Invitae: Genetic Testing on the Cusp of a Breakout

Originally published in the December 2016 issue of The Growth Stock Advisor

In this month’s edition of The Growth Stock Advisor we head to the healthcare sector once again to find a relatively new company to the public markets.

This growth name occupies a rapidly expanding part of healthcare spending and the company is experiencing explosive growth that looks to be in its very early innings.

Although not yet profitable, the risk to reward profile is favorable, especially given that the stock sells for about 35% of the level at which this it came public in early 2015.

Company Overview:

Invitae (NASDAQ: NVTA) is a San Francisco based genetic information company. The company provides a diagnostic service comprising hundreds of genes for various genetic disorders associated with oncology, cardiology, neurology, pediatrics, and other rare disease areas. The company aims to drive down the costs of testing for inherited genetic conditions by aggregated genetic testing.

As noted above, the company came public early in 2015 at approximately $20 a share. It is what I like to call a “Broken IPO”. It is a prima facie example of why I never buy IPOs in this space when concerns come public. If an investor is patient and waits for 12-18 months for the analyst hyperbole and lockup expirations to die, often times you can buy the same company for 30 to 50 cents on the dollar a year or two down the road. Invitae currently has a market capitalization of just under $250 million.

Business Model:

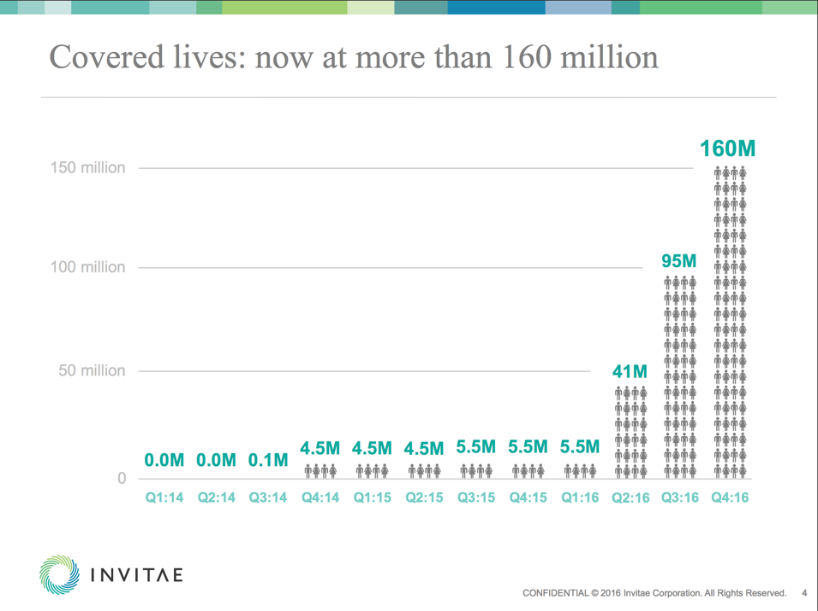

The company has rapidly brought down the cost of its tests over the past few years as well as increased the amount of what it tests for per sample. Invitae now tests for over 100 different conditions. Its primary clients are large insurers like Aetna (NYSE: AET) and United Health (NYSE: UNH). Thanks to continued expansion into new health plans, Invitae is now covered at insurers that carry 160 million individuals on their plans. As can be seen below, the company has made great progress in recent years in this area.

Genetic testing is worth approximately $3 billion and the market is expected to triple over the next five to six years, so the company is in the middle of a secular growth theme. Invitae started out primarily offering oncology tests, which are still growing at 200% annually and 25% quarter over quarter as the company is taking market share in a growing space.

The company has expanded into offering tests in cardiology, neurology and other disease areas. These offerings are growing much faster than the company’s oncology tests, albeit off a much smaller space. These new tests also have higher average selling prices than the cancer offerings. Invitae believes that each of these new business areas of cardiology, neurology, pediatrics and proactive health will be equal or greater in size to the current cancer genetics market five years out. It also projects that the entire genetic testing market will grow to between five to ten million individuals per year over that period.

Prominent healthcare investor, the Baker Brothers, hold a significant stake in Invitae and bought over $4 million off a recent secondary offering, which we will cover a bit later on.

Recent Results and Growth Trajectory:

The company’s growth trajectory is impressive even as it continues to post considerable losses while it ramps up to scale. In the recently completed third quarter, revenues came in at $6.3 million, nearly triple the same period a year ago. However, total costs and operating expenses were $31.2 million in the third quarter of 2016 compared to $24.6 million for the third quarter of 2015 as the company expanded its testing footprint. Revenues are tracking to approximately $25 million this fiscal year compared to less than $8.5 million in FY2015. The consensus has Invitae producing $60 million to $70 million in revenues in FY2017. Based on recent run rates, I expect Invitae to be at the top end of that range and quite possibly slightly exceed it.

As can be seen by the charts, Invitae has seen explosive growth in both billable tests and revenue since early in 2014, and this growth should continue in the years ahead as the genetic testing market continues to expand rapidly. Losses will be cut next year, but the firm will still be in the red. Invitae is targeting being cash flow positive by the end of 2018. As can be seen below, the company has made tremendous progress in reducing the losses per test as its billable tests expand.

The company already accomplished its year-end goal in reducing costs per test as of the third quarter. Cost per test is now down to $450 in the third quarter. This was down approximately 10% from the second quarter and this will continue to fall. Within two years, current losses will start to turn into profits.

Analyst Commentary and Balance Sheet:

The company ended the third quarter with over $70 million in cash and marketable securities on the balance sheet. Invitae then raised another $45 million via a secondary offering earlier this month. Cash was reduced by $18.8 million in the third quarter and this cash flow burn rate should go down consistently and substantially in the quarters ahead as revenues and billable tests continue to expand exponentially.

This should keep any funding concerns off the table until 2018 at least, and given the way the company is growing, I would not be surprised if this turns out to be the last capital raise Invitae will need to do.

This should keep any funding concerns off the table until 2018 at least, and given the way the company is growing, I would not be surprised if this turns out to be the last capital raise Invitae will need to do.

The company gets relatively sparse analyst coverage at the moment which is understandable given its small market capitalization. JP Morgan reiterated its Buy rating and $14 price target on NVTA earlier this summer. In November, Benchmark reissued their Hold rating and $8 price while Leerink Swann initiated the shares as a Buy with a $12 price target.

Outlook:

Although Invitae is not yet profitable, the company and stock seem poised for big things in the quarters and years ahead. Its growth trajectory is impressive and I have done well investing alongside the Baker Brothers in the past. What’s also encouraging is that the CEO threw in another $400,000 of his own funds in the recent secondary offering. The Baker Bros. also added more than $4 million in the same offering. Finally, genetic testing is seeing explosive growth and is a secular theme I want to have some exposure to.

When the company came public, investors believed it was worth $20 a share. All the company has done since its IPO is marvelously execute on its growth plan, and it is a more attractive asset than when it first hit the markets, although that is not currently reflected in its stock price. If Invitae continues to show exponential revenue growth while continuing to reduce costs per test and expand reimbursement coverage, I think this stock price will rise in the near future.

Given the Baker Bros. involvement in the stock, a buyout at some point cannot be ruled out, as that has been the outcome at myriad healthcare firms they previously had significant stakes in.

Eventually, Invitae should also be able to develop a data analytics business from its growing testing database, which is given no value by the market. From a growth perspective, the name is significantly undervalued at current trading levels.

I hope you’ve enjoyed this free sample from The Growth Stock Advisor. My readers who invested in NVTA when I recommended it have enjoyed a nice quick run-up, but there’s more to come for this innovator.

If you’d like to test drive The Growth Stock Advisor to see how high growth stocks can boost your portfolio then I invite you to try it for the next 90 days at half off: just $24.50.

This offer ends at midnight February 8th.

Happy Hunting,

Bret Jensen

Editor

The Growth Stock Advisor

P.S. When you sign up today you’ll get the February issue. Plus you’ll get the March and April issues as part of your 90 day test drive.

Just click here to get started.