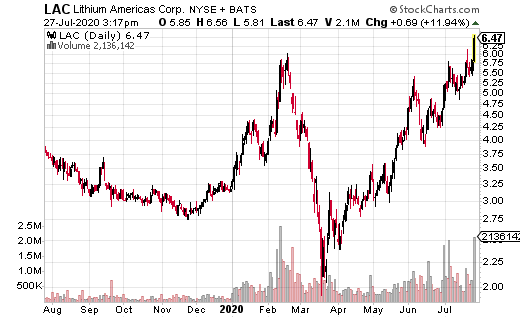

Since bottoming out at $1.92 in March 2020, shares of Lithium Americas (LAC) rocketed to a recent high of $5.78. All because there’s a potential lithium supply shortage.

According to Reuters, “A new demand surge is already looming in the form of the multiple ‘green stimulus’ packages as governments try and kick-start locked-down economies. You don’t have to be a market genius to see that another price boom is coming sooner or later as an under-powered supply chain has to catch up with the next demand surge.”

All thanks to increasing demand for electric vehicle demand, which is growing much faster than anyone expected. In fact, according to a new study from the Boston Consulting Group, by 2025, EVs could account for a third of all auto sales.

By 2030, EVs could surpass internal combustion engine vehicles with a market share of 51%. That could lead to a sizable spike in demand with lithium used in EV batteries.

But for that to happen, the world needs far more lithium.

Also driving Lithium Americas higher is news that it has been advised by Ganfeng Lithium Co., Ltd. that Ganfeng Lithium has received regulatory approval from the National Development and Reform Commission of the People’s Republic of China in respect to the transaction announced on February 7, 2020.

The remaining PRC regulatory approvals, including approval from the Ministry of Commerce and the State Administration of Foreign Exchange are pending.

As previously disclosed, Ganfeng Lithium has agreed to subscribe for new shares of Minera Exar S.A. for cash consideration of $16 million, increasing its interest from 50% to 51%, with Lithium Americas owning the remaining 49%. Minera Exar owns 100% of the Caucharí-Olaroz lithium project currently under construction in Jujuy, Argentina.

In addition, Lithium Americas will receive $40 million in cash from the proceeds of non-interest-bearing loans from Ganfeng Lithium.

Ian Cooper’s Personal Position in LAC: None