Gold has been around since the beginning of time. It sits in a lump, doesn’t pay interest; yet governments around the world hoard it, and investment pundits recommend we own some. As kids, we watched movies about pirates stealing it, governments fighting over it and women swooning when they receive it as a gift. Warren Buffett, a former gold critic, just bought 21 million shares of a gold mining company. Why?

Historic low interest rates make it very difficult to grow and accumulate wealth. Tim Plaehn, our dividend expert, and Chuck Butler our Fed and currency expert both recommend owning gold and gold stocks as part of a well-diversified portfolio.

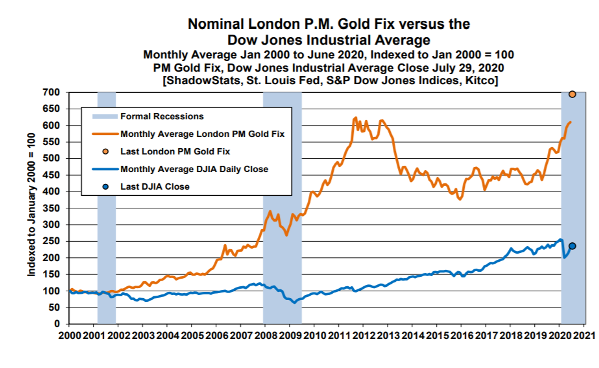

Friend John Williams of Shadowstats shows us that gold has outperformed the stock market since 2000.

Friend Jeff Clark, our gold expert tells us, as of September 23rd, silver is the best performing asset class of 2020 (+27.3%), gold is second (+22.7%) and Nasdaq third (+11.8%).

| Why are people buying an asset that sits in a lump ahead of shares of solid businesses producing profits and paying dividends? |

We’ve recommended owning gold for quite some time; today I would like to discuss why. Why has gold stood the test of time and considered a measure of true wealth?

Who better to help us than Jeff Clark, our gold expert, and senior analyst at GoldSilver.com.

DENNIS: Jeff, on behalf of our readers, thank you for your time. Let’s get to it. Many times I’ve heard you say, “Gold is REAL money.” You remind us that it will NEVER go to zero.

Unlike other metals like iron or copper that have a lot of industrial uses, gold is expensive and industry looks for lower cost alternatives.

What makes gold so special?

JEFF: Thanks again Dennis for the opportunity to address your readers.

The primary reason gold is money is it represents real wealth. It can’t be debased by man or destroyed by nature. It’s the asset of last resort, which is why the price has been rising in response to the virus, riots, recession, geopolitical conflicts, and currency printing.

| “The great merit of gold is precisely that it is scarce; that its quantity is limited by nature; that it is costly to discover, to mine, and to process; and that it cannot be created by political fiat or caprice.” – Henry Hazlitt |

Another reason is because it has a finite supply, which of course is the opposite for paper currency. A few keystrokes and a central bank can conjure up trillions in paper dollars – it doesn’t even need to be printed.

Gold, on the other hand, takes a decade to bring to market, from when it’s first discovered to you and I holding a newly minted gold Eagle in our hand.

The last reason is because it is universal. Gold is understood by every central bank and virtually all citizens around the world. It transcends borders, even borders of countries that may be at war. The power is that you can literally take gold anywhere in the world and sell it if you need to. There aren’t very many assets in the investment world today where one can do that.

DENNIS: Countries used to back their currency with gold. As a kid, we had both gold and silver certificates. Today, I don’t think any currencies are gold-backed.

Jeff, why is that? Does it really make a difference?

JEFF: Good question. It’s true, no major economy in the world today backs their currency with gold. In fact, this is the first time in recorded history where NO currency is backed by gold or silver. It’s a fiat world, literally everywhere. The risk that goes with that is something we’ve never faced before as a civilization.

However, many central banks do hold gold as part of their reserves. Many have been adding to those reserves on a net basis for over a decade now. Central banks understand that in a world full of monetary, economic and geopolitical risks that they need to hold the asset of last resort. We should view it the same way.

The difference is a gold-backed currency limits government spending to the amount of gold in the treasury. When currency is not gold-backed, governments can spend as they please.

DENNIS: Some history before the next question.

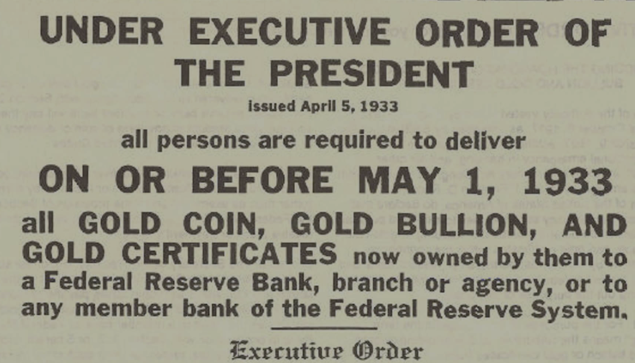

In 1933, President Roosevelt signed Executive Order 6102 making it a criminal offense for US citizens to own or trade gold anywhere in the world, with very limited exceptions. Gold was valued at $20.67/oz and citizens were forced to redeem their gold for paper dollars.

In 1934 the Gold Reserve Act was passed giving Roosevelt the power to value gold by proclamation. He promptly revalued gold at $35/oz. In round numbers, citizens saw their dollar decline by 70%.

Federal Reserve History tells us:

“…. (The) $20.67 per ounce…rate had prevailed until…1933, when the Roosevelt administration began its campaign to devalue the dollar.” (Emphasis mine)

With the Fed’s new inflation policy, wanting to devalue the dollar, pundits predict potential inflation, perhaps like we endured in the Carter years.

For the moment citizens can own gold. Is confiscation possible a second time around?

JEFF: The risk is not zero, but remember the U.S. was on a gold standard at the time. Gold actually backed the currency, and given the tumult at the time Roosevelt probably felt he had to acquire as much gold as he could. It was wrong what he did by later devaluing the dollar, but that was the risk at the time.

Today gold is not part of the currency system. The incentive to confiscate is lower. And it wouldn’t net the government much cash anyway; the gold market is tiny compared to other juicier assets like mutual funds and pension funds.

DENNIS: In addition to gold, how do you recommend investors hedge their inflation risk?

JEFF: Silver is very volatile, but it responds directly to inflation. If the CPI starts to rise in earnest, history says silver will respond in leaps and bounds. Before it’s all over I expect silver to rise more than gold, particularly if we get inflation.

Some investors use collectibles but that introduces other risks one doesn’t have by simply owning gold and silver bullion.

DENNIS: Our readers need income, like interest and dividends, which physical gold does not offer.

What are you advising readers to do in order to hedge against inflation; yet generate some income at the same time? Are you recommending stocks?

JEFF: It’s not easy in the current environment, because trying to grab any meaningful yield-something that yields more than the rate of inflation-requires one to increase their risk. For me personally, I don’t own common equities, because I feel stocks as a group are overvalued and vulnerable to a major downturn.

With regard to mining stocks with strong dividends; I’ll point out that many miners have increased their dividends recently, as their free cash flow has jumped due to higher gold prices.

DENNIS: In the last year we increased our holdings of mining stocks. Chuck Butler mentioned he has done the same.

What are you currently recommending to your readers as far as physical metals, and stocks as a percentage of their overall portfolio?

JEFF: This greatly depends on each individual, but for me I didn’t start buying dividend-paying mining stocks – in spite of knowing a lot about them – until I had my monetary insurance in place – until I had purchased a meaningful amount of physical gold. And given the current world circumstances, this is clearly a time to be overweight gold-I can’t think of a more conducive environment to owning gold than now.

Long-term studies show the optimal allocation to gold to balance risk and reward is 20%. Based on this extensive research, going all the way back to 1968, any amount less than that leaves a portfolio at risk, particularly today.

I also own mining stocks as part of my offensive strategy. They’re riskier, but if gold is in a bull market as I think, they will more likely follow gold up than what common stocks may do. I enjoy capturing some dividends along the way.

DENNIS: One final question. A few months ago you said the supply of physical gold was tight, but was still available. What is the current situation?

JEFF: Demand is still high, and most mints are still on reduced operating hours, so physical metal is still tenuous. Depending on the product, you may or may not have to wait for delivery. As we speak premiums have come down from their highs, as have prices, so for someone who felt like the market got away from them earlier buying now may be a good opportunity. There’s little doubt in my mind that we will see much higher prices and much higher premiums as the bull market progresses.

Thanks for inviting me, Dennis.

Dennis here. With the Fed hell-bent on creating inflation, investors need to stay ahead of the game. Most can ill afford to see the buying power of their wealth erode. Jo and I own gold and metal stocks. Yes, they have been volatile lately, but the Fed will prevail and we will eventually see the anticipated inflation.

I’ve known Jeff for several years. He is a true precious metals expert and is prominent speaker at investment conferences. His company, GoldSilver, offers a low-price guarantee.