Jay’s Fed Trade: $1,100 Weekly Income

Former market maker Jay Soloff found an ETF that could pay $1,100 weekly. Wednesday’s Fed decision will trigger massive volatility. This specialized ticker converts Wall Street’s chaos into weekly cash flow. Get the ticker symbol free.

September 17, 2025 - 10:00 am

Weekly Trades Ahead of the Fed

Dear Subscribers,

Like many of you, I’m interested to hear what the Fed has to say this afternoon. I’ll wait to share my thoughts until after we’ve had a chance to digest their decision and remarks.

In the meantime, our weekly trades are ready.

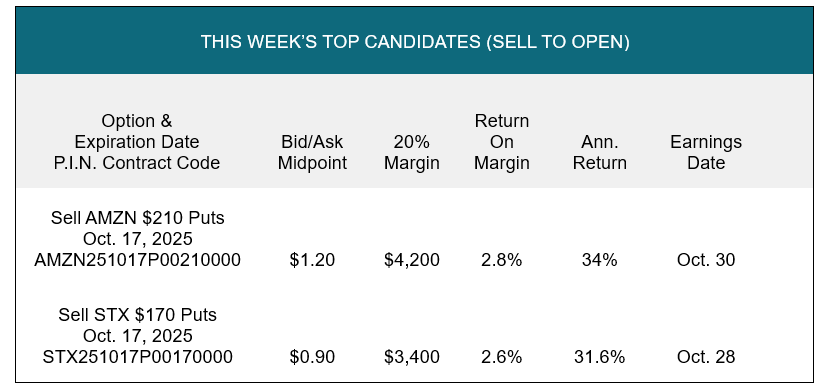

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Thank you for your continued trust. I’ll follow up after the Fed meeting.

Good Trading,

September 10, 2025 - 8:00 am

Historic Labor Revision Keeps Premiums Elevated

It takes a historic revision to knock nearly a million jobs off the payroll count, yet even that was not enough to push the Federal Reserve toward deeper cuts.

The market recalibrated quickly, sending yields higher, but what stands out most is the persistent demand for volatility protection. Option premiums remain elevated even as market movement stays contained.

The Bureau of Labor Statistics removed 911,000 jobs from the roster in its annual benchmark adjustment, the largest revision on record. The reduction confirmed that the labor market was weaker than reported, though not weak enough to change policy expectations.

Yields climbed in a bear-flattening move, with the short end leading as traders adjusted to diminished odds of a half-point cut next week.

Equities were little changed overall, but the Russell 2000 declined as small caps absorbed the heaviest pressure from higher rates. Larger companies held up better, while the main story for us is the continued bid for protection.

Implied volatility remains above actual market movement, leaving premiums attractive to collect.

Focus now turns to PPI and CPI. Consensus forecasts sit at 3.3 percent and 2.9 percent, while my expectations are lower. Even if softer numbers are confirmed, they will not justify a half-point cut.

The buildup into these releases has already lifted option premiums. If price movement remains contained after the releases, we keep the advantage.

The coming days will bring new data and shifting narratives, but the underlying setup has not changed. Premiums remain inflated, market movement is contained, and the ITV indicator continues to find winning trades for us.

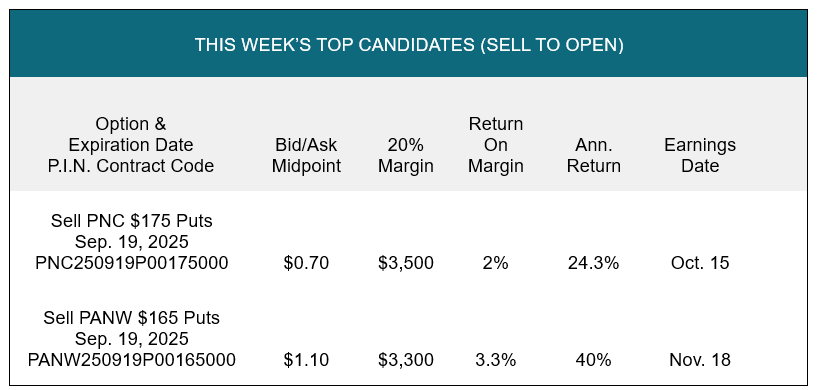

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

September 3, 2025 - 10:11 am

September Kicks Off with a Shift in Sentiment

The market opened September in retreat, and while it’s easy to point to seasonal patterns, the real drivers of the recent weakness are more complex.

A mix of global bond market pressure, renewed tariff uncertainty, and early talk of a potential government shutdown triggered a more cautious tone.

It’s true that September is statistically the weakest month for the S&P 500 over the past 25 years, with an average return of –1.51%. But that’s not the whole story.

Even with that average, roughly half of those Septembers still finished positive. Last year’s +2% return is a reminder that expectations and outcomes don’t always match.

More telling than the numbers was the tone shift on the tape. Dip buying, which has fueled much of this year’s rally, was muted. Several intraday bounce attempts were quickly faded, and the S&P gave back much of its post-Jackson Hole gains.

This wasn’t panic, but it wasn’t confident either.

At this point in the year, it’s not unusual for traders to step back and reassess. We’ve seen a powerful run driven by falling rate expectations and persistent demand for risk. Now the question becomes: how much more upside can that same playbook deliver?

The technical picture reflects this pause. The S&P is testing key levels, and while short-term rate cut odds remain elevated, the tone feels different. Markets are recalibrating.

That doesn’t mean we abandon the trend, it means we watch for signals that confirm it’s still valid.

While we continue to follow market developments closely, our process remains centered on the ITV indicator. That discipline is what allows us to trade with clarity, especially when the market tone becomes uncertain.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

August 27, 2025 - 8:00 am

What’s Driving Services Inflation—and What It Means for Rates

Following last week’s Jackson Hole symposium, both stocks and bonds responded with renewed optimism. Markets are now pricing in two potential rate cuts starting in September. The shift in expectations comes as inflation data shows some modest stickiness, but not where many expected.

The recent uptick in core inflation hasn’t been fueled by goods, even amid tariff discussions.

Instead, the pressure has come from services, specifically discretionary sectors like air travel and financial advisory. Airline fares rose notably in the July CPI and PPI reports, and brokerage and advisory firms have shown increased pricing power, supported by broader strength in asset markets.

This reflects growing consumer confidence. Fears of recession earlier in the year have eased. Discretionary spending is picking up, which gives service providers room to raise prices, even in a low-oil environment.

But underneath the surface, several key areas remain soft.

Real estate continues to struggle. Inventory is high, pricing power is weak, and new home sales data suggests continued pressure. Existing home prices, which matter most to household wealth, are barely positive year-over-year and could turn negative soon. Credit-sensitive sectors like this stand to benefit the most from easing.

Manufacturing is showing mixed signals. Capital investment is strong, but order volume has been weak until a recent jump in PMI data. And labor markets still lack the cyclical hiring strength needed to fuel broader expansion.

Meanwhile, a slowdown in immigration is pressuring labor supply in housing-related industries and reducing rental demand, two headwinds that further weigh on real estate.

Markets expect the Fed to begin cutting rates in September, and some would argue it should have started already. With inflation in the mid-2% range and weakness in key sectors, there’s a case for easing to support broader participation in the recovery.

In fact, small-cap stocks, often more sensitive to monetary policy, led the rally during the Jackson Hole meeting, rising around 4%. Other rate-sensitive sectors also responded: industrials, materials, real estate, technology, discretionary, and energy all gained.

For now, that tells us what traders are watching, and where momentum could build if rate cuts materialize.

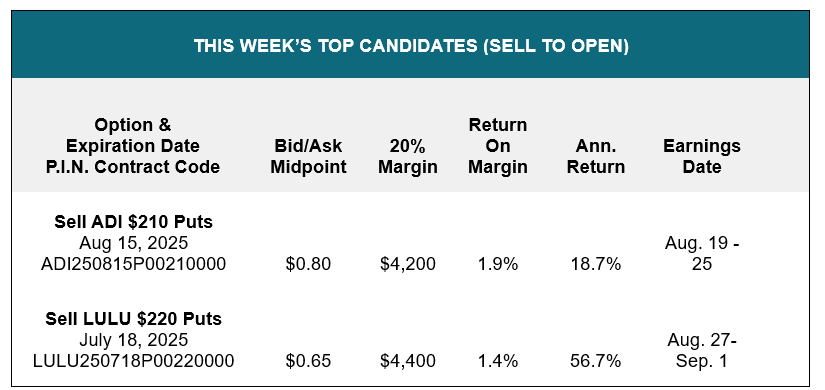

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

August 20, 2025 - 10:31 am

What Central Bank Independence Means for Markets Right Now

Central bankers from around the world are meeting this week to discuss inflation, labor markets, and the macroeconomic outlook. But the backdrop is more charged than usual.

Alongside the formal agenda, there’s a growing concern taking center stage: the independence of central banks.

In the past, central banks largely operated free from political interference, especially in developed economies. That independence helped stabilize inflation and guide long-term policy decisions.

But as pressure mounts, questions are resurfacing about whether monetary policy can remain insulated from political agendas.

This matters more than most headlines suggest.

The bond market, currency market, and even short-term rate expectations all respond to perceived credibility. When a central bank is seen as independent and consistent, markets tend to remain anchored.

But when that independence is questioned, whether through public pressure campaigns or politicized appointments, expectations shift. Investors start pricing in not just the data, but the motives behind the decisions.

So far, the U.S. economy has weathered this relatively well. Stocks are near highs, and inflation expectations are stable.

But market pricing still reflects the tension. The dollar has softened, long-end yields are rising, and policy expectations are increasingly reactive to public commentary—not just economic data.

For us, it’s a reminder that price stability is just one part of the equation. Policy stability matters, too. And during periods of perceived policy instability, volatility may follow.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

August 13, 2025 - 9:12 am

Interpreting CPI: The Numbers Say One Thing. The Market Says Another.

The latest Consumer Price Index (CPI) report arrived with no major surprises, headline and core inflation came in right around expectations. But if you looked at the headlines that followed, you’d think we were dealing with two different reports.

One emphasized “sticky” price pressures. Another highlighted continued progress toward the Federal Reserve’s inflation target. Both technically accurate. Both pulling in different directions.

The market’s response was more decisive: stocks and bonds rallied, and rate cut expectations ticked higher. Why? Because in a momentum-driven market, meeting expectations is often good enough.

Traders weren’t looking for a major downside surprise, they just didn’t want worse-than-expected.

From a volatility standpoint, this is a useful reminder. When inflation prints come in close to consensus, it tends to calm markets, even if the underlying data still suggests persistent inflation.

This can suppress implied volatility and keep premiums in check, especially if rate expectations drift further into “cut territory.”

But the bond market told a more complex story. Short-term yields dipped on rate cut optimism, while longer-term yields reversed higher, steepening the curve again.

That’s a signal of some internal push-pull: policy optimism on one end, concern about long-term inflation dynamics on the other.

Data moves expectations. Reactions move premium. The gap between them? That’s where we get paid.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

August 6, 2025 - 12:51 pm

Update: Correct JNJ Put Trade for This Week

Dear Subscribers,

In this week’s issue, there was an error in the trade table for Johnson & Johnson (JNJ). The trade was incorrectly listed as:

Sell JNJ $ 185 Puts at $ 0.55

There are no $ 185 puts available. The correct trade should be:

Sell JNJ $ 155 Puts at $ 0.45

I apologize for the oversight and appreciate your understanding.

Good Trading,

August 6, 2025 - 8:00 am

What Happens When the Messenger Gets Fired?

The week began with a jolt. After a surprise downward revision in the U.S. jobs report erased two months of job gains, the head of the government agency responsible for compiling that data was publicly dismissed.

This move raises important questions about transparency and trust in economic reporting. While the numbers themselves shocked markets, especially given how consistently the labor market had been beating expectations in prior months, the underlying cause may be more about deteriorating survey participation than any deliberate manipulation.

With response rates to government surveys reportedly down to about 60% (from 85–90% historically), data gaps are becoming harder to ignore. It appears those who were hiring submitted their reports, while those laying off may not have. Which is a timing issue that drastically skewed the result.

This isn’t just a headline. It matters for traders. Markets rely on clean, reliable data. If the integrity of that data becomes a political football, it introduces uncertainty that’s hard to price in. And it doesn’t stop at jobs. The same agency also compiles inflation data, data the Fed watches closely.

When credibility erodes, so does confidence in monetary policy.

Meanwhile, economic signals remain mixed. Some indicators, like the ADP payroll report, have been more consistent than government releases, suggesting a flat labor market over the past six months.

And yet, stocks continue to rally, even as bond yields and currencies hold their ground. That disconnect between equity markets and everything else might not be sustainable.

We’re also seeing a bifurcated market: mega-cap tech is thriving, but consumer discretionary and travel sectors are showing cracks. And if rate cuts do arrive sooner than expected, the “why” matters.

Cuts tied to falling inflation are one thing. Cuts made in response to a weakening economy are another.

For us, this environment requires both skepticism and discipline. The path of least resistance may be up, but under the surface, volatility is simmering. And when data gets politicized, all bets are off.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

July 30, 2025 - 7:00 am

What a CIA Analyst Taught Me About Trading

When I was training to become an intelligence analyst in the Army, one of the foundational texts we studied was the work of Richards Heuer, specifically his research on how cognitive biases distort the way we interpret complex information.

For context, Richards Heuer was a former CIA analyst and one of the most influential thinkers in modern intelligence tradecraft. His work became required reading across U.S. intelligence agencies because he focused not just on information gathering, but on how analysts think, and where thinking can go wrong.

Heuer didn’t just write about psychology, he focused on real-world decision-making under uncertainty. And, as it turns out, that’s exactly the environment we trade in every day.

He made three key points that have stuck with me ever since:

First, the human mind isn’t wired to handle uncertainty well, especially in complex or deceptive environments. In markets, that looks like misleading narratives, headline whiplash, and false signals.

Second, just being aware of bias isn’t enough. You can’t will yourself into being objective. We still tend to favor confirming evidence and ignore what contradicts our expectations.

Third, the best way to reduce bias is to use structured tools and systems, frameworks that help challenge assumptions, surface alternatives, and clarify what’s actually there.

That’s exactly what the ITV indicator is for.

I developed ITV to help me think clearly under pressure. It’s not about gut feel. It’s about identifying when the market is mispricing risk, even when it doesn’t look obvious on the chart.

The system keeps us disciplined. That’s what it was built for. Let’s take a look at what it’s showing us this week.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

July 23, 2025 - 7:00 am

Chasing the Crowd: Newton, FOMO, and What Markets Still Reveal

The fear of missing out, what we now casually call FOMO, has been part of human nature long before anyone gave it a catchy name. It taps into something timeless: the desire to act, to belong, to not be the one left behind while others appear to surge ahead.

Even history’s greatest minds weren’t immune. Isaac Newton, one of the most disciplined thinkers in history, got caught in the South Sea Bubble, not because he lacked intelligence, but because emotion overtook logic.

His story is a perfect reminder that fear and greed aren’t modern inventions. They’ve always been in the market, and they always leave clues.

Back in the early 1700s, the South Sea Company captured the public’s imagination. Its mission was ambitious: take over Britain’s national debt and open up trade with South America.

The promise of untold riches sent stock prices soaring. Newton, ever the rational observer, initially made a sound trade. He bought early, sold early, and walked away with a profit. And then he watched.

As prices kept climbing and friends grew richer, reason gave way to emotion. Newton reentered the trade, this time late, this time big—and got caught in the collapse. When the bubble burst, it reportedly cost him over £20,000, a financial disaster in his time.

His famous quote, “I can calculate the motion of heavenly bodies, but not the madness of people,” sums up exactly why this matters. Even the best minds are vulnerable when emotion overtakes discipline.

FOMO isn’t just about greed. It’s about comparison. Watching others succeed, especially when success looks easy or guaranteed, triggers that deep internal pressure to act. Logic fades. Urgency rises. Even Newton wasn’t immune. And neither is anyone else.

I’m not Newton, but I’ve always been guided by his wisdom, particularly his reminder that progress often comes from building on the work of those before us.

That’s exactly what I’ve tried to do in the markets. I’ve studied how investors behave, not what they say, but what they do. Because the truth is, behavior leaves a trail. If they’re bullish, they buy. If they’re scared, they sell. We can see it, clear as day, in the price action.

One of the more consistent patterns I’ve found is this: most of the meaningful market activity happens near the end of the trading day.

This isn’t opinion, it’s backed by studies from the exchanges. That data point, combined with the directional nature of price trends, gave me the foundation for a signal I use often.

In uptrends, price tends to close near the highs. In downtrends, it tends to close near the lows. Simple, but powerful.

I built my indicator around this tendency, then added another layer: I apply an indicator to the indicator.

That’s where Bollinger Bands come in. These bands don’t just show price extremes, they can also show when indicators themselves reach unusual levels.

What I found is this: when my indicator dips below its lower Bollinger Band, something interesting happens. That’s often when FOMO starts building, not the peak euphoria, but the moment when doubt and hesitation create the setup for the next move.

Not every signal is perfectly timed. Not every trade is a winner. But this approach has proven effective over time, and it’s one I’m watching closely in the current environment.

FOMO is as old as speculation itself. Newton’s story proves that it doesn’t matter how smart or experienced you are, emotion will always test your discipline. But while human behavior repeats, so do its patterns. That’s where opportunity lies.

By focusing on behavior, and by using tools that highlight when emotion is distorting price, we can position ourselves with reason instead of reaction.

That’s what my indicator is built to do. It helps keep us grounded, especially when the crowd starts to run.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

July 16, 2025 - 7:00 am

The Disconnect That’s Paying Us

This month’s CPI report came in largely as expected, offering short-term reassurance that inflation pressures remain manageable, at least by the numbers.

Headline inflation rose 0.3 percent month-over-month and 2.7 percent year-over-year, both in line with expectations.

The core reading, which excludes food and energy, increased 0.2 percent on the month and 2.9 percent year-over-year—slightly cooler than forecasts. That softer core reading nudged market expectations for a potential rate cut somewhat higher.

But looking beneath the surface, the drivers of inflation tell a more detailed story.

Increases in categories like medical care, dining out, and apparel suggest consumer demand remains strong, not that inflation is broadly weakening. Gasoline and energy services also posted notable monthly gains, signaling potential persistence in key cost components.

With tariff impacts still unfolding and core inflation holding near 3 percent, it’s understandable that the Fed remains in wait-and-see mode. Powell’s cautious tone isn’t just rhetoric, it reflects what the data shows.

And that’s exactly why the market’s reaction matters more than the print itself.

Investors are rotating into growth stocks and pricing in future rate cuts, as if inflation is definitively cooling. Meanwhile, several components of the CPI report are showing renewed upward pressure. That disconnect is creating inflated premiums in technically stable names, a favorable setup for put sellers.

We’ve seen this kind of pattern before, particularly during the last round of tariff-driven inflation in 2018 and 2019. CPI approached 3 percent, market expectations pulled away from the Fed’s message, and premiums expanded. Disciplined option sellers were rewarded.

It’s no different now.

We’re identifying premium-rich setups in fundamentally sound names, while the broader market prices in a version of the future that may not hold.

Let’s break down this week’s best opportunities.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

July 9, 2025 - 10:00 am

What Tariff Deadlines Teach Us About Volatility and Complacency

Another policy deadline hit the headlines last week. A proposed round of tariffs is scheduled to begin August 1. Markets didn’t blink.

That’s not because tariffs don’t matter. It’s because traders have learned to expect flexibility. In fact, the phrase “firm but not 100 percent firm” has been repeated enough that many assume delays or revisions are part of the process.

This kind of market behavior is important to understand, not because we’re taking sides on trade policy, but because it impacts how volatility is priced and how risk is managed.

Markets have seen this before: bold policy headlines followed by walk-backs, revisions, or delays. Over time, this conditions traders to expect reversals. When a headline drops, their first instinct isn’t to hedge, it’s to wait.

This is a textbook example of how expectations shape volatility. When uncertainty feels temporary or optional, the market stops reacting. Implied volatility doesn’t expand. Option premiums stay contained. And the reflex becomes: wait it out, buy the dip.

This complacency can create challenges and opportunities.

When the market shrugs off risks, implied volatility stays low, even if actual policy outcomes could have real economic effects. That can lead to lower premiums in the near term, mispriced risk over the medium term, and sudden volatility spikes when the market is finally forced to care.

For us, that means being selective. It’s tempting to ignore the headlines. But the better approach is to recognize when the market is underpricing real uncertainty. When premiums are thin, you don’t stretch. You wait for setups where the edge is clear.

Right now, the market is operating with a short memory. Dips are shallow. Rebounds are fast. The “buy the dip” mentality remains strong across a wide range of names.

But nothing works forever. And the more investors believe every policy headline will be reversed or softened, the more likely they are to be caught off guard when one isn’t.

We don’t sell puts just because the market is quiet. We sell puts when the premium justifies the risk and our indicator confirms the setup. That discipline matters more when others are relying on luck.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

July 2, 2025 - 7:00 am

Big Bill, Soft Earnings: The Setup Beneath the Surface

As you probably know, the Senate just passed what’s being called the “One Big Beautiful Bill”, a piece of legislation that touches nearly every corner of the economy, from taxes and spending to the debt ceiling.

Vice President J.D. Vance cast the tie-breaking vote to send the bill back to the House for final approval, with President Trump pushing for it to be signed by July 4th.

The bill makes the 2017 tax cuts permanent, expands the standard deduction, adds targeted tax relief for tips, overtime, seniors, and car loan interest, and increases spending on defense and immigration enforcement.

It also eliminates most green energy tax credits, applies a new remittance tax, and imposes work requirements for safety net programs like Medicaid and SNAP.

For traders, this is more than just politics. The bill lifts the debt ceiling by trillion, sidestepping a default risk that had been looming this summer. That alone can calm markets in the short term and reduce headline-driven volatility.

But longer term, a projected .3 trillion increase to the national debt raises serious questions about deficits, inflation, and the Fed’s next move.

The timing matters too. Earnings season kicks off soon, and expectations are already being revised lower. S&P 500 earnings are projected to rise just 5% year over year in Q2, down from 13.3% in Q1.

Several sectors are expected to report declines, and higher tariffs could pressure profit margins further, especially if companies are absorbing costs instead of passing them on.

That could weigh on earnings and, eventually, on forward guidance. On the other hand, a weakening dollar may offer a boost for multinationals, so early estimates may prove too conservative.

Meanwhile, industrials are quietly leading the 2025 sector scoreboard, up nearly 12% year to date.

With increased defense and manufacturing spending baked into the bill, the strength in names like GE, CAT, RTX, and HON may be signaling something broader: growing investor confidence in U.S. infrastructure and production capacity.

For us, this legislation brings a few things into focus. In the short term, we may see a dip in volatility now that the debt ceiling crisis is off the table.

But the longer-term effects, more government spending, rising deficits, and potentially delayed rate cuts, could keep a layer of uncertainty beneath the surface.

As I say each week, no matter what’s going on around us, we’ll rely on our indicator to identify trades. This week, there were only two signals, and I’ve shared both with you.

Since we don’t trade through earnings, our selection is more limited right now, but I’ll continue monitoring for new opportunities.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

June 25, 2025 - 6:00 am

The Discipline of Seeing What Others Miss

As many of you know, I was an intelligence analyst. My job was to interpret patterns in unpredictable environments, stay focused under pressure, and help decision-makers act on facts.

That mindset still guides everything I do. I don’t trade headlines. I analyze what they mean and what’s missing.

This week, that discipline matters more than ever.

Earlier this week, markets pushed higher after geopolitical concerns eased slightly and Fed Chair Jerome Powell reiterated the Fed’s “wait-and-see” stance.

Oil dropped sharply, the dollar softened, and growth sectors, particularly tech and consumer discretionary, continued to lead.

In testimony before Congress, Powell emphasized the Fed’s commitment to managing inflation, which he expects to drift slightly higher in May.

He noted that tariffs remain a wildcard, and said the Fed will likely hold rates steady until it better understands their long-term effects. His tone was cautious but steady, and he made clear that the central bank isn’t rushing to make changes without more data.

Internally, Fed officials remain split. Some see no cuts this year. Others see one or two. And a few voting members have floated the possibility of easing as early as July, if inflation continues to behave.

The result? Conflicting signals, rising uncertainty, and growing divergence between what the Fed says and what the market expects.

That combination is creating a sweet spot for those of us selling puts, as short-dated options are offering elevated premiums in stocks that are still trending higher or trading in stable ranges.

We’re seeing it across several sectors in names that are recovering while implied volatility stays elevated. These are the moments that reward selective entries and precise risk control.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

June 18, 2025 - 7:00 am

Markets Are on Defense, But That’s Where We Do Our Best Work

Markets have been on edge since President Trump abruptly left an economic meeting to address rising tensions in the Middle East, specifically calling for the evacuation of Tehran.

That headline alone was enough to rattle investors. Oil jumped, Treasury yields dropped, and capital rotated into defense mode almost instantly.

It’s the kind of environment where implied volatility jumps, not because fundamentals are breaking down, but because fear is being priced in faster than facts can catch up.

Crude bounced nearly 2%. The VIX jumped almost 5%. And Treasury yields dropped, with the 10-year falling to 4.40% as capital moved toward perceived safety.

For us, this is a moment worth watching closely.

At the same time, the Fed kicked off its two-day policy meeting, and the May retail sales report landed with a thud. Headline sales dropped 0.9%, well below expectations for a 0.6% decline. Excluding autos, sales fell 0.3%. April’s numbers were also revised lower.

But here’s where it gets interesting: the retail control group, the component that directly feeds into GDP, rose 0.4% vs. the 0.3% expectation. In other words, while the headline made for an ugly number, the data beneath the surface wasn’t nearly as weak.

This is why we don’t just trade the headlines.

The selloff in autos may have been driven more by buyers pulling demand forward ahead of tariff changes, not by collapsing consumer sentiment.

Even restaurant and bar sales, which fell 0.9%, may reflect a tightening in discretionary spending, something we’ve been anticipating as the services side of the economy begins to slow.

And while no rate move is expected from the Fed this week, the real focus will be on the updated economic projections. The question is whether they’ll stick with their forecast of two rate cuts for 2025, or revise that lower.

Right now, markets are pricing in just a 14.5% chance of a July cut, and 66% odds for a September cut, numbers that could shift depending on the tone of Powell’s remarks.

Also worth watching: jobless claims and the Treasury International Capital (TIC) report.

Claims have been trending higher, from ~220,000 to ~250,000 in the last three weeks, and we’ve seen nearly 700,000 layoff announcements year-to-date, compared to 390,000 this time last year. That’s a signal the labor market may be cooling faster than it appears.

The TIC data, often overlooked, could also give us an early read on foreign appetite for U.S. assets in the wake of rising trade tensions.

If demand for Treasuries starts to waver, especially in the context of a projected deficit nearing 7% of GDP, yields could become even more reactive in the months ahead.

All of this adds up to one thing: uncertainty is back, and that tends to benefit disciplined put sellers.

Premiums are perking up. Sector rotation is uneven. And while headline volatility may be driving quick reactions, the underlying data remains mixed, which means we’ll continue to see short bursts of fear, but not necessarily a change in trend.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

June 11, 2025 - 7:00 am

What a “Strong” Jobs Report Isn’t Telling Us

Markets rallied on last Friday’s jobs report. The S&P 500 rose 1%, and 10-year Treasury yields climbed from 4.40% to 4.51%, as headlines pointed to stronger-than-expected job growth and a steady unemployment rate. Payrolls increased by 139,000 in May, beating the 125,000 estimate.

On the surface, it looked like confirmation that the economy remains solid despite higher rates.

But under the surface, the data tells a more cautious story.

Job gains from March and April were revised down by 95,000. That brings 2025’s average monthly job growth to 124,000—a clear drop from last year’s 168,000 pace.

The unemployment rate may have stayed at 4.2%, but the unrounded number rose to 4.244%, with 71,000 more people now counted as unemployed, the highest total since October 2021.

The household survey added more signs of weakness. The civilian labor force shrank by 625,000, and employment fell by nearly 700,000. This isn’t a collapse, but it’s a meaningful slowdown that doesn’t show up in the headline numbers.

Other data reinforced the trend. Initial jobless claims rose to 247,000, and continuing claims stayed above 1.9 million. Small business hiring plans are near 10-year lows.

Layoff announcements remain elevated, with 94,000 job cuts in May, up 47% from a year ago. And wage data suggests actual job growth may be overstated, with downward revisions likely ahead.

This doesn’t point to a sharp downturn, but it does suggest a cooling economy.

Even so, the Fed isn’t likely to cut rates soon. Inflation pressures tied to tariffs are only starting to appear, and the consumption deflator could reach 3.5% by year-end, well above the Fed’s 2% target. At the same time, fiscal policy remains uncertain, with a new tax bill potentially adding more stimulus.

Immigration is also slowing, tightening the labor pool and keeping upward pressure on wages. And with markets back at all-time highs, the Fed has little incentive to act now.

For put sellers, this is a favorable setup. The economy is slowing, not breaking, an environment that tends to produce short bursts of volatility, especially in names that disappoint or get caught in sentiment shifts.

With the Fed sidelined and inflation still sticky, investors are adjusting their expectations. That uncertainty is where we find premium worth selling.

This isn’t a market in crisis. It’s one in transition. And transitions often bring just enough fear to open the door.

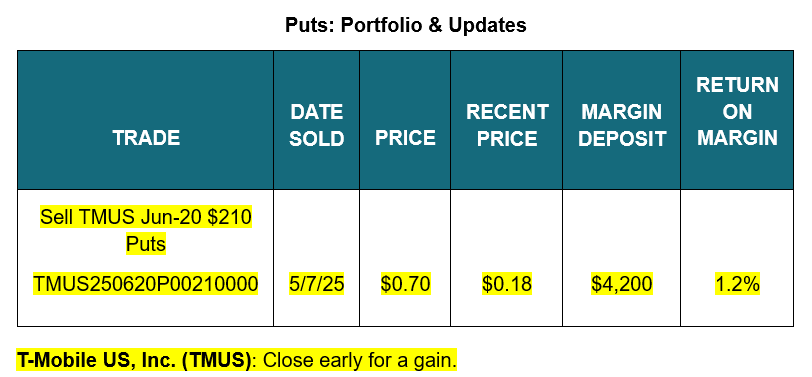

T-Mobile US, Inc. (TMUS): continues to trade above our strike price and is on track to deliver a gain next month.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

June 4, 2025 - 7:00 am

What Rising Yields Are Really Telling Us

This week, I came across several commentaries that echoed what many of us have been feeling: the climb in long-term yields isn’t just about inflation anymore, it’s about risk.

Investor demands for higher returns on long-term debt are rising as concerns over U.S. fiscal sustainability grow. A projected deficit near 7% of GDP, increased Treasury issuance, and the threat of credit rating downgrades are all feeding into a very real repricing of long-duration risk.

Here’s what that means in plain terms: the bond market is no longer operating on yesterday’s assumptions. It’s adjusting, and that shift is rippling across everything from equity valuations to sector rotation and, of course, option pricing.

What’s interesting is where the disconnect lies. While headlines zero in on 10-year yields creeping toward uncomfortable levels, equity markets have been surprisingly resilient. Tech bounced. Small caps showed life. Volatility remains relatively muted. That tells us the story isn’t as simple as “rates up, stocks down.”

This kind of dislocation, where market narratives and price action don’t align, often creates opportunity. For us, it means short bursts of premium expansion without a major trend shift.

We’re not changing our strategy. But we are watching the pressure points, especially in interest-rate-sensitive names, small caps, and sectors tied to macro confidence.

The Top Instant Income Opportunities This Week

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

May 28, 2025 - 7:00 am

Why the Market Feels Worse Than It Looks

There’s still a clear gap between how people feel about the economy and what the numbers say. Consumer confidence remains low. Small business optimism has faded. Forward guidance from major companies has been pulled or cut back. But hard data, things like job growth, retail spending, and industrial output, has held up.

That split between sentiment and actual economic output has made it harder to get a clean read on where we really are in the cycle.

In economic terms, this is the difference between soft data and hard data. Soft data reflects expectations and attitudes. It’s how people and businesses say they’re feeling.

Hard data tracks what they’re doing. Lately, the two have been heading in different directions. Surveys show that many consumers are still worried about inflation and jobs, even though the labor market remains strong and the Consumer Price Index has been slowing.

Some of the pressure on soft data seems tied to ongoing uncertainty around trade policy, tariffs, and the broader geopolitical climate. Businesses are trying to plan without knowing what the rules might look like in a few months. Consumers are still adjusting to higher prices on everyday goods.

And that uncertainty shows up in their responses.

Even in areas like inflation expectations, there’s a gap. Short-term and long-term expectations have both moved higher, while actual core inflation has been easing. The same goes for the Misery Index. The traditional version, based on actual unemployment and inflation rates, has stayed low.

But when measured by how people expect those numbers to change, the index moves sharply higher. It’s another example of perception outpacing reality.

In some cases, soft data does lead the hard data lower. It can act as an early warning sign, especially when uncertainty lingers. In other cases, sentiment improves as policy becomes clearer and the hard data continues to hold.

Right now, we’re still in between. The economy is still functioning, but many people don’t feel like it is.

For investors, this kind of environment tends to feel unstable. But that doesn’t mean it has to be unmanageable. When sentiment is this uncertain and hard data is still holding up, it helps to focus on consistency. Which is exactly what we do each week.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

May 21, 2025 - 7:00 am

The Hidden Risk in “Safe” Portfolios

This past weekend, I took my kids to the beach. It’s something we do every year while visiting my family down south.

The kids get to spend time with their grandparents and play in the ocean. And I get to sit on the porch and listen to my folks tell me what their friend’s son, the one who’s a financial adviser, has to say about the market.

“Options are too risky and he only trades stocks,” he says.

I wish I had a dollar for every time someone tried to tell me that options are too risky. Every time I hear it, I think, the real question people should ask is: Why not?

That question usually reveals a common misconception. Many people assume options are inherently risky. They can be, but that depends entirely on how they’re used.

What most investors don’t realize is that the traditional “buy and hold” strategy can carry far more risk than they’re aware of. In fact, many so called conservative investors are exposed to levels of risk I actively avoid.

Take a typical buy and hold investor. They may own blue chip stocks, dividend payers, or low fee index funds. They’re often told they’re playing it safe. But if the S&P 500 falls 50%, most of these portfolios are built to fall with it. That’s not risk management, that’s risk acceptance.

The problem is that these investors often measure safety with misunderstood metrics. Low beta stocks, for example, are designed to move less than the market. But in a bear market, that just means they lose a little less.

Over time, these portfolios tend to underperform. And while they may be labeled “lower risk,” the truth is that volatility (often defined by standard deviation) doesn’t pay the bills.

Your bank doesn’t accept deposits in standard deviations, only in dollars.

Long term investors also rely heavily on the idea that stocks “always come back.” That’s generally true for the market as a whole, but the timeline matters.

After the dot com bubble burst in 2000, it took more than 12 years for the S&P 500 to return to its previous highs. If you were planning to retire, send a child to college, or cover an unexpected expense during that period, the rebound didn’t come fast enough.

This is where options come in, not as a high-risk strategy, but as a disciplined, structured way to manage risk. I’m not comfortable sitting through a decade long drawdown.

That’s why I use strategies like put selling to generate income and protect capital, approaches that let me define risk in advance, adjust when conditions change, and stay in control.

The truth is, buy and hold works, until it doesn’t. And when it doesn’t, the consequences can be life altering. I’d rather avoid that.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line).

Good Trading,

May 14, 2025 - 7:00 am

Controlled Chaos: What Smart Traders Are Watching Right Now

Last week, I shared the story about the gorilla in the CT scan and how focusing too narrowly can cause us to miss what’s right in front of us.

That idea has been top of mind lately as I watch the market’s recent behavior.

Take last week’s jobs report. The headlines were clear: payrolls came in hot, wage growth ticked up, and everyone started bracing for the Fed to keep rates higher for longer. Stocks dropped briefly.

But then something interesting happened. The Nasdaq rebounded fast. Small caps followed. Even some rate-sensitive sectors, the ones you’d expect to get hit hardest, caught a bid.

To someone locked into the “bad news equals bad market” script, that bounce might look like noise. But to me, it was a tell. Big money wasn’t selling into weakness. They were buying the dip.

It reminded me of something I learned during field training. Sometimes what looks like chaos is actually controlled movement. The trick is knowing what to trust and when.

This is exactly why we rely on our ITV indicator.

Most investors watch market-wide volatility like the VIX to decide whether the environment is good for selling options. But the ITV goes deeper. It measures volatility at the stock level. And that distinction matters.

While the VIX has been drifting sideways, ITV is showing something else entirely. Select stocks are experiencing localized surges in volatility, and that’s driving up premiums even in a low-VIX market.

That’s where the opportunity lives right now.

Instead of waiting for broad market fear to drive up prices, we’re identifying pockets of elevated individual-stock volatility and stepping in to sell puts when the risk and reward align.

It’s a cleaner, more precise way to trade. And more often than not, it keeps us one step ahead of the noise.

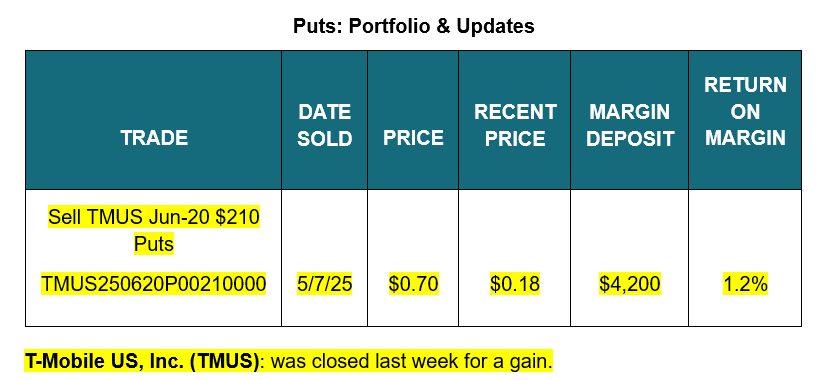

Puts: Portfolio & Updates

T-Mobile US, Inc. (TMUS): Is trading above our strike price and on track to deliver a gain next month.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

May 7, 2025 - 7:00 am

Trading Success Comes Down to These 4 Letters

For those of you who’ve been with me for a while, you’ve probably heard this story before. Still, I think it’s one worth repeating. It’s a reminder that’s just as important today as the first time I shared it.

In the Army, we lived by the phrase “Keep it simple, stupid,” or just “KISS.” Acronyms were everywhere, and this one stuck. Not because anyone was stupid, but because simplicity saves lives.

It’s a philosophy that works outside the military too. Albert Einstein once said, “Everything should be made as simple as possible, but not simpler.” If he’d been in my unit, I doubt anyone would’ve cared about his Nobel Prize. He would’ve been handed a helmet, a flak jacket, and a set of instructions that looked more like a comic book than a physics paper.

Why? Because when you’re in high-stakes situations, clarity is everything. The Army doesn’t assume you’ll have time to interpret dense manuals or overcomplicated instructions. They break things down so anyone can act quickly and confidently, no matter how complex the mission.

That mindset came back to me when I saw a study showing 83% of radiologists missed a gorilla in a lung CT scan. Yes, a gorilla. It was right there, a clearly out-of-place image in the upper right corner. But only 4 of 24 doctors noticed it.

Source: NLM.gov

Source: NLM.gov

Why? Because they were told to focus on nodules. Their attention was so narrowly tuned that they missed the obvious. It’s not that they weren’t skilled, it’s that they were too specialized.

In contrast, the Army trains you to look for anything that seems off. You don’t always know what you’re looking for, but you’re trained to spot it anyway. You keep your head on a swivel. You simplify the mission, but you stay alert to what matters most.

Trading works the same way.

A lot of investors fall into the radiologist trap. They rely on one strategy or one indicator, believing that if they master it, they’ll always come out ahead. But markets are messy. Rigid focus can cause you to miss the gorilla, the obvious shift or risk that didn’t fit your model.

My trading style is rooted in what the Army taught me: Stay flexible. Use every tool available. Build a clear plan, and keep it simple enough that someone else could take over if you weren’t there. In the field, overcomplication isn’t just a bad habit — it’s a risk.

I’ve developed my own indicators and tools, and I know them inside and out. But I never ignore something just because it doesn’t fit the pattern. If something feels off, I investigate.

Because whether you’re on a mission or in the markets, success doesn’t come from being the smartest person in the room. It comes from seeing what’s really there, even when no one else does.

Today’s Trade: Generate 1.7% In TMUS

As I write this, TMUS is trading around $ 253.80. This week, I recommend selling (to open) TMUS June-20 $ 210 Puts for $ 0.70 – $ 0.95. That’s a put option on TMUS with a strike price of $ 210 that expires on June 20, 2025 (TMUS250620P00210000).

When entering the trade, I recommend using a limit order near or below the current ask price of the option. (A price quote will include a bid and ask price; trades are often completed between these two prices.)

For example, if the current quote on this option is “bid $ 0.60, ask $ 0.70,” I would suggest using a limit order to sell at $ 0.65. If that order is not filled within a few hours, you could lower the limit price based on the current quote. A limit order at this level will usually be filled quickly.

No matter what the current bid and ask prices are, I do not recommend trading outside the limit I set for the trade. For this trade, your limit price should be between $ 0.70 and $ 0.95.

As soon as your trade is executed, you will generate immediate income of about $ 70 (each contract controls 100 shares), assuming you enter the trade at the bottom of the range. (I’m using the bottom of the range because that’s the least amount of income we’ll accept for this trade, which gives us the most conservative estimate of our return.)

Selling this put will obligate you to buy TMUS at $ 210 a share if the stock trades for less than that on June 20th (the last day these options can be traded).

Buying 100 shares of TMUS at $ 210 each would cost $ 21,000. To initiate this trade, your broker will likely require you to deposit a percentage of that obligation in your account, like a down payment on a house.

This is called a “margin requirement.” It usually runs about 20% of the amount it would cost you to buy the shares. This TMUS trade would require a margin deposit of $ 4,200 (20% of $ 21,000).

Here’s how the trade looks if the option expires worthless:

Assuming TMUS trades for $ 210 or more on June 20th, we keep the premium and make a profit of $ 70 on $ 4,200, or 1.7%, in 44 days. If we can repeat a similar trade every 44 days, we will earn about 14.1% on our capital in 12 months.

Recommended Trade: Sell TMUS June-20 $ 210 Puts for $ 0.70 – $ 0.95. Remember, each option contract you sell represents a potential obligation to purchase 100 shares of TMUS. If you’re not comfortable owning more than 100 shares of TMUS, don’t sell more than one put.

I don’t recommend using a stop-loss on this trade. I will be monitoring it closely and will send an immediate update if anything changes.

As always, I recommend readers use limit orders to execute trades. If prices move and you can’t get the premium you want, don’t chase the trade. Income Trader is a weekly publication, so you’ll get plenty of opportunities to generate income selling puts.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

April 30, 2025 - 8:00 am

A Nod to a Wall Street Legend

Last week, a friend asked me about an old article I had written on Hetty Green and said it reminded her of a woman who owned her own firm. She said, “You know, the one with the TV commercials when we were little.” Without hesitation, I said, “Oh, that’s Muriel Siebert.”

It’s a name that I’ll always remember. As odd as it may sound, I recall reading her obituary and thinking of how my success was thanks to her and other women like her who challenged the status quo.

I remember thinking at that time that this was all so recent. It was only during my mother’s lifetime that women have become accepted on Wall Street.

To refresh my memory, I found that 2013 obituary. Muriel was the first woman to own a seat on the New York Stock Exchange. That was in 1967, 175 years after the exchange was founded.

It wasn’t easy. Other members had to sponsor your application to buy a seat. Nine of the first ten men she asked refused to sign her application.

Muriel also founded her own firm, Muriel Siebert & Co., Inc. Now it’s publicly traded at Siebert Financial Corp. (Nasdaq: SIEB), a small broker with a market cap of about million.

She wasn’t the first woman to own a broker. That honor seems to belong to Victoria Woodhull, a pioneer in the woman’s suffrage movement. She founded a firm with her sister in the 1870s.

That was long before we were watching Muriel Siebert on television. Now, no one really sees an analyst or a trader as a woman or a man. I like to think they see us our profit and loss statements.

My P&L statement will depend on getting the short-term trends right over the next few months. This is what I always do. At times like this, I am reminded of how glad I am I focus on the short term.

Especially when I think back on things like the subprime mortgage crisis in 2008 and how it became a global credit crisis. Massive government and central bank intervention kept the system functioning. But stocks fell sharply in a bear market that lasted 73 weeks.

In 1998, Long Term Capital Management collapsed. Traders were concerned about whether the crisis could be contained to the one fund. In the end, the crisis passed quickly and we saw new highs in the S&P 500 just three months after LTCM’s demise.

Despite all the recent noise and panic in the market, I’m hopeful that this will be like 1998. We’ll continue focusing on the short-term and locking in those steady, quick gains.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

April 23, 2025 - 8:16 am

The Headlines Say One Thing. Price Says Another.

Lately, the financial headlines have been loud, and mostly negative. Talk of stagflation, geopolitical instability, tech layoffs, and rising debt burdens dominate the news cycle. You’d think we were on the verge of collapse. But if you take a closer look, the price action tells it’s own story.

This disconnect isn’t new. In fact, it’s a recurring theme in every market cycle: fear-based narratives often lag price reality. The media moves in response to what already happened, or worse, what feels like it’s about to happen. But price moves based on actual flows, positioning, and sentiment shifts that most headlines miss entirely.

That’s why we don’t trade based on news.

Our ITV indicator isn’t scanning headlines, it’s scanning volatility, trend persistence, and strength relationships across sectors. It watches what traders do, not what they say. Just recently, ITV gave us a high-probability setup in DoorDash (DASH). The news cycle was full of reasons to stay away, rising food delivery costs, consumer pullback, and fears about discretionary tech. But ITV didn’t care. It flagged an opportunity, and we followed the signal. That trade locked in a solid short-term gain, even as headlines told us not to touch it.

Here’s the truth: clarity is expensive. By the time a story is “confirmed,” the trade is gone.

That’s the edge of ITV. It doesn’t need a narrative. It finds setups rooted in structure, patterns that repeat when markets are uncertain, irrational, or even fearful.

So the next time a scary headline crosses your screen, take a breath. Then take a look at what the market is actually doing. Because price, like our ITV indicator, doesn’t lie.

DoorDash, Inc. (DASH) was closed last week for a gain.

The Top Instant Income Opportunities This Week

Below you will find the top trade candidates identified by the Income Trader Volatility (ITV) indicator. Each of these trades recommends selling (to open) a put option. If you’re looking to make additional Instant Income trades, I can’t think of a better list of stocks to start your research.

Bonus trades have less stringent risk parameters, and these trades have slightly more risk than trades I recommend for the Income Trader portfolio. Risk is still relatively low in a bonus trade, but it is not low enough to pass my most rigorous screens. We recommend closing all bonus trades when they trade at $ 0.10 or below.

I always recommend the use of limit orders when entering an options trade. A limit at the midpoint between the bid and ask prices will often be filled fairly quickly.

The charts below show this week’s top candidates: In the upper section of each chart, you can see the stock’s weekly price movement; in the bottom section, you’ll see the stock’s ITV (red line) and the ITV’s 20-week moving average (blue line). These charts usually show several previous signals and could help subscribers evaluate how successful signals were in the past.

Good Trading,

April 16, 2025 - 6:00 am

Global Markets: What Currency Moves Are Telling Us

In late February, global risk markets took a sharp dive, and many of the so-called “Trump trades” were swiftly reversed. The dollar wasn’t immune. While it held steady against some currencies, it weakened meaningfully against others, most notably the euro.

Over a two-week stretch, the EUR/USD moved roughly 7,800 pips, producing a series of large weekly candles, historically a sign that volatility is far from over.