Cassava Sciences (SAVA) has been in the news throughout 2021 as the company continues its efforts in bringing its lead drug, Simufilam—an experimental Alzheimer’s treatment currently in Phase 3 trials—to market.

Aside from Simufilam, the company’s product portfolio also includes an investigational blood-based diagnostic to detect and monitor the progression of Alzheimer’s disease, called SavaDx.

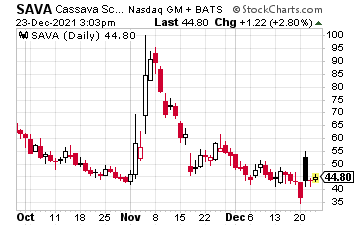

SAVA released positive data for Simufilam over the summer, which sent shares soaring to a high north of $146. However, shares began to tumble in August towards the $50 area following a petition that questioned the company’s scientific integrity related to clinical trials conducted with the drug.

Specifically, the petition urged the Food and Drug Administration (FDA) to halt the studies following reports that images from Simufilam’s trial results were manipulated. To make matters more intriguing, the lawsuit is believed to be initiated by two physicians who shorted Cassava’s stock.

The company got some good news last week after a review conducted by The Journal of Neuroscience found no evidence of data manipulation; it supported Simufilam as a treatment for Alzheimer’s disease. Assuming a six-month review period from the mid-August filing timeline of original petition, the FDA will review the findings; a response should come during the first quarter of 2022.

While the recent developments from two leading journals suggest a lack of wrongdoing and are supportive of Simufilam’s efficacy, there is risk the FDA might not rule in Cassava’s favor.

On a fundamental basis, the company is still losing money after reporting a third-quarter loss of $0.24 per share. The company is also expected to post a loss of $0.33 for its current quarter; however, SAVA but has more than $240 million in cash, with no debt.

For 2022, analysts are on both sides of the ledger on continued losses or a possible profit, based on Simufilam getting FDA approval. In other words, the company could lose more than $2 per share or make a profit of more than $2 per share. If the latter plays out, the drug would surely be a blockbuster that could generate hundreds of billions in yearly revenue.

On a technical analysis, the chart below shows shares breached longer-term support at $40 from mid-September with the December low kissing $34.41. The sharp rebound off these levels came on the aforementioned news that The Journal of Neuroscience found no wrongdoing, with shares clearing $53 but the 50-day moving average holding.

The 52-week low for the stock is at $6.70; the high is at $146.16. As you can see, investing in an Alzheimer’s disease pure play like SAVA is not for the faint of heart.

Shares will likely remain volatile until the FDA issues its findings and investing in a biotech company with only one or two drugs is its pipeline is risky. However, it has been estimated that nearly six million people has Alzheimer’s disease in the United States alone, so the stock is worth watching as the developments unfold.