2020 continues to be a year for the record books. I’ve heard the comment “I’ve never seen this happen before” more times over the last month than I have the previous five years. And it doesn’t seem like things will normalize anytime soon.

The most recent unbelievable incident to hit the financial markets is the negative price of crude oil. Yes, you read that right. The price of oil was actually negative this week. Does that mean when you go to the gas station, you fill up your car and get handed cash? Unfortunately, no.

Rather, what happened is the May futures contract for crude oil (which has since expired) got to as low as -$40 a barrel. As expiration was approaching, suppliers (sellers) were looking for buyers to take delivery of the oil they produced; however, with very little demand for oil (due to coronavirus-related shutdowns), oil storage capacity is mostly full.

Next Live Session is Tomorrow in The “Virtual Trading Pit”. Get Time and Link Here. [ad]

With no place to store oil, sellers were forced to pay buyers to take delivery. In other words, they are paying for someone to store oil—that’s why the price was negative. To put it another way, negative oil prices are a result of the lack of storage capacity.

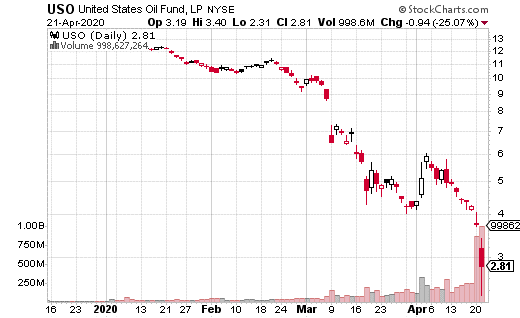

Crude oil has never gone negative before, and for the most part, the investment crowd didn’t know how to react. It seems the casual trader decided this was an opportunity to buy oil, primarily by using the United States Oil Fund (USO). After all, the ETF went from around $12 to $4 in about two months.

It’s easy to understand why some investors were betting on a bounce back, or mean reversion. However, you’ll notice in the chart that the drop to $4 was just the start. As of the writing, USO has plunged to as low as $2.31. Meanwhile, the June futures contract for oil is around $13 per barrel.

So, is now the time to buy?

Looking at the order sentiment in USO options, and it’s mixed. There is a 50/50 split between call and put trades. However, that number is down from a five-day average 70/30 split. The 30,000-foot view is that a lot fewer people are now buying calls.

Keep in mind, the easiest way to use options to get bullish on a stock is to buy calls. The significant drop in call activity is likely a sign that traders have become far less upbeat. But USO is under $3! How low can it go? My only response to that is to ask the people who held long May crude oil futures (which went to -$40).

In a nutshell, given the vast glut of oil and the expected lack of demand, it could be very plausible to see the June futures contract also go negative. USO can’t go negative, but it can get close to zero (and reverse split and then continue dropping). Longer-term options action also suggests that USO isn’t going to climb much higher soon (there’s been a lot of selling at the three-strike in fall options).

The bottom line is, buying calls is very likely not the best course of action in USO or any other long oil ETF at this time. There will be time to purchase oil once the fundamentals change, so don’t rush into a bad trade just because we’re seeing negative oil prices for the first time.