I’m Tim Plaehn and I want you to know… there’s a simple and safe way to turbo-charge your returns from income stocks.

It’s a skill every investor should have. And as we’re approaching the end of our 29-day roadmap to building a lifetime of comfort and ease with dividends, it’s time for you to join in.

You see, I want to make sure you have a variety of weapons in your arsenal when you’re hunting big game income. And one of the very best to have is raking in bonus income with options.

I want to focus on a particular kind of option trade – “covered calls.” I think of covered calls as the “third leg” of the income trifecta. Covered calls take a little more work, but I promise you, learning the ins-and-outs will be worth your time.

But first let’s get into the basics…

I’m going to show you how to get started with options, how options contracts work, options terminology and how to execute the options trades I’ll be recommending.

Your subscription gets you access to the training videos on the website as well as the “how-to” videos for setting up a trade, so by all means head over there to get deeper into options.

But before you can make a trade, you have to get clearance from your broker to trade options. You’ll need to complete some paperwork on your broker’s website or just give them a call. They’ll get you set up for options trading based on your trading experience. Trading levels for options range from one to five – the higher the level the more risk you’re allowed to take.

Don’t worry, we’re only going to do low risk trades, so you’ll only need level two to make the trades I recommend in the Weekly Income Accelerator. Most brokerage firms will authorize even novices to trade at level two.

Now, let’s get started!

Calls, Puts, and All That Jazz!

An option is a contract to buy or sell 100 shares of a specific stock – called the underlying security –for a specific price – called the strike price.

A call option gives you the right to buy 100 shares of the underlying stock at a certain strike price. So if you buy one call option, you have the right to buy 100 shares of the underlying stock at the strike price, two calls equals 200 shares, etc. All options have an expiration date, when your right to buy those shares expires.

If the stock price is above the strike price, the option is “in-the-money,” meaning you could exercise the call and buy the shares at cheaper than market price. On the other hand, if you sell a call option, you are obligated to deliver 100 shares if the buyer exercises the option. The option buyer can choose to exercise the option any time before the expiration date.

A put option gives you the right to sell 100 shares of the underlying stock at a certain strike price. So a put option is “in-the-money” if the stock share price is below the strike price. If you sell a put option, you are obligated to buy 100 shares if the buyer exercises the option .

A call option gains value as the underlying stock price moves up, especially if the stock is above the strike price and the option is in-the-money. Traders buy calls to profit as share prices rise.

A put option gains value when the share price falls, especially if the stock is below the strike price and the option is in-the-money. Investors buy puts to profit as share prices go down.

The cost of an option is usually a small percentage of the price of the stock, so options allow you to control 100 shares of a company’s stock for a small price. Options are simply a low cost way to leverage changes in the price of a stock. It’s just like putting a down payment on a house. You can put down say, 10% of the total price and control the whole house.

The trick is to get the timing right… so when a stock moves higher or lower you’re in line to reap the profits.

There is also additional cost – called time premium – included in the price of every option. The share price must change enough in value to overcome the time premium before expiration to become profitable. Stock options expire at the close of trading on the third Friday of the expiration month.

Nuts & Bolts

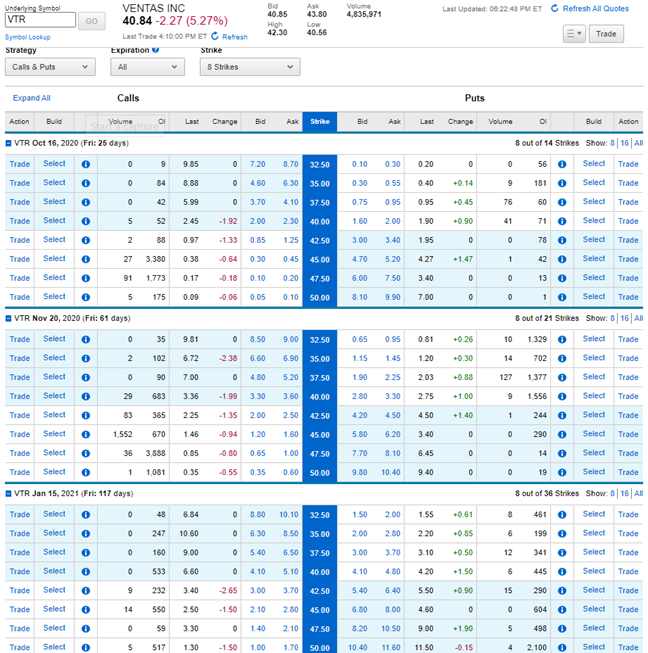

Almost all stocks and ETFs offer call and put options. Each stock will have puts and calls with a range of monthly expiration dates. Typically a stock will have options with expirations in the current month (before the third Friday), the next two months and then every three months out to the next January. Each expiration will have a range of strike prices above and below the current stock price. Here is an options “chain” for Ventas, Inc. (VTR):

Remember, one contract covers 100 shares of the underlying stock. So if an option is quoted at $0.50, one contract would cost $50.00 and 10 contracts would be $500, plus commissions. A $2.50 quote means one contract sells for $250.00.

To start, you look up the option chain for a stock and select the specific option you want to buy or sell. You’ll find a trade button next to the option price or hover your cursor over a price to get Buy or Sell buttons. Selecting a trade option will take you to an order screen. This is what one looks like on the Charles Schwab King brokerage web site:

The most important thing is to select the right Action. In this example, I am selling a VTR call option, to collect the $200 premium. That makes it a Sell to Open trade. When I want to close the trade I’ll use the same options with a Buy to Close trade. Bid/Ask spreads on options can sometimes be quite wide, so in this case, I’m using a limit order to receive no less than $2.00 per option or $200. If no one is willing to sell the option at that price the limit order won’t go through.

After you submit the trade, you’ll see a preview order screen that shows the total dollar amount of the trade, including commissions. If you place the trade as a market order you will get an immediate fill. Again, it’s possible a limit order won’t fill, so you can choose to adjust your limit price and resubmit the order, or walk away.

When a Sell to Open order is filled, cash will be credited to your account. You are “Short” that option and it will show as a negative contract and negative value on your account. When you buy options you are “Long” and the cost will be subtracted from your cash balance and will show as a positive value in your account.

Options Strategies

There are hundreds of different put and call contracts, and dozens of strategies and combinations to trade. I published an options strategies book in 1993 with over 800 pages of different combinations! So if you want to become a full time options trader, it will take long hours of study and practice to learn how to trade them.

So let’s keep it simple.

I only want to use options to conservatively add incremental cash flow and profits to my income-focused investment portfolio.

And the best strategy of them all is selling “covered call” options. That’s the one we’ll be using as the primary trading vehicle for Weekly Income Accelerator.

Fact is, selling covered calls is such a great way to pad your bank account, it’s hard to believe more investors don’t do it on a regular basis.

Why’s that?

Well, there are traders out there who’ll give you money today for the right to buy your stock from you later for a much higher price!

The covered call strategy involves selling call options which are backed by shares of the underlying stock. We can sell options against shares that we already own, or buy the shares and sell the call options at the same time. Here’s an example of a covered call trade and the expected return.

- Stock XYZ is trading for $59 a share

- A call option on XYZ with a strike price of $60 and expiring in 60 days can be sold for $1.50

- You buy 100 shares of XYZ and sell one $60 call for $150

- The net cost is $5,750 ($5,900 for the stock minus $150 for the call contract) plus

- commissions

Here’s what could happen next:

XYZ never goes above $60 before the expiration date, the call expires worthless and you keep the $150 call premium. That works out to a 2.4% return in 60 days, or an annualized return of 14.4%. After expiration, you can sell another call against the XYZ shares you own.

If XYZ is above the $60 at the expiration date, the call option will be automatically exercised, the shares sold and you receive $60 per share, or $6,000 minus commissions. If the stock is called, the 60 day return would be 4.3%, or a whopping 25.8% annualized.

If the stock price moves above $60 before the expiration date, it’s possible the buyer will choose to exercise the option. So the stock may be called away early and you get to keep the $150 plus whatever the stock is sold for. Either way, you make money.

The biggest risk of a covered call trade is when a stock goes down and stays down. But remember, you can limit your losses by selling the stock and buying back the option at any time.

Since covered call trades last for two to three months, you can recycle the trade four or five times a year, generating double digit annual cash returns. If you add in the cash paid by dividend stocks, you can see this approach can generate very attractive cash returns.

Again, when we use covered calls on dividend stocks, the yield provides share price support and even if the share price does go down, we continue to earn dividends while waiting for prices to recover.

Establishing a Covered Call Position

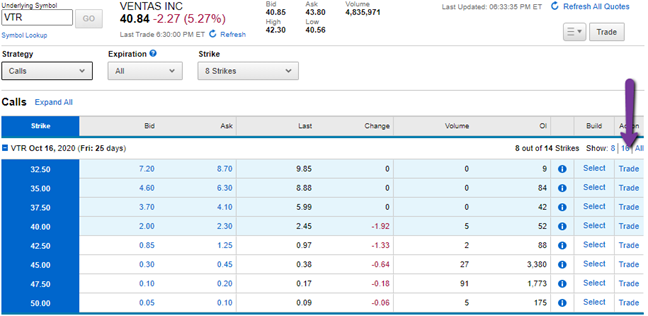

Another thing I like about covered calls is how easy it is to enter a trade. All brokerage firms will have a mechanism to go from a stocks options chain straight into a covered call order screen. Here is how it looks from one broker:

From this screen, just click on the trade link and you will be taken to a fully populated order screen. There you can choose market or limit order, adjust the price and submit the order.

Option sellers using covered calls collect the premium and then deliver the underlying stock if the call option is exercised, or buy the shares if a sold put option is exercised. Option contracts that are in the money at expiration will be automatically handled by your brokerage firm.

The fabulous thing about covered calls is it allows you to passively accumulate income over time while someone pays you money. Another terrific benefit is they help reduce your cost basis of the stock by the amount of the option you sell. If you are forced to sell your stock, so be it. You still come out ahead!

Now you know why I like to trade covered call options. It’s a great way to add income on top of our dividend income!