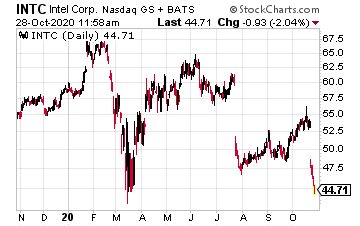

On October 20, the struggling chipmaker Intel (INTC) announced it would sell its money-losing NAND flash memory business to South Korea’s SK Hynix for $9 billion. This appears to be the start of a move toward greater consolidation in the semiconductor industry. More on that later. First, let’s look at what it means for Intel.

Changes Underway at Intel

The move is likely the first step in Intel’s shift away from an integrated device manufacturing (IDM) business model, toward a fabless business model.

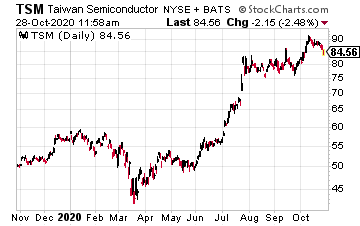

With a fabless model, a company designs chips but contracts out their production to companies such as Taiwan Semiconductor (TSM). Most U.S. chipmakers have opted for the fabless model in recent years—an approach that has been highly profitable.

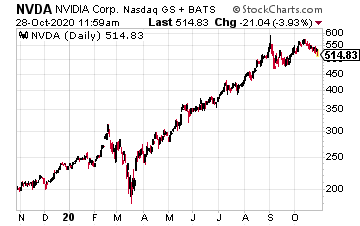

Just look at Nvidia (NVDA), which recently overtook Intel in terms of market capitalization thanks to its strong profitability and rapid growth.

And Intel’s longtime rival in microprocessors, Advanced Micro Devices, went fabless in 2009. The move freed it from having to make big capital investments and gave it access to the most advanced chipmaking capabilities offered by manufacturing specialists like TSM. Ever since, AMD has been gaining market share in the microprocessor market. Long gone are the days when this market was a de facto monopoly controlled by Intel.

5x Your Investment This Year With Just 2 Hours Per Month [ad]

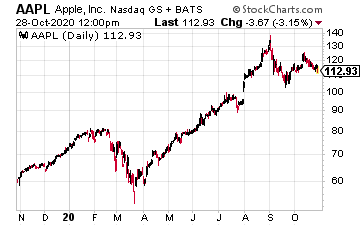

Chipmakers like Intel face growing pressure from makers of end products, which are starting to produce their own semiconductors using the fabless model.

For example, Apple (AAPL) has decided to stop using Intel microprocessors in its Mac computers, replacing them with chips designed in house and manufactured by Taiwan Semiconductor.

I believe that within a few years, Intel will become a completely fabless company, like so many of its global competitors.

However, this NAND flash memory deal has implications beyond Intel. This is the start of a consolidation move across the chip industry.

Semiconductor Consolidation

NAND flash memory is used to store images and other data on devices such as smartphones and digital cameras, which require large amounts of long-lasting data storage capacity.

SK Hynix and Intel had the fifth- and sixth-largest NAND market shares, respectively, in 2019. Both shares are just too small to give them pricing power or sufficient profitability in the business.

The combined market shares in 2019 would have been 19.4%—larger than that of number two player, Kioxia Holdings of Japan, which holds 19.0%… so the consolidation makes sense.

The NAND flash memory sector is consolidating because it so is difficult for manufacturers to make a decent profit, what with six players competing fiercely. Even the market leader, Samsung Electronics, is not satisfied with the profitability of its NAND business.

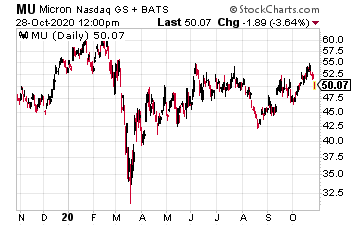

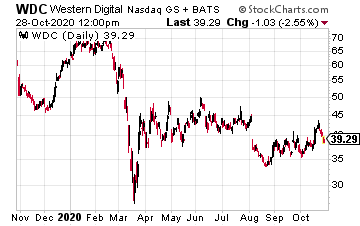

SH Hyxix’s move may now push both Micron Technology (MU) and Western Digital (WDC) to consider various consolidation options.

WesternDigital has partnered with the aforementioned Kioxia in operating NAND plants in Japan.

I’m sure Western Digital is aware SK wants to take a controlling stake in Kioxia; it could make a move to put a major obstacle on SK’s path to acquire Kioxia.

In the meantime, China’s Tsinghua Unigroup has developed a rapidly growing NAND business at its subsidiary, Yangtze Memory Technologies. Given China’s national objective of becoming a semiconductor technology powerhouse, it is believed Yangtze will expand production regardless of profitability, which would make the battle for market share even fiercer.

This will make the NAND segment of the chip industry even more un-investable.

Looking a little better is the DRAM memory chip segment. These chips are widely used in computers to store data temporarily.

This market is dominated by only three manufacturers: once again, South Korea’s Samsung Electronics and SK Hynix lead here, along with Micron Technology. All three companies make healthy profits on their DRAM memory chips. Micron gets about 63% of its revenues from DRAM and 31% from NAND.

Nevertheless, the stocks of all these companies have seen little upward movement over the past year.

More consolidation in the industry will help these companies get on a more solid profit path.