“The time to buy is when there’s blood in the streets.”-Baron Rothschild

Many years ago, I heard this statement: “Life is hard; however, once you understand that, it gets a little easier.” Out of your life’s many pursuits, this statement applies especially to investing your money.

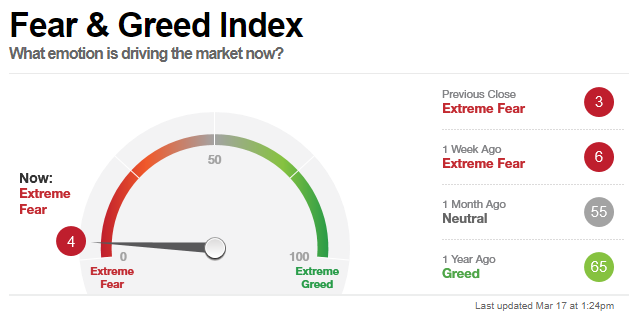

Most investment decisions are emotion-driven. You have heard that fear and greed drive the market. There even is an index from CNN that tracks Fear and Greed in the stock market.

In its article on contrarian investment Investopedia notes these key points:

- Contrarian investing is a strategy of going against prevailing market trends or sentiment.

- The idea is that markets are subject to herding behavior augmented by fear and greed, making markets periodically over- and under-priced.

- “Be fearful when others are greedy, and greedy when others are fearful,” said Warren Buffett, a phrase that encapsulates the contrarian philosophy.

- Being a contrarian can be rewarding, but it is often a risky strategy that may take a long time to pay off.

I think of contrarian investing is having a strategy to replace emotion-driven investment decisions with ones derived from logic and analysis. What would you like your investment decisions to be based on? Fear and Greed, or Logic and Analysis?

Note on the Fear and Greed Index Graphic above that a month ago, the Index had a Greed rating of 60. At that time, in mid-February 2020, the major stock indexes were at a record high. Now, 30 days later, on March 13, the stock indexes are down 25%, and the Index shows Extreme Fear. Investors were happy to buy stocks at record high prices and are now afraid to buy shares after a 25% decline. That is the opposite of buying low and sell high. Not a lot of investors succeed with an emotion-driven buy high and sell low “strategy.”

When the stock market crashes, you will feel fear. Knowing that you will have those feelings makes a little easier for you to weather out the stock market decline and stick to your investment strategies.

I have lived through my share of stock bear markets, starting with the 1987 crash. There have been at least eight fear-driven stock market sell-offs in the last 25 years. After each, share prices recovered, and market indexes climbed to set new record highs. I developed my Dividend Hunter, income-stock focused strategy to give subscribers a plan that works through the swings in the stock market. It’s easy to own stocks when the market is rising and hard to look at your brokerage account when share prices are falling.

The Dividend Hunter approach focuses on building a stable to growing income stream. That focus naturally leads to being able to buy low when others are fearful. However, it is not a buy low, sell high system. I think of it as a buy low and earn more strategy. For many investors, this is a new concept and way to invest in the market. I provide step by step and stock by stock guidance to help you put together your own stock market strategy that works through the full stock market cycle.