in an ultra-low interest rate environment, banks’ profits on loans are compressed. In other words, they’re even less exciting than usual.

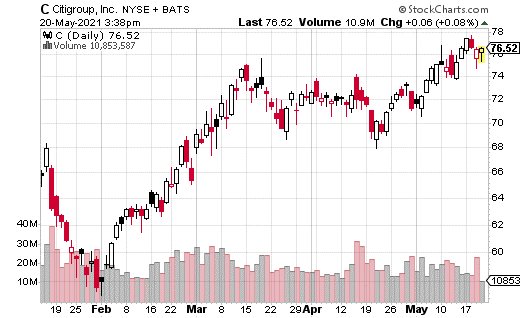

Let’s take a look at Citigroup (C). The banking giant has actually been more volatile than you’d expect over the years. The stock is up 24% year-to-date, but that’s mostly because the economy is emerging from the pandemic. C does pay a dividend of 2.7% per year—not bad.

Nevertheless, with interest rates expected to remain low for the foreseeable future, C’s share price isn’t likely to continue rising at the current pace. It could very well wind up stuck in a sideways pattern for an indefinite period.

One way to add some spice—and more importantly, yield—to owning C is to use a covered call strategy.

Last week, a trader placed a large C covered call trade which caught my eye. The strategist bought 500,000 shares of C at $76.46 while simultaneously selling 5,000 of the July 16 85 calls for $0.92. From the call sale, the trader collected $460,000 of premiums.

To break the trade down further, the strategy allows a fair amount of upside stock appreciation in C while still collecting a reasonable yield. Since the call is sold at the 85 strike, that’s as high as the stock price can rise before hitting a cap payout cap. In this case, there’s 11.2% of share growth potential.

Calls on less expensive stocks than Citi are what my Options Floor Trader PRO readers use for big gains with very little to start with. Click here to see how to start with less than $500 in your account.

The $0.92 in call premium works out to a 1.2% yield over a roughly two-month period. Annualized, it’s about 7%. Between the call premiums and the regular, quarterly dividend payments, if you make a similar trade to this every couple of months, you’ll generate about 10% per year. Now that’s a much more exciting proposition in a low-rate environment.

And let’s not forget, this trade does leave room for the stock to appreciate. The beauty of covered calls is they can be tailored to the needs of the trader. A covered call can be set up to produce higher yields, or be situated to allow for more stock appreciation.