No matter how much you like a company, or believe in its future, sometimes you have to stay on the sidelines before a major breakout occurs. Shares of Sirius XM Holdings (SIRI) seem to fit that bill, having been rangebound between $5–$7 for the past five years.

The company is one of the best-known audio entertainment companies in the United States. It owns Sirius XM Radio and Pandora and also recently acquired Cloud Cover Media, which offers a music-for-business service.

Sirius XM Radio offers music, sports, talk shows, and podcasts, while Pandora and Cloud Cover Media are application-based platforms that offer music and create personal recommendations.

Sirius XM Radio has nearly 35 million subscribers, while Pandora has slightly more than six million subscribers. The company’s revenue sources are comprised of subscription-based models and advertising.

The bulk SIRI’s revenue is dominated by subscription fees, so the acquisitions of Pandora and Cloud Cover Media makes sense as the company builds out both its advertising revenue and its reach across platforms.

SIRI will report fourth-quarter earnings in early February, with analysts expecting a profit of $0.07 per share on revenue of $2.25 billion. For 2021, forecasts have Sirius XM Holdings earnings $0.31 per share on revenue of $8.65 billion.

For fiscal year 2022, Wall Street has penciled in earnings of $0.34 on revenue of nearly $9 billion. Currently, 18 analysts cover the stock, with four strong buy ratings, four buys, eight holds, and two underperforms.

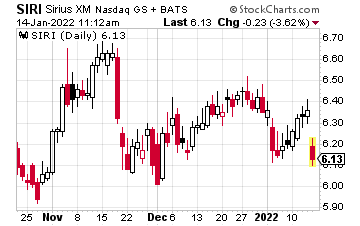

As far as the technical setup, shares are hovering just above the 50-day moving average with resistance at $6.40–$6.50. Support is at $6.30–$6.20 and the 200-day moving average. The 52-week high is at $8.14, with the low at $5.75.

With shares down roughly 20% from their 52-week peak, bargain hunters might find shares appealing at current levels; however, streaming music remains a fragmented space despite Sirius XM Holdings’ dominant position and recent acquisitions.

The annual dividend of $0.09 is also paltry, as it represents just a 1.4% yield. Writing covered calls could help in gaining more income, but the effort seems frugal given the current rate of inflation. For instance, the SIRI December 7 calls are currently trading for $0.60. They would lower the cost basis by 10%, but would also require you to hold the stock into mid-December.

For these reasons, it seems like shares are dead money but could offer some safety if the market struggles throughout 2022.